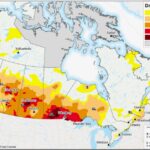

MarketsFarm — Much of Western Canada remained in some state of drought at the end of August despite widespread rains late in the month, according to updated maps compiled by Agriculture and Agri-Food Canada. The area mapped out as dealing with ‘exceptional drought’ in south-central Manitoba’s agricultural regions contracted slightly compared to the previous month

Drought maps show little change at end of August

Traffic remains lighter at Manitoba auction marts

Recent rains across Manitoba brought some much-needed relief to dry pastures, slowing activity at the province’s cattle auctions during the week ended Sept. 3. Prices for what was moving were solid, with strength in the feeder market but a softer tone in butcher cows. “There were light offerings everywhere this week, for feeder cattle and

ICE weekly outlook: Canola market awaits harvests, USDA

MarketsFarm — Canola contracts on the ICE Futures platform drifted lower during the week ended Wednesday, although the market remains stuck in a sideways trading pattern overall as participants try to get a better handle on the size of this year’s crop. An upcoming supply/demand report from the U.S. Department of Agriculture also has the

Tight supplies underpin oat bids with demand rationing expected

Corrected, Sept. 3 — MarketsFarm — Canadian oat prices should remain well supported over the next year given the smaller crop, but some demand will likely back away as buyers look for cheaper alternatives. While most of his customers were still taking delivery on existing contracts and not yet in the spot market, Ryan McKnight

Pulse weekly outlook: Tight Canadian supplies to cut into exports

MarketsFarm –– Canadian pulse supplies during the 2021-22 marketing year will be the tightest of the past decade due to drought during the growing season, with the country likely to be a much smaller player in the international export market for peas, lentils and chickpeas as a result. Statistics Canada pegged the country’s 2021-22 pea

StatsCan confirms Canada’s crop production down in 2021

Corn expected to be lone exception

MarketsFarm — Production of most of Canada’s major grain, oilseed and pulse crops was down substantially in 2021-22, as drought conditions across the Prairies cut into yields, according to preliminary estimates released Monday by Statistics Canada. Of the major crops, only corn was expected to see a slight increase in production on the year as

Smaller crops anticipated in looming StatsCan report

Survey-based data due out Monday

MarketsFarm — Heat and drought across Western Canada during the summer of 2021 seriously cut into the country’s crop production, raising traders’ expectations for reduced yields across the board when Statistics Canada on Monday releases its first production estimates of the year. Canola production is estimated at 11.5 million to 16 million tonnes, which would

Ag department lowers crop production, export estimates

Expectations knocked down for most major Prairie crops

MarketsFarm — Canadian crop production will be down significantly in the 2021-22 marketing year, cutting into exports for all of the country’s major grains, oilseeds and pulse crops. That’s the estimation from the latest supply/demand estimates from Agriculture and Agri-Food Canada (AAFC), released Thursday. Total field crop production for all crops is forecast to decrease

ICE weekly outlook: Canola rangebound, awaits report

New StatsCan data due out Monday

MarketsFarm — ICE Futures canola contracts saw some choppy activity during the week ended Wednesday, hitting their lowest levels in nearly a month before recovering back toward the upper end of their wide sideways range. A new production report from Statistics Canada, due out Monday (Aug. 30), could set the stage for a break one

ICE weekly outlook: Volatility expected in canola markets

MarketsFarm – The ICE Futures canola market saw some large price moves during the week ended Aug. 4, hitting their lowest levels in a month as investors booked profits before recovering to hold relatively range-bound overall. More choppiness is expected over the next few weeks, as the market waits to get a better handle on