Reuters / Shareholders in Viterra Inc. will vote May 29 whether to approve a $6.1-billion friendly takeover of Canada’s biggest grain handler by Swiss-based commodities trader Glencore International PLC.

The vote will be taken at a special shareholder meeting in Calgary, Alberta, a Viterra spokeswoman said.

The deal’s completion requires approval of two-thirds of the votes cast by shareholders or their proxies. If it gets a green light, it is expected to close in Viterra’s third quarter, ending July 31.

Alberta Investment Manage-ment Corp., Viterra’s biggest shareholder with a 16.5 per cent stake, has already agreed to support the takeover.

Read Also

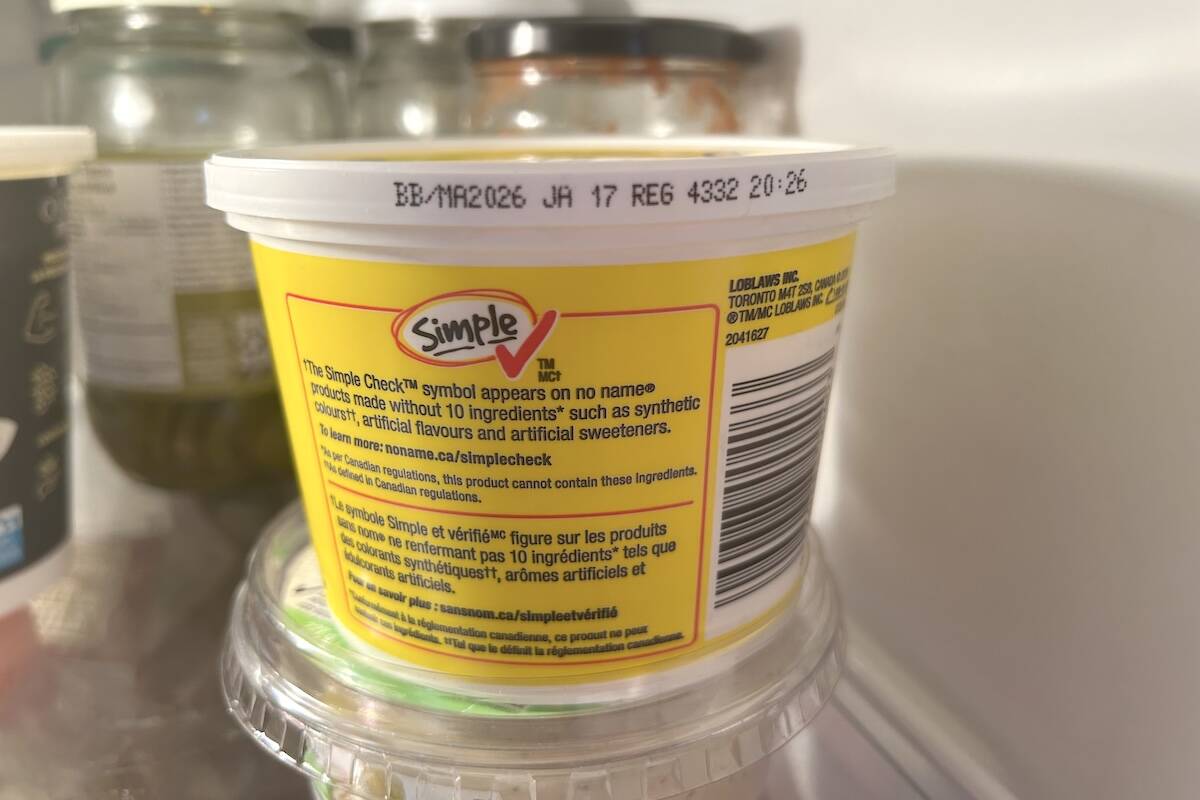

Best before doesn’t mean bad after

Best before dates are not expiry dates, and the confusion often leads to plenty of food waste.

Glencore said on March 20 it had reached a deal to buy Viterra and sell off some parts of it to Canada’s Richardson International Ltd. and Agrium Inc., giving Glencore a huge new presence in the grain industry.

The deal still needs regulatory approval in Canada and Australia. Because it is a foreign takeover, the Canadian government must decide if it is of “net benefit” to the country.

Prime Minister Stephen Harper noted Glencore’s global marketing reach in comments on March 26 that signalled Ottawa has little appetite for blocking the deal.

The takeover also requires a review by Canada’s Competition Bureau. The arm’s-length bureau consults with various industry players when considering a transaction’s impact on competition, spokesman Greg Scott said last week.