Farmers should not expect much of a break on nitrogen fertilizer prices in 2026, says an analyst.

“There are still enough problems in the world that it’s going to be incredibly hard to get back to anything that we would ever consider cheap,” said Josh Linville, vice-president of fertilizer at StoneX.

WHY IT MATTERS: Farmers are being told to lock in their fertilizer buys sooner rather than later, or risk being at the whim of higher prices in spring.

Read Also

MANITOBA AG DAYS: Wild oat resistance tightens its grip in Manitoba

Herbicides are increasingly failing to control wild oats as the weed pops up across Manitoba farm fields.

Protests in Iran and the subsequent government crackdown that saw 3,117 people killed during the uprising tops his list of concerns.

“If you want to topple the regime, you hurt their income, and if you want to hurt their income, you go after their nitrogen production and natural gas production,” he said.

Iran is the third largest urea exporter in the world.

The European Union is another major exporter of urea, anhydrous ammonia and UAN.

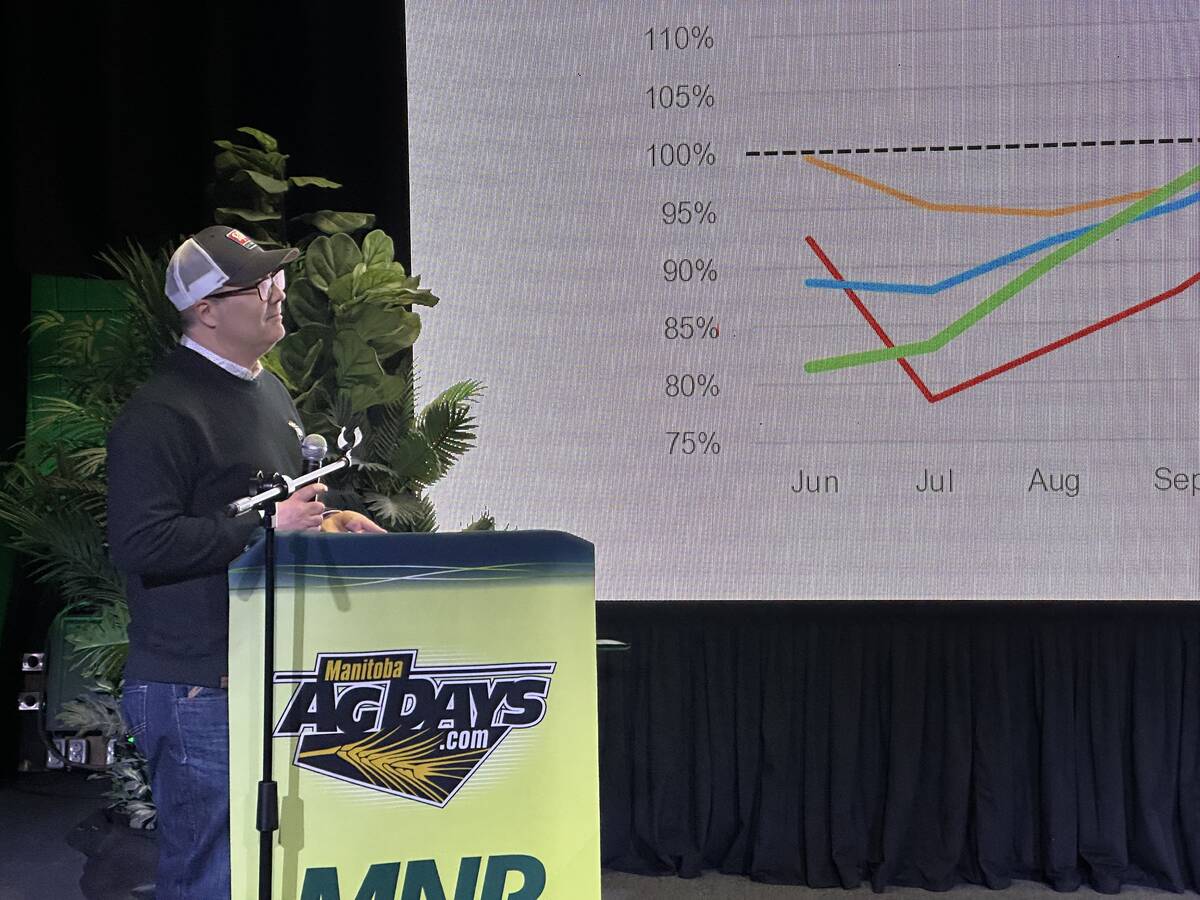

“Their production is still 75 per cent of normal,” said Linville.

European natural gas futures fell for most of 2025 but have rebounded in 2026. It is a key feedstock for the manufacturing of nitrogen fertilizer.

He is also nervous about the ongoing Russia/Ukraine war because Russia is the world’s biggest exporter of urea and was the biggest anhydrous and UAN exporter before the outbreak of tensions between the two nations.

Linville worries what might happen if Ukraine starts targeting Russia’s nitrogen fertilizer plants or export facilities.

“We could be talking about losing one of the biggest single nitrogen countries in the world,” he said.

Linville doesn’t expect prices to “skyrocket” back to 2022 levels, but he doesn’t see them plummeting to 2020 levels either.

Prices moving up

Silje Ingeberg Nygaard, director of market intelligence with Yara International, said during the company’s Capital Markets Day presentation that urea prices climbed in 2025 despite vastly improved Chinese shipments.

China exported 4.8 million tonnes of the product in 2025, up from 300,000 tonnes the previous year.

There were production problems in Egypt, Iran and India, but not enough to offset the 4.5 million tonne net increase in China’s export program.

Strong demand from India bolstered prices. The country had good growing conditions and had to replenish unusually low inventory levels due in part to reduced domestic production.

Ingeberg Nygaard said urea demand is growing at a rate of 1.7 per cent per year.

Global urea capacity has grown by 50 million tonnes since 2010, but production has only increased by 30 million tonnes over that period because of plant closures and low utilization rates.

Age, poor maintenance, exhaustion of feedstocks and the lower scale and efficiency of older plants have contributed to the need for replacements.

She estimates there is a need for another 3.9 million tonnes of urea supply per year over the next 10 years, depending on China’s exports.

Anticipated capacity growth will fall short of that target over the next five years.

Phosphate market

Linville said there are two big factors that will influence the phosphate market going forward.

China did not export much phosphate between January and May of 2025, but it shipped out 5.3 million tonnes during the remainder of the year.

That is about half a normal export program.

It appears that China is going to be even less active in 2026.

“Right now, the expectation is they’re not going to export phosphate again until August,” he said.

“We’re talking about a global phosphate market controlled mostly by five countries, and the biggest of those five countries is sitting there saying, ‘yo, we’re not going to export anything until next fall.’ ”

The other big factor to consider are the struggles for single superphosphate (SSP), which is a lower-level phosphate product.

The product contains sulfur, and sulfur prices have been skyrocketing. That contributed to the recent closure of a SSP production facility in Brazil. Linville said others might follow.

The phosphate supply curtailments from China and the SSP plants does not bode well for monoammonium phosphate (MAP) and diammonium phosphate (DAP) prices.

“I don’t see how we get a significantly lower price than where we are today, and today’s prices are exceptionally high,” he said.

“It’s just another tough year.”

The urea-corn price ratio is tied for the third-worst for this time of year, while the UAN/corn ratio is the second worst and the DAP-corn ratio is the worst.