Rising canola prices earlier in the week ended Aug. 28 were quickly erased as futures on the Intercontinental Exchange were pressured by numerous factors.

And that was before Statistics Canada’s report that Thursday.

StatCan’s first satellite/model-based crop production estimates of the year showed the 2025-26 canola crop at 19.94 million tonnes, compared to a revised figure of 19.24 million for 2024-25. Barring any adverse weather, this year’s canola crop would be the largest in seven years. Even more impressive was the fact that at 21.6 million acres, it was the lowest seeded area for the oilseed in three years.

Read Also

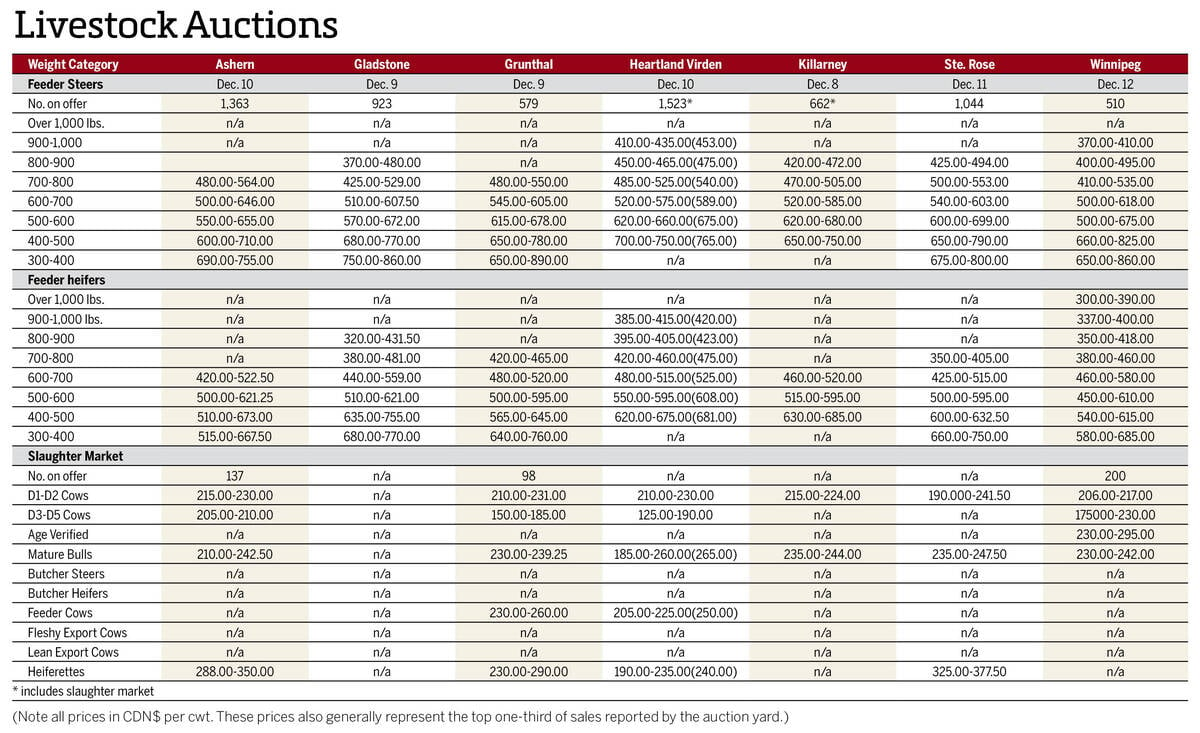

Manitoba cattle prices Dec. 16

Here’s what local farmers were getting paid last week for their cattle at Manitoba livestock auction marts; prices covering the week Dec. 8-12, 2025.

While many analysts, traders and farmers remain skeptics of StatCan’s methodology, the larger crop wasn’t much of a surprise. Agriculture and Agri-Food Canada provided its preview on Aug. 20 by estimating the crop at 20.1 million tonnes. Healthy rainfall and normal temperatures throughout the summer created optimal growing conditions for the oilseed.

While this should be cause for celebration for canola growers, the market is saying otherwise.

China’s 75.8 per cent tariff on Canadian canola seed implemented earlier this month continues to pressure prices and force growers to put more canola in storage they may not have. There were reports this week that China booked at least three shipments of Australian canola for the fourth quarter, ending a freeze that lasted several years. A lack of urgency from the Canadian government to convince China to drop its tariffs has only added to growers’ pessimism.

Weaker vegetable oils also pushed canola futures further downward, especially Chicago soyoil. The oil’s December contract lost nearly three U.S. cents per pound from Aug. 25 to Aug. 28. Despite upcoming trade talks between China and the United States, the prospect of the former buying the latter’s soybeans, while South America has a larger and cheaper crop, seems dim.

In the short term, canola prices can get a bump up from the weather. A heat wave has blanketed the Prairies over the past week with dry conditions in tow, which would expose most of the crop to the elements before harvest gets into full swing. There could be some bargain buying as prices go lower, but long-term relief needs to come from Canada’s canola industry. That would include finding new trade partners or selling more to existing ones. Such as convincing the U.S. to purchase more canola seed, oil and meal.

Otherwise, the final four months of 2025 could be a very rough time for canola.