Despite reports of China suspending purchases from some exporters, its imports of Canadian canola as of March 31 are well ahead of same period last crop year crop, as are its imports of soybeans and wheat.

Meanwhile, in a report last Friday, the U.S. Department of Agriculture again reduced its Chinese oilseed import forecasts due to the effects of an outbreak of African swine fever in its hog herd, and predicted it would reduce total world soybean trade by 42 million tonnes through to 2019-20.

Read Also

VIDEO: PhiBer drone carrier wins ag tech innovation award

PhiBer Manufacturing’s Dash Carrier trailer can land, recharge and refill four drones. The Manitoba company won the ag tech innovation at Ag in Motion 2025.

The figures raise the question of whether China’s suspension of canola import licences for two Canadian exporters is anything more than political strategy following realization that it would have to reduce purchases anyway due to ASF.

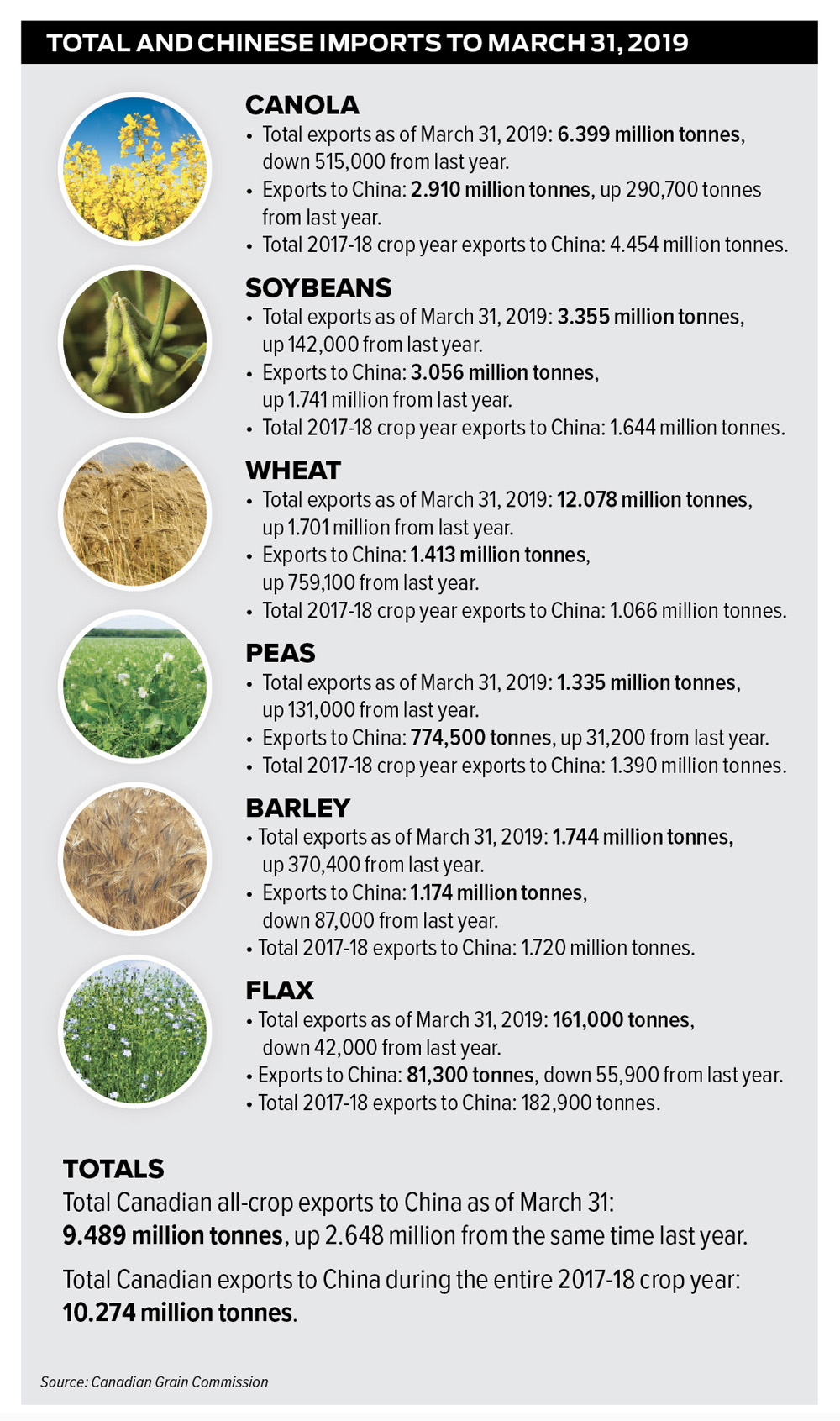

Based on the latest statistics from the Canadian Grain Commission, total Chinese imports of canola, soybeans, wheat, peas, barley and flax were at 9.489 million tonnes as of March 31, up by 2.648 million tonnes from the same time last year. With four months left in the crop year, that was already at 91 per cent of China’s total purchases in 2017-18.

As of March 31, total canola exports to all customers were down sharply by 515,000 tonnes, but China’s imports were up by almost 300,000 tonnes.

Its imports of Canadian soybeans had already reached over three million tonnes compared to 1.644 million for all of the last crop year.

China also accounted for more that half of the total 1.7-million-tonne increase in total wheat exports.

Soy imports to slump

In its monthly report issued last Friday, the USDA dropped its estimate for Chinese total oilseed imports to 90.6 million tonnes, down almost nine million tonnes from last year. It forecast further declines next year.

“African swine fever (ASF) in China will be a game changer for the global oilseed complex, and soybeans in particular, in the coming years,” USDA analysts said in their commentary.

Citing Chinese estimates that ASF has cut the hog herd by 20 per cent, they now estimate a potential 42-million-tonne accumulated decline in China’s soybean import demand through the 2019-20 crop year.

The analysts said there would be little opportunity to draw down U.S. stocks, noting that there were large soybean supplies available elsewhere.

“Consequently, large global supplies and lower demand in China will continue to pressure soybean prices; a situation that will likely continue as the industry adjusts to ASF,” the analysts said.

“This is a far cry from the market dynamics producers experienced since the mid-2000s and will require adjustments by producers to remain profitable in a lower-priced market.”

The USDA also dropped its estimate of Chinese 2018-19 coarse grain imports to 12.35 million tonnes, more than four million less than last year.