The Canadian dollar has rallied nearly 600 basis points in the past six weeks. This rally may have come as a surprise to some people, but not to those studying candlestick charting.

The Japanese are regarded as the true pioneers of candlestick charting. The Japanese method of charting is called candlestick because the individual lines resemble candles. The exact same data used in traditional bar charting (open, high, low and close) is all that is required.

Basic construction of a candlestick line

The daily line shows the open, high, low and close. The thick part or candle is called the real body. It highlights the range between the open and close. If the close is above the open then the body will be white. When the real body is black this simply means the close was below the open.

Read Also

Canadian canola prices hinge on rain forecast

Canola markets took a good hit during the week ending July 11, 2025, on the thought that the Canadian crop will yield well despite dry weather.

The lines above and below the real body represent the high and low ranges for the period. A long black body illustrates a bearish period in the market with an opening near the day’s high and a close near the day’s low. A long white body is the opposite of a long black body and shows technical strength with an opening near the low and a close near the high.

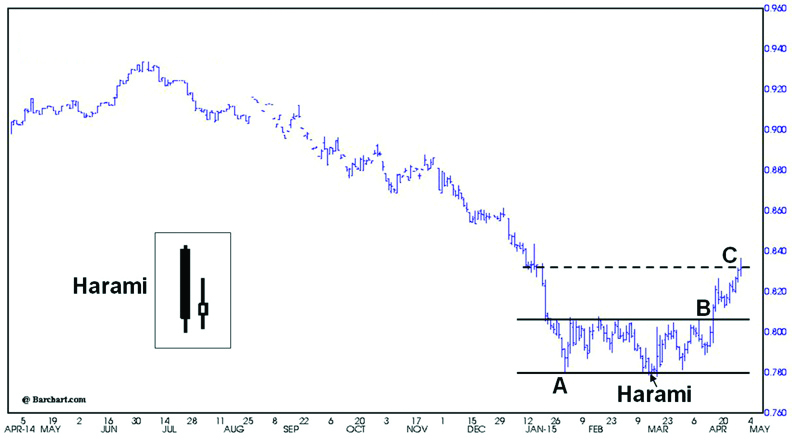

The harami is similar to an inside day in bar chart analysis and is illustrated as an inset in the accompanying chart. A harami that occurs at the end of a significant move down in price and time will have more reliability than any other place on a chart.

On the first day, the market closes weak relative to the opening, creating a long black body. The next day, the market opens higher and closes slightly higher than the opening, creating a short white body. Thus, the small body of a harami must be contained by the real body preceding it.

A harami developed in the June futures contract on March 16, 2015. A harami is a reversal pattern which indicated the Canadian dollar was about to turn up from the low at .7800. This low coincided with the previous low on January 30, 2015, reference point A. Markets will often turn up from a previous low, as it provides an area of support where market participants are no longer willing to pressure the short side and the longs are eager to buy in anticipation of an impending rally.

Caution should be exercised as markets don’t always hold at previous lows, but when a chart provides a buy signal by way of a reversal formation at a previous low, it increases the probability the market will turn up from that level.

The June Canadian dollar futures contract went on to develop a rectangular pattern with the lower boundary of the pattern providing support at .7800 and the upper boundary defining an area of resistance at .8060.

Once the loonie exceeded .8060, point B, all those who shorted the market since January 23, 2015 were caught losing money. The shorts place buy-stops above the market to protect their capital and once triggered, the buying frenzy causes the market to accelerate higher.

An advantage in identifying rectangular patterns is the predictability of the advance after prices exceed the upper boundary. Simply measure the height of the rectangle and add it to the breakout point.

For example, the Canadian dollar was trading in a sideways range between .7800 and .8060, so the height of the rectangle was 260 basis points. Add this to .8060 and the technical measurement provided an objective of .8320, point C, which was achieved on April 29, 2015.

Producers who sold grain or livestock and received payment in U.S. dollars were able to take advantage of these important market signals by converting their U.S. currency to Canadian as soon as the harami developed.

Send your questions or comments about this article and chart to [email protected].