June has ended and many have looked up at fireworks lighting up the night sky, celebrating holidays on both sides of the Canada/U.S. border.

However, canola growers, traders and analysts will either be looking at the sky for clouds or down at weather maps.

After rallying throughout the first half of June to its highest price since April, the second half has seen canola trading rangebound. The November contract, after reaching a two-month high of $738.10 per tonne on June 16, has closed sessions between $700 and $722 since, mostly between the 50- and 100-day averages. Canola was also pushed to near-overbought territory, coming within a hair’s width of 70 on the Relative Strength Index (RSI) on June 19 before easing off.

Read Also

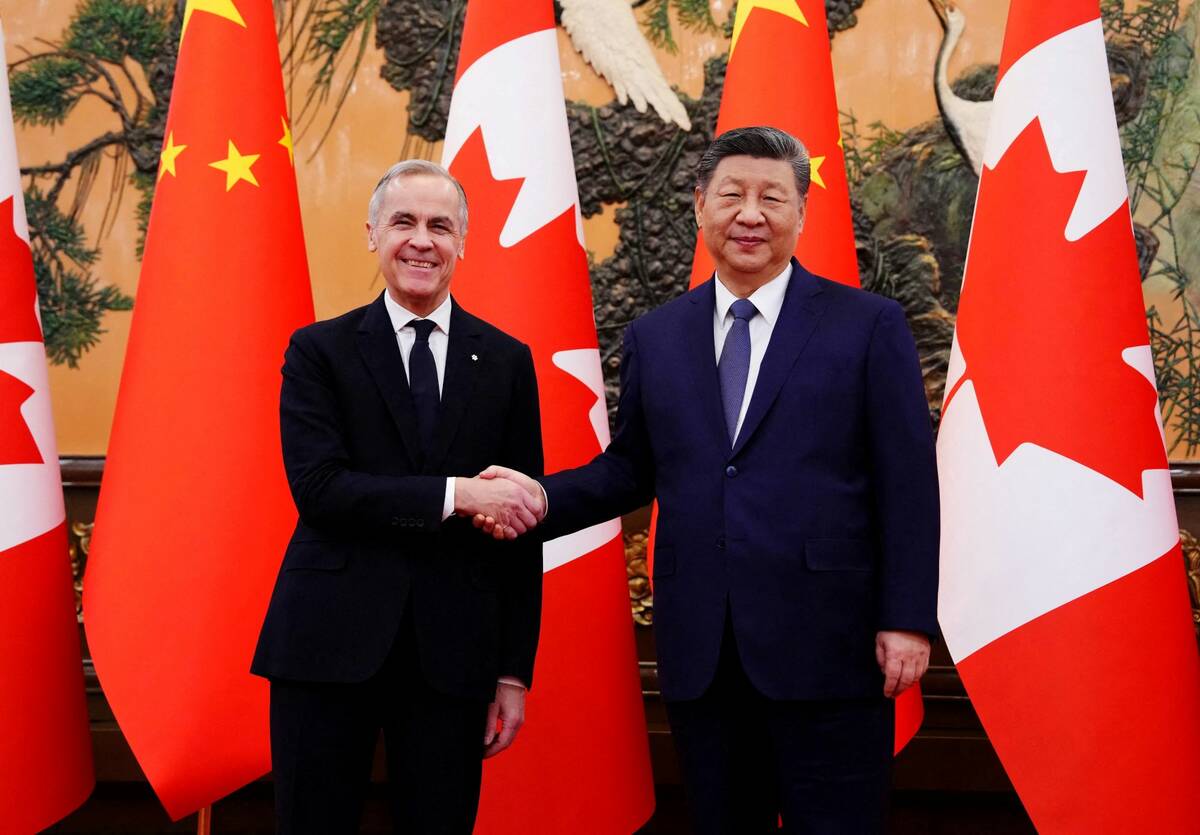

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

The oilseed has been in a push-and-pull situation over the past week. Statistics Canada (StatCan) released its principal field crop acreage estimates for 2023-24 on June 28, pegging canola for 22.082 million acres. This figure was more than the trade estimated, 485,000 more acres than estimated in StatCan’s April report, and 686,000 more than what was planted in 2022-23. The loonie exceeding 76 U.S. cents on June 26, and spillover from falling corn and soybean futures on the Chicago Board of Trade (CBOT), certainly didn’t stop the pressure.

August Chicago soyoil approaching the 60 U.S. cents/lb. mark like it did in March gave canola a boost, but it’s still a weather market and what comes from the sky has been the main supportive influence.

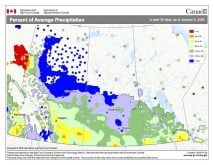

Dryness is seemingly settling in for the long haul in Western Canada. After a drier and hotter-than-normal June across the Prairies, forecasts still show dry conditions and warmer temperatures for the first half of July. Sporadic rains over the past month have eased fears of a 2021 repeat, but more typical levels of precipitation would be needed for this year’s crop.

Canola’s performance over the past month mirrors that of soybeans. Over the span of three weeks starting at the beginning of June, the November soybean contract gained more than US$2 per bushel and hit overbought territory before losing more than US$1 during the final full week of June. Rains across soybean-growing areas in the U.S. also contributed to recent weakness and corn lost US$1 per bushel in one week, largely due to forecasts calling for rain in the U.S. Corn Belt. Will recent bouts of precipitation be enough to revitalize these parched crops? Canola buyers will have to answer that same question very soon.

Unlike corn and soybeans, though, canola is currently entertaining a net short of more than 43,000 contracts. Dry weather could lift canola prices, but short-covering by the funds may also cause some fireworks in the market.