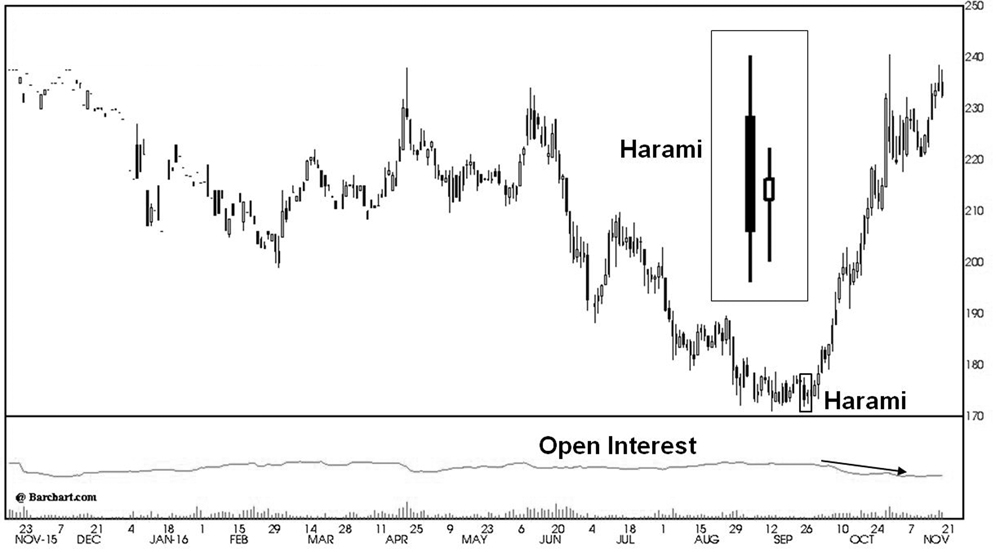

Oat futures at the CBOT experienced a 40 per cent gain from September 13 to October 28, 2016. The December 2016 oat futures rallied $.69 per bushel (all figures U.S. funds), going from a low of $1.71 to $2.40, a one-year high.

The December oat futures contract had been in a major downtrend since it came on the board and started trading at $3.15 per bushel on December 12, 2014, so some market participants may have been surprised by the suddenness of the rally. However, the development of a harami on the CBOT December oat futures candlestick chart on September 27, 2016 alerted technical analysts that the market was about to turn up.

Read Also

Canadian canola prices hinge on rain forecast

Canola markets took a good hit during the week ending July 11, 2025, on the thought that the Canadian crop will yield well despite dry weather.

Candlestick charting provides an insight into market activity that is not readily apparent with the conventional bar-type charts. When you see a black bar you know the sentiment is bearish. When the bar is white, it is bullish. The harami illustrated in the accompanying chart is quite common, and is a very useful tool in predicting changes in market direction.

The Japanese are regarded as the true pioneers of market technical analysis. They began trading forward rice contracts (futures) in 1654 and by the year 1750 developed a relatively sophisticated way to analyze the markets. These same techniques have evolved over nearly 250 years into an amazingly powerful modern-day charting method called candlestick.

An advantage in studying candlestick charts is they allow the viewer at a casual glance to spot technical strength and/or weakness by highlighting the relationship between the open and the close for each line (candle). The candlestick method gives you deeper insight by utilizing numerous interpretations for intra-line activity. Hence, the user has a timely advantage in spotting key market turning points for all time frames.

The Japanese method of charting is called candlestick because the individual lines resemble candles. The daily line shows the open, high, low and close. The thick part or candle is called the real body and it highlights the range between the open and close. If the close is above the open then the body will be white. When the real body is black this simply means the close was below the open.

The lines above and below the real body represent the high and low ranges for the period and are called shadows. The long black body illustrates a bearish period in the market with an opening near the day’s high and close near the day’s low.

A white body is the opposite of a black body and shows technical strength with an opening near the low and a close near the high. The small body represents a tight range between the open and close. Combined with other patterns they can be very significant, such as in the development of a harami. The small body of the harami must be contained by and opposite to the real body preceding it. This pattern indicates the market has entered a point of indecision and a trend change is possible.

Shortly thereafter, a short-covering rally ensued. This occurred when the shorts bought back their positions. As futures moved through key areas of resistance, they uncovered buy stops, which drove futures higher.

Shorts exiting the market, place buy stop orders above the market in order to take profit, protect their capital and/or cut losses. This buying frenzy continues until the weak shorts have been flushed out of the market. Declining open interest in a rising market is indicative of a short-covering rally. Total open interest in the CBOT oat futures went from a high of 10,738 contracts on September 28 to a low of 8,332 contracts on November 3, 2016.

Oat producers who recognized the harami and the subsequent short-covering rally had the conviction to sit tight and wait for higher oat prices.

David Drozd is president and senior market analyst for Winnipeg-based Ag-Chieve Corporation. The opinions expressed are those of the writer and are solely intended to assist readers with a better understanding of technical analysis. Visit Ag-Chieve online at ag-chieve.ca for information about grain-marketing advisory services, or call us toll free at 1-888-274-3138 for a free consultation.