Speculators have turned bullish across all three Chicago and Minneapolis wheat contracts for the first time in over two years. Funds are also buying back gobs of corn and soybean contracts after being record or near-record short in recent weeks.

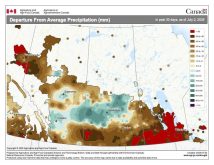

Crops in the United States are extremely sensitive to weather at this time of year. Condition scores are not as good as they have been in previous seasons and have declined earlier this month, and the weather forecasts continue to show dry – and potentially hot – weather for much of the areas producing U.S. corn, wheat, and soybeans, sparking supply fears.

Read Also

Thunderstorms and straight-line winds

Straight-line winds in thunderstorms can cause as much damage as a tornado and are next on our weather school list exploring how and why severe summer weather forms.

In combining Chicago-traded corn, hard and soft red winter wheat, soybeans, soybean oil and meal, and Minneapolis-traded spring wheat, money managers held an overall net short position of 53,234 futures and options contracts in the week ended July 4, according to data from the U.S. Commodity Futures Trading Commission.

This is the least bearish combined view that the funds have held in recent months since crossing onto the short side in mid-March. They now also hold their most bullish stance since May 2014 when summing positions over all three wheat contracts.

Money managers entered bullish territory on Chicago wheat in the week ended July 4, which was both the result of short-covering and new longs. The net long of 18,003 futures and options contracts compares with 10,158 contracts short in the previous week and is the first bullish fund view since July 28, 2015.

But the milestone traces back further when examining the outright Chicago wheat longs – some 113,929 contracts – which is the most since Nov. 13, 2012. The number of outright shorts dropped below 100,000 contracts for the first time since November 2015.

Funds reached an even longer-standing landmark in K.C. wheat the first week of July, by extending their net long to 54,926 futures and options contracts from 44,240 in the week before. This marks the funds’ most bullish bet on hard red winter wheat since Nov. 9, 2010.

Speculators either extended longs or trimmed shorts across all grains and oilseeds through July 4 except for Minneapolis wheat. Shorts reappeared in the spring wheat market for the first time in five weeks, which assisted in the slight cut to 14,017 futures and options contracts net long from 15,347 the week prior.

Funds mostly sold wheat late last week as futures prices dropped across all three contracts, but the action was reignited July 10, on fresh weather concerns for Minneapolis wheat, and the spec buying continued.

Corn too

Speculators were frantically buying back their short positions once again in the Chicago corn futures and options market in the first week of July, though the degree of short-covering was only half of what it was back in the week ended June 13.

The U.S. corn crop is pollinating this month and the weather is more critical than ever. Dry weather forecasts, which have since begun trending warmer, prompted funds to slash their bearish corn bets to 46,715 contracts in the week ended July 4 from 106,119 in the week prior.

Money managers have been buying even more of the yellow grain in the days since as forecasts have continued to show dry, and in some places, warm weather for key spots in the U.S. Corn Belt. The buying was extremely heavy on July 10 as CBOT corn futures hit a one-year high.

The buying trend is likely to continue after the U.S. Department of Agriculture late that day rated 65 per cent of the domestic crop in good or excellent condition, down three percentage points on the week.

Soy backpedalling

U.S. soybeans are influenced by precipitation in August more so than in July, but specs decided that the drier weather – and the potential for that to extend into next month – was concerning enough to start shedding their record bearish soybean stance.

The lower-than-expected June 1 U.S. soybean inventory published by USDA on the last day of the month – along with slightly fewer planted acres than were anticipated – also encouraged the shift in spec attitude toward the oilseed.

Money managers cut their net short in CBOT soybean futures and options to 70,216 contracts from an all-time record 118,683 the week before. This move was the result of the fourth-largest-ever reduction of outright shorts, but funds were also actively adding longs to the largest degree that they have in five months.

Funds also bought back CBOT soybean meal shorts for a new bearish stance of 42,967 futures and options contracts versus 54,530 in the week prior – which was also a record. However, specs actually cut outright longs in soymeal in the week ended July 4, suggesting that they were still largely pessimistic on the protein-rich animal feed.

CBOT soybean oil is the only non-wheat contract in which money managers hold bullish bets, as they extended their net long to 19,718 futures and options contracts from 10,511 the week before.