We’re officially into ‘interesting times.’

There’s no other way to categorize it, as the reports start stacking up.

Tire and glyphosate shortages because of power cuts in China. The U.K. contemplating a pig cull and milk dumping for lack of labour. Retailers fretting over a ‘cancelled Christmas’ due to supply chain snarling. Gasoline prices in Manitoba that jump by 20 cents a litre overnight.

It’s becoming very clear that navigating the post-pandemic world is going to be even more complex than the last 18 months have been.

Read Also

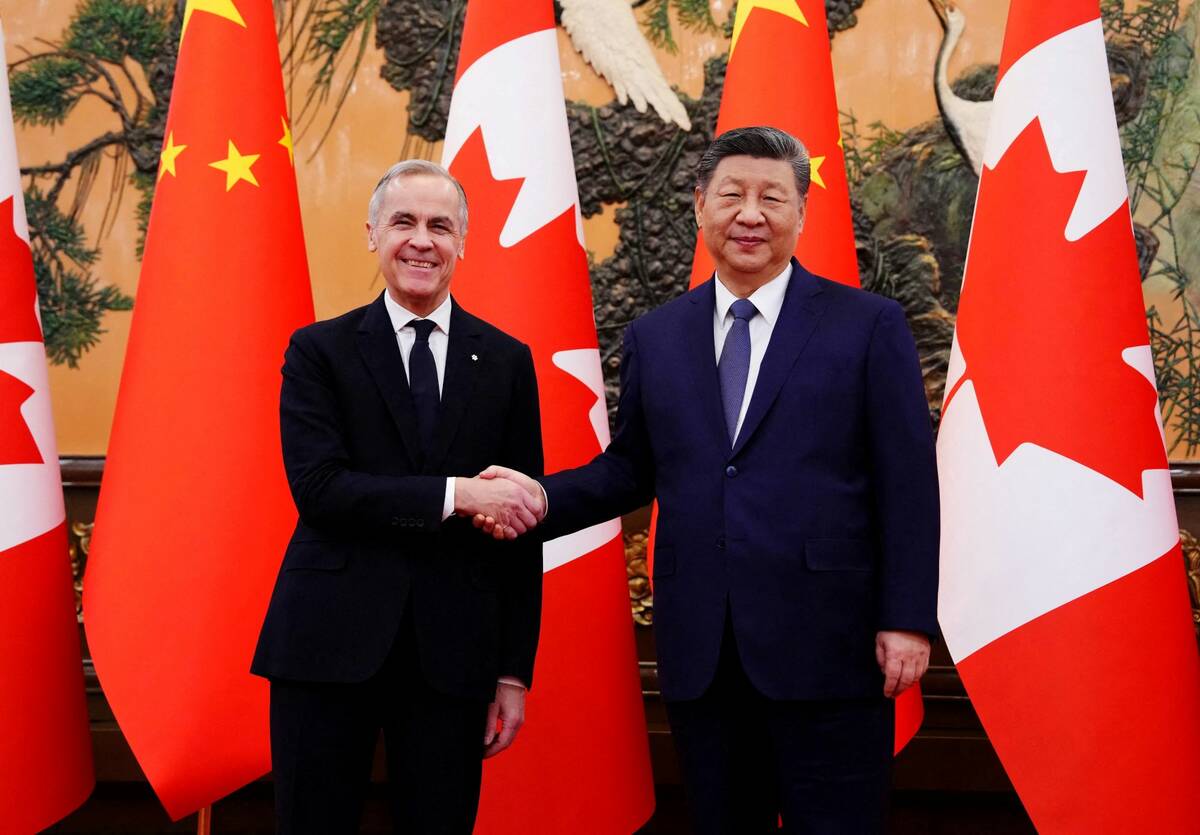

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

One of the key challenges is going to be managing inflation, and all of its negative effects.

There’s growing evidence that it’s setting in as labour shortages increase wages while at the same time more dollars chase less goods because of lack of supply.

Those of us who are a bit longer in the tooth can remember times of higher inflation. In the early 1980s the first Prime Minister Trudeau unleashed his second set of wage and price controls, dubbed “six and five,” aimed at the public sector.

That’s right… the government’s emergency target to lower inflation during that period started at what seemed like a then-unattainable six per cent.

The inflation of the 1970s and early 1980s was particularly damaging because it was a very peculiar type of inflation, known as ‘stagflation.’

That occurs when inflation sets into an otherwise stagnant and slowly growing economy.

It’s particularly hard to fight, because policy-makers have so few tools.

In a hot economy, they’d raise interest rates and lower demand. But in the case of stagflation that has no effect, because consumers already aren’t buying.

It makes the workout period for stagflation long and painful — about 15 years in the case of the stagflation of the 1970s and ’80s.

During that period buying power fell, savings were eroded and ultimately only ultra-high interest rates were the cure, though at the time many felt the cure to be worse than the disease.

The western economies were particularly hard hit, and then as now, the U.K. was the canary in the coal mine.

It faced power cuts, labour unrest, a currency crisis, an International Monetary Fund (IMF) bailout and all other manner of economic woes — and that was just 1976.

We’re not at this point of crisis yet, but it’s clear that policy-makers are growing more worried by the day.

Bank of Canada Governor Tiff Macklem recently admitted the inflation question was “more complicated” than originally thought and could be around for longer than hoped.

In August Canada’s Consumer Price Index hit 4.1 per cent. A brief spike in 2003 took it slightly higher, but before that you’d have had to go back to the 1990s to see similar inflation.

And many would say that number is artificially low because of how that measure is taken. Those who measure such things say they remove certain items — like energy and housing — because they can be volatile and muddy the true picture.

Inconveniently, those both also happen to be among the largest expenditures of most Canadians and totally unavoidable for most of us.

Whether the current bout of inflation will prove to be transitory is still unknown. And just how high the rate will get is another unknown.

One fortunate factor for most farmers is the fact that during inflationary times real assets tend to hedge against the erosion of purchasing power.

A dollar might be worth less, but by the transitive property it will take a lot more dollars to buy stocks, real estate and, yes, farmland.

Where you’re exposed is if inflation lingers long enough that central bankers are forced to increase rates. That’s something the Bank of Canada’s Macklem has signalled he’s prepared to do — that’s what it means when he says the central bank will stick to its two per cent inflation target.

An entire generation of Canadian farmers have grown up in an economic environment that’s been stable, featuring low inflation and low interest rates. It’s pretty easy to plan in that environment, where you can basically take a ‘set it and forget it’ approach to key things like interest rates.

Where they’ll be challenged is in adjusting to a less certain economic environment that can change quickly.

No doubt most are up to the challenge; after all, they manage a lot of other quickly changing variables on the production side.

But setting themselves up for success is going to take a change in mindset if things continue down this path, and particularly, in being ready to identify changing circumstances.

A prudent first step is running some numbers that project the effect of potentially higher interest rates.

Whether or not they’ll actually go up is anybody’s guess. But if that lightning escapes the bottle, having a plan will help.