Saudi Arabia isn’t a big Canadian grain customer, but Canada’s grain sector isn’t happy about losing access to it in the wake of a diplomatic spat sparked by Canada’s criticism of Saudi Arabia’s poor human rights record.

“I think we really do need to see a focus from all government agencies and departments that they consider trade implications of policy decisions and announcements,” Cereals Canada president Cam Dahl said in an interview last week.

Read Also

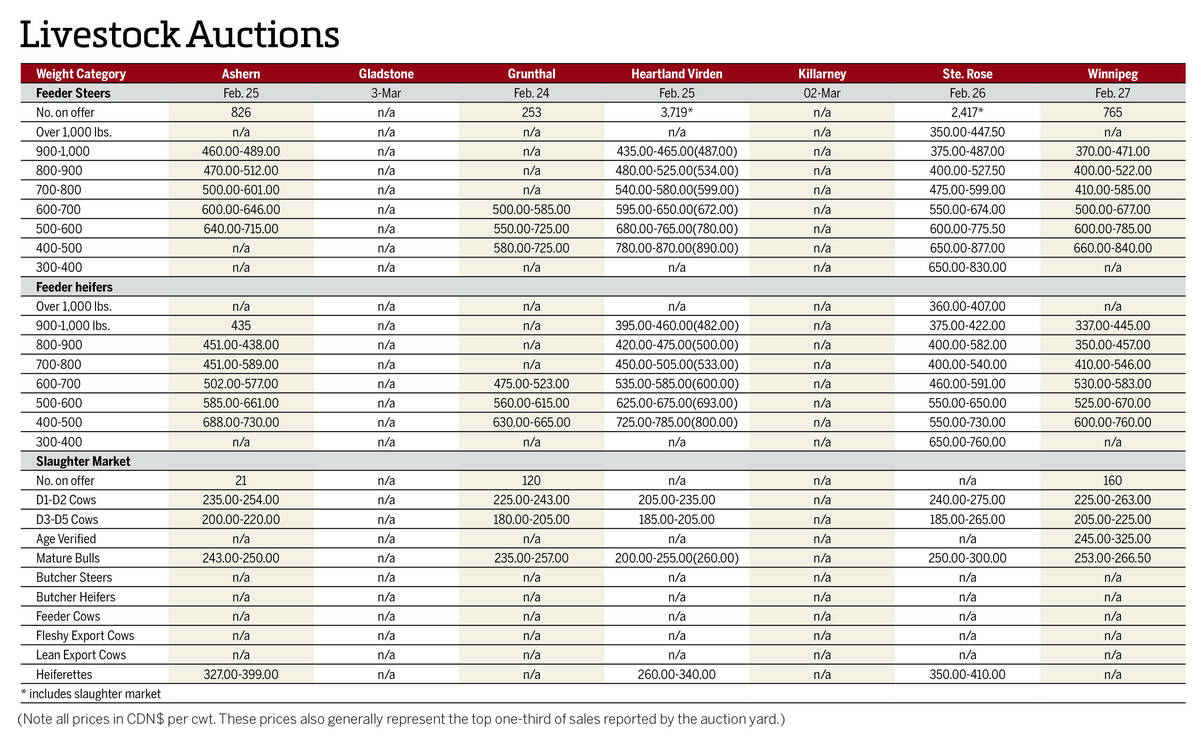

Manitoba cattle prices, March 4

Chart of weekly Manitoba cattle prices.

“All actions and policies have trade implications as well and those need to be well understood before any policy moves forward.”

Last week Saudi Arabia expelled Canada’s ambassador, recalled its own, froze new trade and investment with Canada, suspended flights by the state-owned airline to Canada and ordered thousands of Saudi students — including about 1,000 training to be physicians — to leave Canada.

The move, which shocked many political and diplomatic experts, was prompted by a tweet from Foreign Minister Chrystia Freeland criticizing the Gulf state’s jailing of women’s rights activist Raif Badawi and her brother Samar, followed by a Global Affairs Canada tweet calling for the release of “all peaceful #humanrights activists” held by Saudi Arabia.

Several pundits suggested by punishing Canada, Saudi Arabia, ruled by an absolute monarchy, was sending a signal to all western democracies to refrain from criticizing its draconian and undemocratic government. However, Saudi Arabia’s actions have drawn worldwide attention to its human rights record and tarnished some of the Kingdom’s recent reforms, including allowing women to drive.

Significant barley buyer

Last crop year Canada exported 70,000 tonnes of wheat and 135,000 tonnes of barley to Saudi Arabia.

That accounted for less than one per cent of wheat exports, but seven per cent of barley exports.

The country imports more than seven million tonnes of barley a year to feed sheep, but most comes from Black Sea and European suppliers.

“It is a significant part of our barley export markets,” Dahl said. “It has been a stable market for quite some time.

“If you had asked me a week ago if I’d had any concerns about access to Saudi Arabia the answer would be no.”

Dahl said he has no idea when grain sales to Saudi Arabia might resume.

The Saskatchewan Barley Development Commission (SaskBarley) isn’t happy to lose access to any market, it said in a news release August 10.

Although Saudi Arabia has been a frequent Canadian barley customer SaskBarley noted the Kingdom didn’t buy any Canadian barley between March 2014 and March 2016 and none so far this year.

“While we are always disappointed by trade disruptions, we have confidence in our government and our national value chain to respond to trade concerns and work with our global trading partners to maintain and optimize relationships and opportunities for our farmers,” said SaskBarley chair Jason Skotheim.

All markets are important to farmers, Keystone Agricultural Producers (KAP) president Bill Campbell said in an interview following KAP’s advisory council meeting in Brandon August 10.

“There are consequences to what’s transpiring here,” he said.

“There are a lot of issues that come into it but it affects so many people.”

Growing list

Losing access to the Saudi Arabian grain market is part of a concerning trend to protectionism and non-tariff trade barriers, Western Grain Elevator Association executive director Wade Sobkowich said in an interview.

The industry can adjust to losing access here and there, but the list of markets with roadblocks is growing, Sobkowich said.

Dahl shares those concerns.

“We see that list growing,” he said.

That list includes Italy, Peru and Vietnam and for a short time recently, Japan and Korea.

For more than a year Italian pasta makers have rejected Canadian durum because it might contain trace amounts of glyphosate even though deemed safe and allowed under international trade rules.

Italy is traditionally one of Canada’s biggest durum wheat customers.

A year ago Peru decided after 40 years of importing Canadian wheat it wanted shipments free of certain weed seeds common in Western Canada, Dahl said.

“There is no way we could have shipments guaranteed to have zero (weed seeds),” he said.

Peru, which usually imports around 1.3 million tonnes of Canadian wheat a year, accounting for 60 per cent of its wheat imports, has taken the issue to the World Trade Organization. The comment period expires December 4 and Dahl hopes an agreement can be reached before then.

Meanwhile, Vietnam, doesn’t want any Canada thistle seeds in its wheat, Dahl said.

“Vietnam is taking a hard line on this,” he added. “Again, there’s absolutely no way we can guarantee shipments that are 100 per cent free of Canada thistle.”

Vietnam isn’t a big Canadian wheat buyer but Canada is hoping for increased sales there because of the Trans-Pacific Partnership, Dahl said.

A few years ago Canada exported 500,000 of DON-infected wheat to Vietnam where it was fed to shrimp, he said.

In June, Japan and South Korea temporarily stopped importing Canadian wheat after a few genetically modified wheat plants were discovered in Alberta.