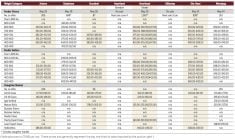

Western Canadian feeder cattle prices last week were $2 per hundredweight lower to $2 per hundredweight higher in comparison to a week earlier. Sellers were passing on record-high bids for heavier-weight feeder cattle, which is usually a signal that the market is due for a correction.

Angus-cross light-flesh steers averaging 880 pounds sold for $141 in central Alberta. A large group of 300 steers of black and red British cattle with medium to light flesh reached $148. Demand for lighter-weight cattle remains firm as 528-lb. steers touched $199/cwt in east-central Alberta. The steer/heifer spread remains relatively wide, with heifers trading at a $15 to $20 discount to steers.

Read Also

Pig transport stress costs pork sector

Popular livestock trailer designs also increase pig stress during transportation, hitting at meat quality, animal welfare and farm profit, Agriculture and Agri-Food Canada researcher says

The North American slaughter pace has slowed over the past two weeks due to unfavourable margins. Packers have been unable to pass on the higher price of fed cattle as wholesale prices come under pressure. Consumer disposable income is up approximately three per cent in comparison to last year, while cattle prices are up approximately 20 per cent. The increase in cattle prices has outpaced the increase in consumer income; therefore, the market is rationing demand.

Can the current economic environment justify December live cattle futures at $134? U.S. ground beef prices are up 15 per cent relative to last year, but higher-end cuts such as the sirloin steak are actually below year-ago levels. Strength in the deferred live cattle futures has been the main factor driving nearby feeder cattle prices higher and the fed market is due for a correction. Cow-calf operators need to assess the risk/reward; the upside potential is limited from current levels.