Ceres Global Ag, a publicly traded, Minneapolis-based company, was flying mainly under the radar — until recently.

But the newcomer grain company made headlines May 25, announcing plans to build a 1.1-million-tonne, US$350-million canola-crushing plant at Northgate, Sask.

That move brought the firm into clearer focus for many market participants, and the picture that’s emerged is a company with a unique focus.

While Ceres has country elevators in Saskatchewan and Minnesota, most are in Manitoba, after acquiring Delmar Commodities in July 2020.

The deal included Jordan Mills, a soybean extrusion plant that makes meal and oil located at Jordan Corner near Roland, Man.

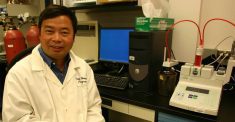

“We’re constantly looking at what we can do with our footprint (in Manitoba),” Robert Day, Ceres’ president and CEO said in an interview earlier this spring.

“The Delmar acquisition was really exciting. We’ve connected Delmar to a bigger network. Those elevators are operating more efficiently with more volume moving through them so that’s been really exciting and we’re always looking for ways to make investments to increase the capacity… Manitoba continues to be a very important province for us as a company. We are looking at some opportunities. We are going to increase our footprint in Canada and Manitoba specifically.”

Why it matters: Grain handling and merchandising is a low-margin, capital-intensive business with high barriers to entry. New entrants can increase competition resulting in better service and prices for farmers.

Read Also

Manitoba sclerotinia picture mixed for 2025

Variations in weather and crop development in this year’s Manitoba canola fields make blanket sclerotinia outlooks hard to pin down

Growth

Work is underway to expand Jordan Mills’ annual 70,000-tonne soybean-processing capacity 50 per cent to 105,000 tonnes, Day said.

To attract a major, one-million-tonne-a-year soybean-crushing plant, Manitoba needs a lot more soybean production, he added.

Crop-insured production the last five years averaged 1.5 million tonnes.

“So we are appropriately sized for that market,” Day said, but added when there’s enough production, Ceres would consider building a large soybean-crushing plant in Manitoba.

“As the oilseed crush story evolves in North America it does make the prospects for that more attractive. We’re pretty excited about that business.”

Ceres might be best known for its grain, fertilizer and energy export facility at Northgate on the Saskatchewan-North Dakota border.

Situated on about 1,300 acres of land on the Canadian side, it has two rail loops, each capable of handling 210 unit trains and two ladder tracks for up to 65 rail cars, connected to the Burlington Northern Santa Fe Railway.

Ceres Global has a 50 per cent interest in Savage Riverport, a joint venture with Consolidated Grain and Barge Co., a 50 per cent interest in Gateway Energy Terminal, a joint operation with Steel Reef Infrastructure Corp., a 25 per cent interest in Stewart Southern Railway Inc., a short line railway located in southeast Saskatchewan and a 17 per cent interest in Canterra Seed Holdings Ltd.

Ceres has terminals in Minnesota, including Duluth and Port Colborne, Ont., giving the company access to the Mississippi and ultimately the Gulf of Mexico and the St. Lawrence Seaway.

Focus

Ceres is focused on grain markets — especially for oats, spring wheat and durum — in Manitoba and Saskatchewan.

“Our goal is to be No. 1 in those products in North America,” Day said. “We are serving customers in North America but also internationally. We are broadly positioned from an origination standpoint in the U.S. and Canada and that makes us unique. Our competitors tend to be all Canadian or all American. We can kind of be a bigger fish in a smaller pond.”

Day added the company has the infrastructure to compete on scale, cross-border supply chains and can provide transloading services in other commodity sectors, giving it a unique position.

That’s why Ceres isn’t as active in Alberta and exports very little through Vancouver, Canada’s biggest grain port, he said.

Ceres has a 50 per cent interest in Farmers Grain, LLC (a joint venture with Farmer’s Cooperative Grain and Seed Association) in Thief River Falls, Minn. and is exploring grain business opportunities in the Dakotas, Day said.

“We want to be very balanced between the U.S. and Canada,” he said. “Over time we think that’s a competitive advantage.”

Upstart

So how does a new grain company compete against patient, private firms, some of which have existed more than 100 years surviving two world wars, the Dirty ’30s and the Canadian Wheat Board?

By having a plan, putting it into action, some “blind faith,” said Day.

“What we found was if we clearly understand what our customer needs… we can be (a) cost competitive and then (b) that we can bring the unique value that they are looking for and add to that over time. Then we’re less concerned about the competition as long as we are really listening to the customer… and we can stay in front of that,” he said. “I think that’s what has allowed us to be successful and increase our confidence as we increase volumes and build those relationships.”

Focusing on oats, spring wheat and durum allows Ceres to be a “market-maker,” managing the supply chain between farmers and processor, Day said.

Ceres has been building its canola seed business too, moving the crop from Canada to a customer in Mexico City via Northgate.

While it’s still largely a commodity business, Day said his customers are increasingly seeking extras.

“They want seed-specific, identity-preserved supply chains and they want low glyphosate or no glyphosate, they want a low carbon footprint,” he said. “We are really trying to provide the non-commodity type, value-add solutions that layer on top of the commodity.”

He says that strategy allows the company to be “big and efficient” in the commodities it deals with because of its infrastructure. That allows it to compete on size, scale and cost efficiency with bigger companies.

“We couldn’t do it if we were handling canola and soybeans, or trying to export out of Vancouver so that’s not our focus,” he said. “But when it comes to serving customers in the United States and Mexico and internationally through the lakes, we can compete on size, scale and efficiency.”

Getting results

The plan is working. When its 2019-20 fiscal year ended June 20, 2020 Ceres recorded $582 million in gross revenue and $4.3 million in net income, compared to a $16.9-million loss the year before.

“The increase was primarily related to $8.3 million in improved income from operations over the prior year along with $8.2 million in a legal case that was settled in the prior year,” Ceres’ 2019-20 annual report states.

Its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was $16.9 million versus -$4.1 million the year before.

It’s a big turnaround for a company created by a hedge fund that really didn’t understand the grain business and subsequently lost about $50 million, Day said. But about seven years ago changes were made, including in the ownership with some shareholders believing Ceres’ assets had the makings of a profitable grain company.

The company’s name Ceres, the Greek goddess of agriculture, was inherited from the hedge fund.

“It’s a great name and it’s a terrible name,” Day said. “And the reason why it’s a terrible name is because it’s such a good name, and the problem is there are so many companies around the world that have used the name.”