At the end of 2017, Canadian farm debt topped $100 billion. At the time, it was a bigger number than the national debt of 135 countries, noted Country Guide columnist Gerald Pilger.

The climb hasn’t stopped. The figure rose steadily since crossing the $100-billion threshold. As of 2022, the most recent year on Statistics Canada’s published record, it had reached $138.9 billion.

Interest rate increases since early 2022 also led to larger farmer payments on that enormous principal.

Read Also

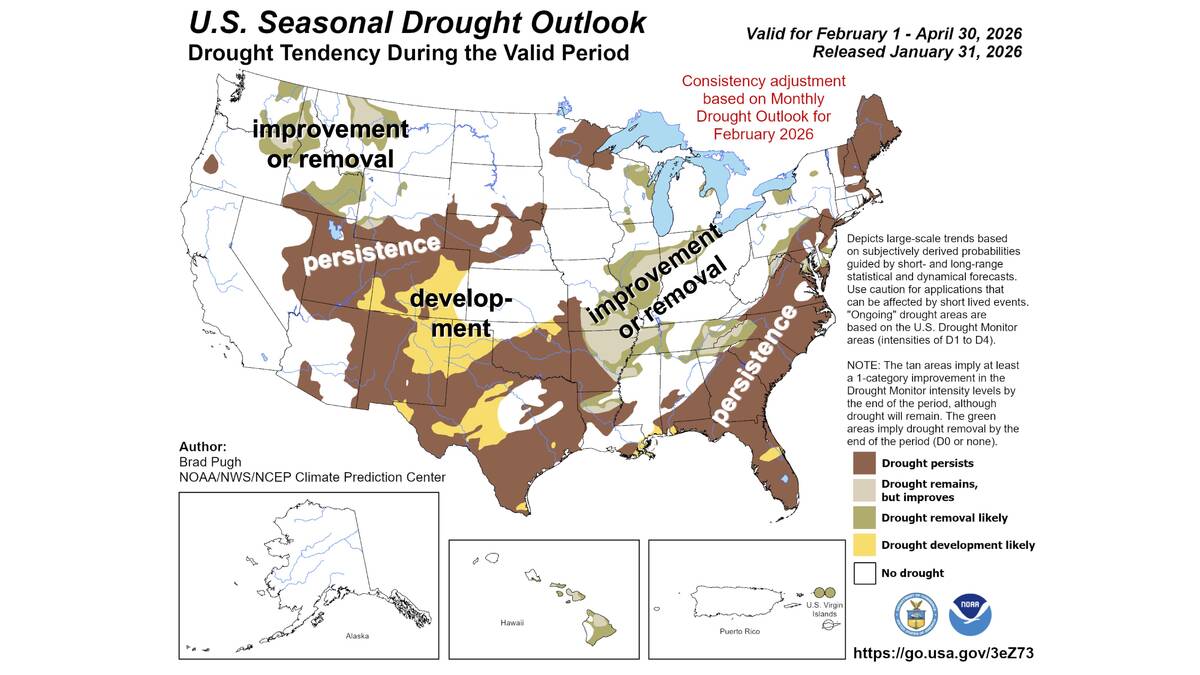

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

Added to that, analysts are expecting tighter margins this year. Farm Credit Canada predicts a 4.8 per cent decline in farm cash receipts on the heels of softening crop prices and expensive inputs. Does it mean farmers are in a tough spot financially?

Experts say no, at least not on paper.

Why it matters: Seed and fertilizer are expensive. Farmland values have been rising in double-digit percentages for years. With bearish market signs ahead, farmers may be contemplating their financial futures.

On aggregate, experts maintain that farmers are in a solid financial position. Farm debts have reached an eye-watering sum, but farm economists note that total asset values have also been climbing steadily.

According to Statistics Canada’s agricultural balance sheet, that $138.9 billion of debt in 2022 was matched by $861.4 billion in assets at the end of that year. Farm equity was $729.9 billion. Of that total asset value, most was tied up in land.

Between 2014 and 2023, average farmland values across the country grew an average 9.1 per cent each year, FCC wrote in a March 27 article. The last few years have pressured that number upward.

The most recent FCC farmland values report, released in March, said Canadian farmland values in 2023 had risen 11.5 per cent. The year before, they jumped 12.8 per cent.

In Manitoba, recent land value increases were 11.1 per cent in 2023 and 11.2 per cent the previous year, up from 9.9 per cent in 2021 and significantly higher than 2017-20, when farmland value increases peaked at five per cent.

That makes for a very comfortable debt to equity ratio, said Eric Micheels, a professor of agricultural and resource economics at the University of Saskatchewan.

“Debt has room to go up,” he said.

At the end of 2022, the ratio of farmer liabilities to equity (leverage) was 0.180, and the ratio of liabilities to assets was 0.153.

“That’s a very strong balance sheet,” Micheels said.

Some extension publications say that up to a 0.4 leverage ratio would be good, Micheels added. In other words, double the debt farmers had in 2022 with the same sum of equity.

However, those numbers don’t tell the whole story. The bigger question is how all that math translates into reality when it comes time for farmers to pay their bills, manage operating costs and make business decisions.

Micheels looks at current liquidity ratio. It takes a farm’s current assets — such as cash on hand, stored grain or other inventory and accounts receivable — and divides it by all its current liabilities — land mortgage payments, operating loans and other accounts payable.

At the end of 2022, that ratio was more than 3.4. So, if farmers liquidated all current assets, they could pay for their current liabilities more than three times over, Micheels noted.

“That’s the best since 1997,” said Krishen Rangasamy, principal economist with FCC, adding that strong crop prices have contributed to that excellent ratio.

Crop prices softened slightly in 2023, but it’s likely the solvency ratio for farms at the end of 2023 was still strong, analysts have said. Farm cash receipts last year were up 3.6 per cent year over year to $98.6 billion. That compares to $95.2 billion in 2022, a sum that smashed the prior year’s cash receipt total by more than $12 billion.

At the same time, however, there were greater drags on profitability. Input costs were through the roof, with particular concerns around high fertilizer prices in 2022 and general volatility in the fertilizer market lasting into 2023.

Casting doubt

Other financial commentators disagree with that rosy view.

In 2018, with farm debt past the $100-billion threshold, author and data analyst Darrin Qualman sounded a cautious note. Qualman, who is also a director with the National Farmers Union, observed that producers at that time were paying about $3 billion per year in interest.

After paying all expenses, they collectively took home $1.6 billion in net income on an average year while borrowing an additional $2.7 billion per year on average, he wrote.

Qualman suggested that Canadian farmers would have difficulty making ends meet without annual government transfers of $3.1 billion, delivered through various farm supports and subsidies.

Government transfers shot up to $5.94 billion in 2021, Statistics Canada’s farm income reports indicated. It hit $7.35 billion in 2022 and $6.36 billion in 2023, StatCan data shows.

The same rising farmland values that boosted asset values have also boosted debt and made land increasingly unaffordable for younger farmers or those looking to expand, some analysts argue.

“Farmland affordability deteriorated to its worst level in 30 years at the end of 2023 as farmland values and mortgage rates increased,” FCC wrote in a March 27 article.

Farmland values are outpacing the revenue producers can generate from it, FCC added.

Farmland affordability is expected to deteriorate further in 2024 as land values continue to rise, interest rates remain high, and farm cash receipts are projected to drop.

Feeling vulnerable

Despite an enviable balance sheet as far as the accountants are concerned, farm group leaders suggest members are feeling less secure about their finances. Last year’s crop was touted by some as the most expensive ever planted, said Keystone Agricultural Producers president Jill Verwey.

“Combined with the pressure on grain prices right now, it’s probably putting farmers in a tight position going into spring because of the large number of bushels still in the bin,” she said.

“From a cash standpoint, you know, the longer you hold that grain over, it’s costing you more because it’s lost value.”

After soaring to new heights in 2022, prices have steadily softened. Western red spring wheat was worth a little over $307 per tonne on March 27, according to Manitoba Agriculture statistics, down from $411.17 per tonne a year prior. Canola was selling at just over $609 per tonne, compared to almost $766 at the same time last year.

Input prices have also softened somewhat, but not at the same pace.

“I think it’s going to be a tighter year this year,” Verwey said.

On StatCan’s balance sheet, ratios like the acid test (the ratio of quick assets like cash and marketable securities to current liabilities) suggest most of farmers’ liquidity comes from stored grain or inventory rather than cash, Micheels said.

“When we store grain, we are also incurring a cost of waiting to convert that grain to cash,” he noted.

And until that grain becomes cash in the bank, uncertainty remains. If prices go up after harvest, the return from storing grain covers that opportunity cost. But if prices fall, the farmer incurs the cost with- out the benefit, eroding profitability of the previous year’s crop.

“That can lead to a double whammy of pessimism and maybe a determination to continue to wait for higher prices to rationalize the decision to store the grain,” Micheels said.

There are other costs facing farmers, and they haven’t been static. Property taxes may have gone up, along with hydro costs, said Keith Currie, president of the Canadian Federation of Agriculture.

In recent years, farmers have also had to deal with the impact of weather events like hurricanes in the east, drought in the west, and various wildfires, last year being one of Canada’s worst wildfire years on record.

“There’s all these factors that you can’t put on a spreadsheet that come into play,” Currie said.