Canola prices hit calendar-year highs on the Intercontinental Exchange during the week ended May 23, with new crop contracts hovering around the $700 per tonne mark.

But lately, there’s been literal rain on canola’s parade.

New moisture has been a welcome sight for growers. However, that benefit has been tempered by drawbacks. On the Prairies, only one-quarter of canola acres have been planted so far, well below the average pace. Adequate moisture can also stabilize prices in the long-term.

Read Also

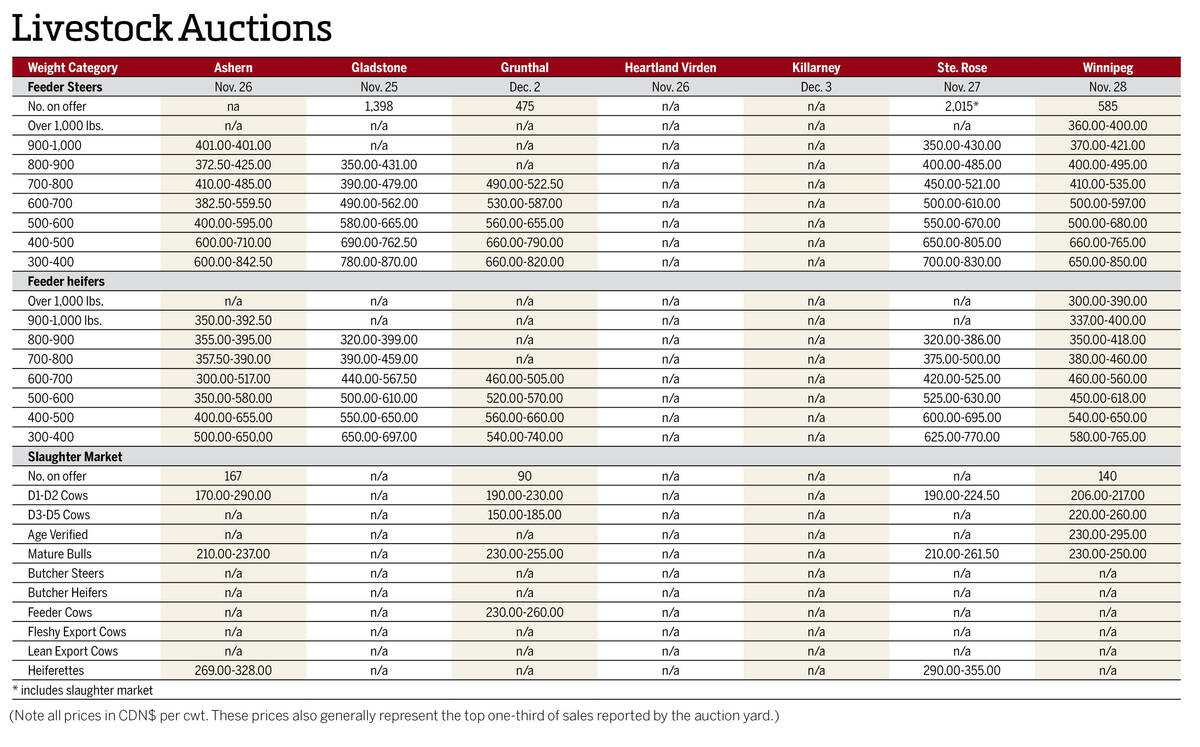

Manitoba cattle prices, Dec. 3

Cattle prices from Manitoba’s major livestock auction marts during the week Nov. 25-Dec. 2, 2025.

While rain can weigh on prices, canola’s interplay with other markets and its relative volatility means that Prairie weather won’t be the only force in play.

Over the past month, canola has followed the lead of the Chicago soy complex as those prices rose. Soybean growing areas in the United States and Brazil have seen severe weather in recent weeks, which may further support prices.

As of May 23, the July soyoil contract is below the 50-, 100- and 200-day moving averages at US45.19 cents per pound, possibly indicating an upcoming rise.

If canola wants to continue its rally, it will have to overcome possible resistance. July canola, which closed at $672/tonne on May 23, was only $10 below the 200-day average. November canola closed the same day at $693.50/tonne with the psychological level of $700 fast approaching.

However, the spread between canola and European rapeseed has widened, possibly making canola more attractive to European importers.

Agriculture and Agri-Food Canada released its monthly principal field crop estimates on May 21, cutting 2023-24 canola exports from seven million tonnes to six million, at no surprise to the trade.

If the Bank of Canada cuts its key interest rate next month, the loonie may weaken, making Canadian commodities like canola cheaper — unless the U.S. Federal Reserve cuts rates first.

While weather will still affect prices as the summer continues, it’s important to look for other signs of impending price movement.