I recently drove back and forth from Winnipeg to the Turtle Mountains in southwestern Manitoba. It’s about a three-hour drive, or three-and-a-half with the required ice cream stop.

There are a few routes that head in the same general direction, so after running into construction on Highway 2 on the way down, we opted for the slightly more scenic route along Highway 23 on the way back – only to run into even worse construction.

Perhaps heading up to the TransCanada or keeping a more southerly route on Highway 3 would have shaved time off the trip, but the total travel distance would have been longer.

Read Also

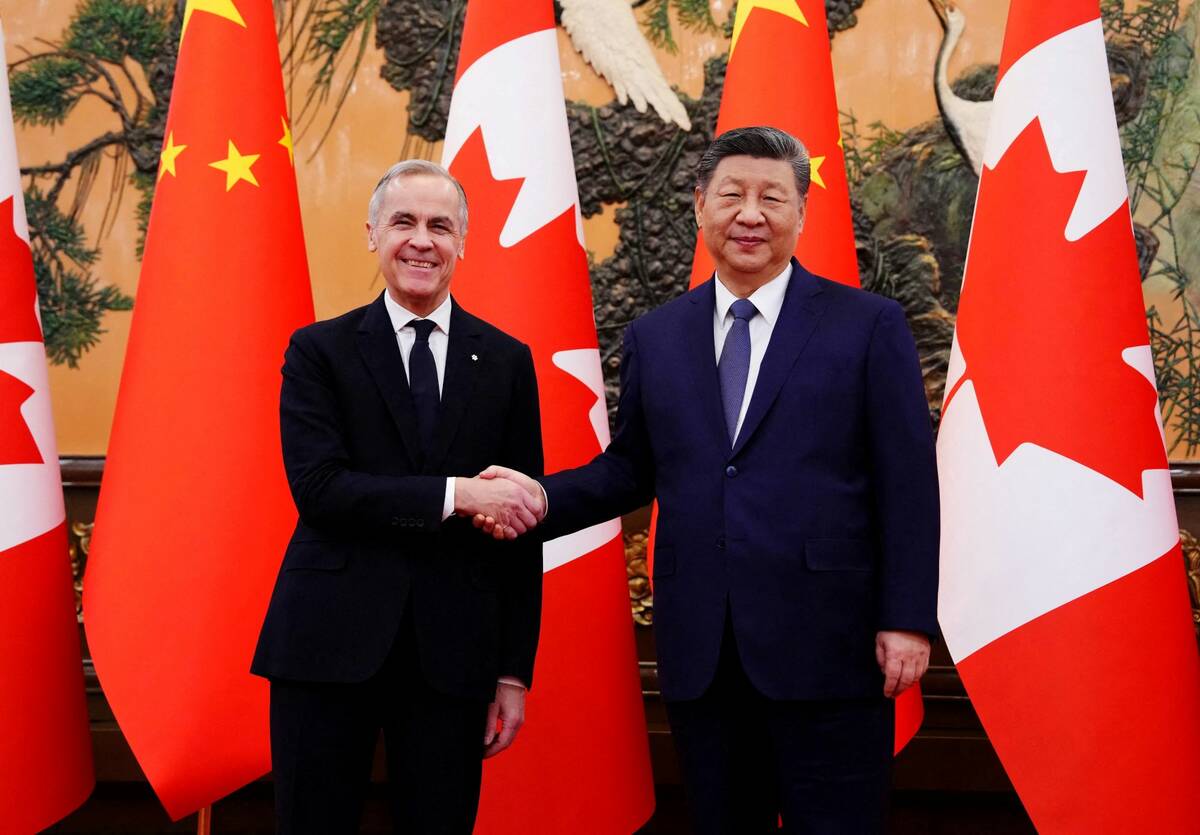

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

Looking at a technical markets chart can be like looking at a map of where you’ve already been.

The November canola contract has risen by more than $200 per tonne in less than two months, hitting its highest levels of the calendar year around $840 per tonne. A return to such heights seemed unlikely when prices were closer to $600 at the end of May, but here we are.

Continued strength will be highly dependent on weather and activity in outside markets, but from a purely technical standpoint, the contract easily has another $30 of room to the upside, with a target around $880 per tonne.

However, just as there are real-time maps available that can show you where traffic is slowed by construction, there are bearish warning signs in the canola chart. The key signal of an imminent correction is the relative strength index, which is heavily into overbought territory.

Soybean/soy oil

Chicago futures for soybeans and soy oil saw a similar pattern over the past month, although canola outpaced its U.S. counterparts to the upside, causing canola crush margins to soften.

The slower rise for soybeans and soy oil also means that neither are overbought. December soy oil has found a comfortable level of just over 60 U.S. cents per pound, with resistance in the 63-to-64 cent area.

Corn

The Chicago corn chart looks completely different than oilseeds, with a sharp drop in late June and early July, followed by a period of consolidation and eventual recovery. The technical outlook has turned relatively neutral for corn. Contract lows of just under US$5 per bushel hit earlier in July are likely the bottom of the market for the time being. The upside target in the December contract at the 200-day moving average sits near US$5.75, followed by the psychological US$6 level.

Wheat

Wheat serves as the greatest reminder these days that technical charts, much like maps, can be fallible. What was once a fine route pointing in a clear direction can be quickly altered by construction or, in this case, the ongoing war in Ukraine, attacks on grain handling infrastructure and end of the Baltic Sea Grain Initiative.