In the world of business, different strategies often create synergies where one plus one can equal three.

Of course, the same is true for farming. There are many agronomic strategies that are used together from advanced seed genetics, to crop rotation and variable-rate fertilizer applications, to tile drainage or irrigation pivots and the list goes on and on.

And because we also have many tools at our disposal in the financial markets, numerous strategies can be used in conjunction to help create a more diverse and robust farm operation.

Read Also

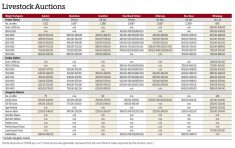

Manitoba cattle prices, Jan. 21

Six of Manitoba’s major seven livestock auction marts held cattle sales from Jan. 13-20, 2026.

For instance, basis contracts, deferred delivery contracts as well as options and futures strategies all work together with your storage capacity. Together, they can help you manage both your price and production risk as you fine-tune your marketing plan throughout the year.

Likewise when it comes to financing, you’ve got many alternatives from short-term borrowing to long-term borrowing, variable rates or fixed mortgages, and equipment leasing all from a variety of different lenders as well as creative crop-sharing arrangements and unique land rental agreements. All of these together — and likely more — help form the overall financial strategy of your farm. But you can always look for more synergies so one plus one can equal three.

Two specific areas that I find more and more farmers embracing are hedging strategies with options and futures as well as the cash advance programs available. However, I’m often surprised by how many farmers don’t use options to maximize their marketing efforts nor take advantage of some of the incredibly low rates and flexibility offered by cash advance programs.

Over the years, Dave Gallant, director of finance and operations at the Canadian Canola Growers Association (CCGA) and I have talked at length about how both our financial tools can work together; how one plus one can equal three and how growers can benefit from all the financial tools available to them.

The CCGA has been helping western Canadian farmers manage their seasonal cash flow needs for 35 years by providing access to cash advances for more than 50 commodities, including crops, livestock and even honey. Gallant says that farmers can use an Advance Payments Program (APP) cash advance to access cash flow on their inventory, while giving them the time they need to find the right spot in the market to maximize price.

He says that the key is that there are no limits to how you can put an advance to work for your farm. It can be used to cover seasonal operating expenses, pre-purchase next year’s inputs, upgrade or do maintenance on farm equipment or structures, or grow your business by investing in capital purchases. The APP gives you the flexibility to plan commodity sales and optimize the prices you receive, while reducing borrowing costs with interest-free and interest-bearing advances below prime rate.

Basically, farmers can apply in the fall or at any time of the year and eligible applicants can receive up to $1 million, including $100,000 interest free.

CCGA’s rate on the interest-bearing portion for the 2021 APP is prime rate less 0.75 per cent. That means the low blended interest rate on a $1-million advance can save your business $10,000 to $20,000 per year over the same loan value taken at commercial lender rates. Farmers have access to advance funds for up to 18 months for crops, small livestock and honey, and up to 24 months for cattle and bison.

Advances are repaid as the commodity that the advance is issued on is sold, so the repayment schedule depends on when you sell your commodity. These low-interest rates lower your cost of production, which allows you to stretch your own dollar further. The added farm cash flow also gives you more time to execute your grain-marketing plan. You can sell when the time and price are best for you. Ultimately, it is this matching of loan repayments with commodity sales that work well with options and futures hedging. Essentially, you can time your hedges to coincide with when you want to make physical sales and also repay the advance.

Bottom line, both the cash advance program and hedging strategies are useful financial tools on their own to enhance your marketing decisions. Together, these financial tools provide greater flexibility and adaptability for your marketing plan, especially if we have drought conditions again next year.