Market news

Seeding conditions swaying markets from day to day

An enthusiastic Canadian dollar is a drag on canola

It was a fairly quiet period in grain and oilseed markets during the week ended April 10, with most futures prices moving lower amid a choppy spring pattern. The U.S. Department of Agriculture’s monthly supply-and-demand report was released April 9, providing some temporary direction for values, but the data was all for the 2014-15 crop

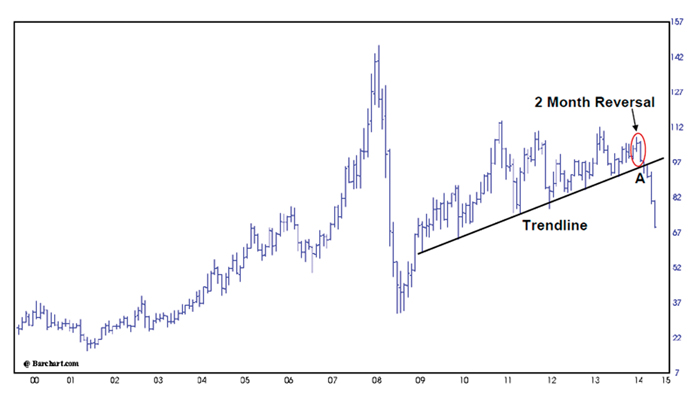

Key reversal alerts livestock producers to recent downturn

Technical analysis has the ability to cut through the news and see opportunities

Live cattle futures plummeted $23 per hundredweight after turning down from a new historical high in late November 2014. As always, the news was incredibly bullish at the top, so some livestock producers may have been caught off guard by the sudden drop in prices. However, producers who study charting and technical analysis may have

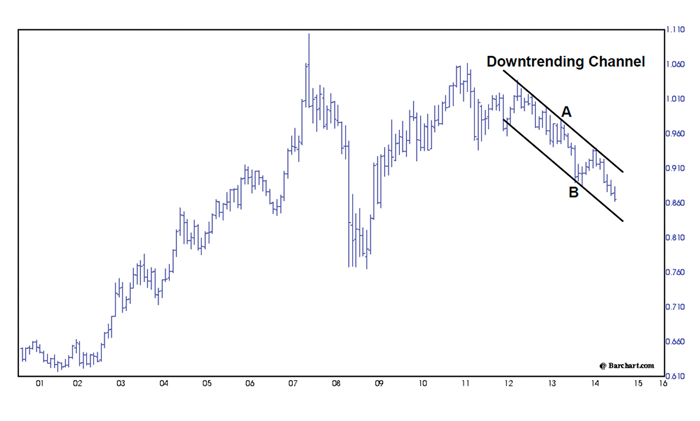

Canadian dollar continues to trend lower, slipping to a 5-1/2-year low

A lower Canadian dollar makes our exports more competitive but it increases the cost of imports

The Canadian dollar has been trending lower for the past three years. As recently as December 2012, it was trading at par to the U.S. dollar. Last year at this time it was worth 94 cents to the U.S. dollar and this year it is down to 86 cents. Canada is a resource-based country and

Crude oil falls to a four-year low

Plunging prices are casting a dark shadow across the commodity sector

At the time of this writing, crude oil has plunged $40 per barrel, losing 37 per cent of its value, since prices turned down from $107.73 in June 2014. This market’s steady decline may have come as a surprise to some followers of oil, but for those who study charting and technical analysis, they were