Canola futures climbed higher during the week ended Sept. 22, as historically wide crush margins finally showed signs of correcting themselves.

Crush margins relative to the November contract rose above $300 per tonne during the week, indicating canola futures values had considerable room to the upside while still being profitable for buyers. Crush margins around $100 per tonne above the futures would be more typical. Last year at this time, the reported margin worked out to a small net loss for every tonne of canola crushed.

November canola started the week below the $800 per tonne level but was well above that key chart point, at $819.60 per tonne at the close of trade Sept. 22.

Read Also

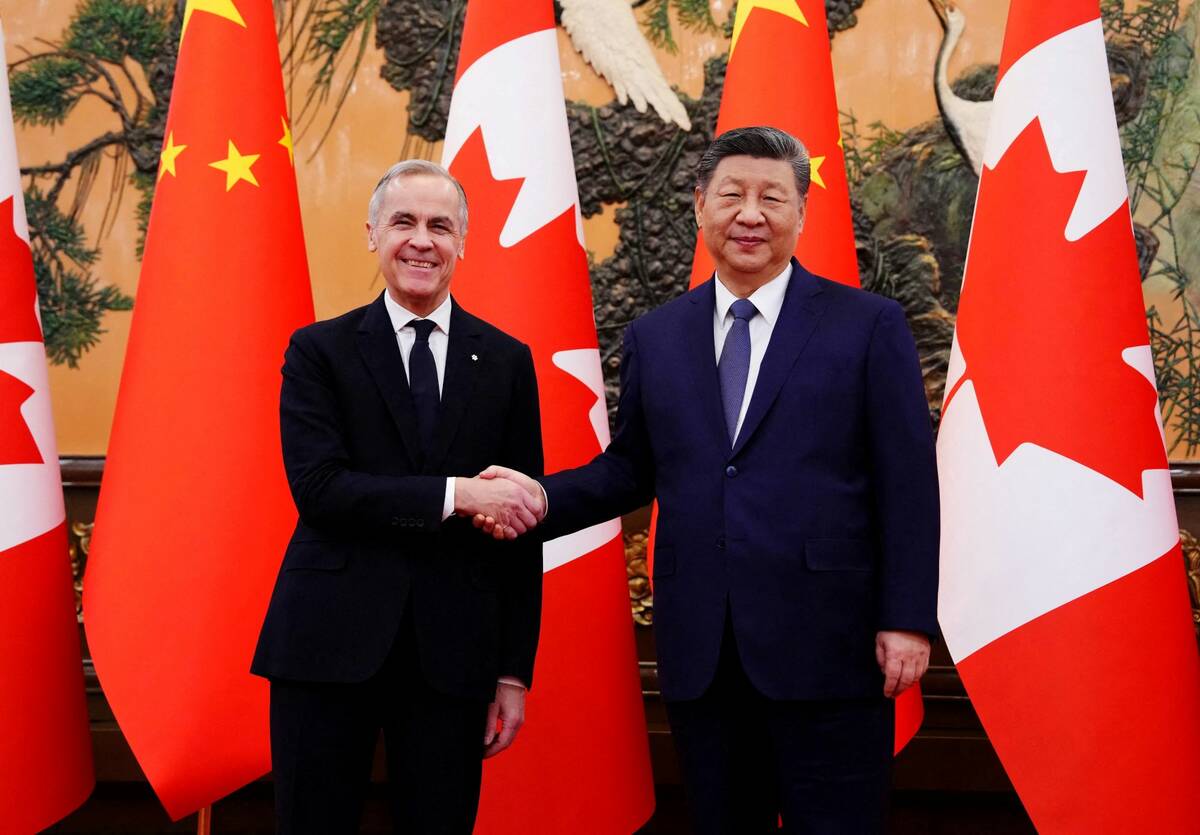

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

Harvest pressure may keep a lid on the upside in the near term, but the bulk of off-the-combine selling should soon subside, with seasonal price trends pointing to a post-harvest uptrend in canola.

Total production will certainly come in well above last year’s drought-stricken crop, but there are also anecdotal reports that the crop may not quite live up to official projections. The final tally on production won’t be known until December, but whatever the number, the supply/demand balance should remain tight.

The oilseed is once again looking attractively priced in the global market, after last year’s drought-induced tight supply situation tempered export movement.

However, numerous outside influences beyond the typical supply and demand fundamentals could still dictate the overall direction of the market. Developments in the ongoing conflict in Ukraine remain a key feature driving grains and oilseeds, especially with the safe-passage Black Sea corridor agreement thought to be in jeopardy.

Mounting recessionary fears and related credit issues also have the potential to cut into demand.

The Canadian dollar has fallen sharply relative to its U.S. counterpart over the past few weeks. A softer loonie makes Canadian exports more attractive for international buyers, but also cuts the other way by raising input costs.

In the U.S., wheat futures moved higher during the week, while soybeans and corn both held range-bound.

Uncertainty over the situation in Ukraine was especially supportive for wheat, although broader global economic worries were also at play. While the Canadian dollar was moving lower, the U.S. dollar climbed higher. That strengthening dollar has a negative influence on U.S. exports.

The advancing harvest will be another factor to watch in the U.S. markets over the next few weeks, with the bulk of the soybean and corn harvests still to come.