From a high of 1.10 to lows of 60 cents per U.S. dollar over the past several decades, the value of the loonie has always had an impact on Canadian farmers.

While these fluctuations certainly will influence crop prices we receive here in Canada, what effect does it really have? Is a strong loonie really a bad thing? What happens to farm commodity prices in a weak U.S. dollar environment?

Sometimes you hear producers say a strong Canadian dollar has a big impact on the prices they receive; others say it doesn’t matter as much as you’d think. Let’s crunch some numbers to see what it all really means.

Read Also

Supply management schism still dividing agriculture

Bill C-202 wound up pitting farmer against farmer for political reasons at a time when an unwritten law of Canadian politics remains very much in effect anyway.

In the last couple of years, the weak loonie has benefited Canadian farmers in the short and medium term, helping to offset the recent drop in global grain prices. Historically, though, what has been the longer-term effects of a strong U.S. dollar on grain prices?

The Canadian dollar tends to move in five- to 10-year cyclical trends. Interestingly, during those longer-term trends, a weakening U.S. dollar and rising Canadian dollar has typically been associated with higher grain prices.

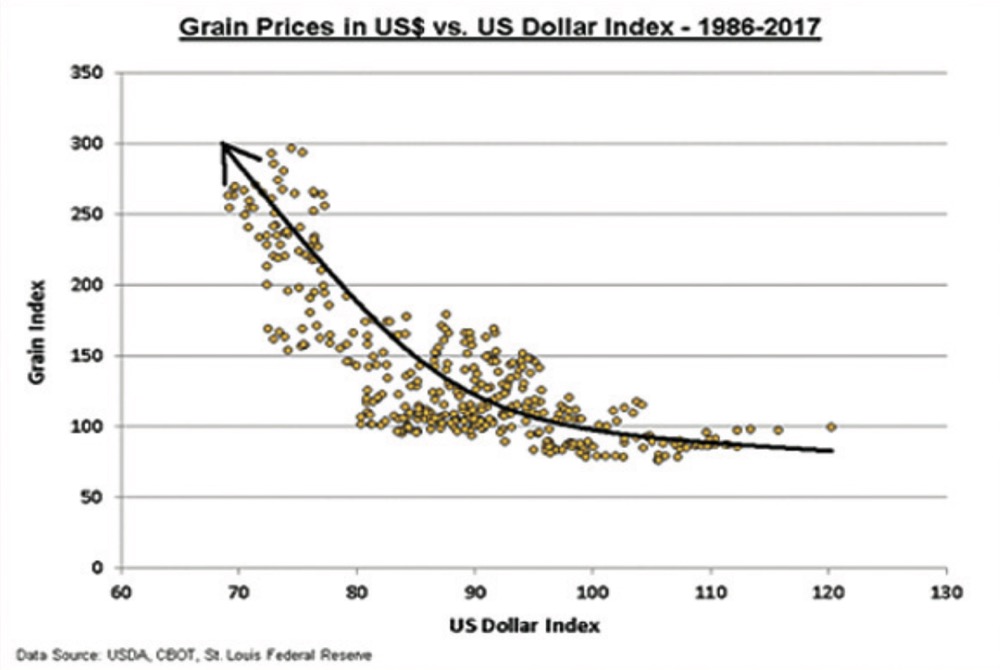

Using 30 years of historical data, wheat, corn and soybean futures actually have a strong negative correlation or connection with the U.S. dollar of about -60 per cent. (Correlation ranges from a low of negative 100 per cent, meaning prices are moving in the exact opposite direction, to a high of positive 100 per cent, indicating prices are moving lockstep in the same direction.) This means that most of the time, corn, wheat and soybean futures move in the opposite direction of the U.S. dollar, often going up when the U.S. dollar goes down and vice versa, as you can see in the accompanying chart.

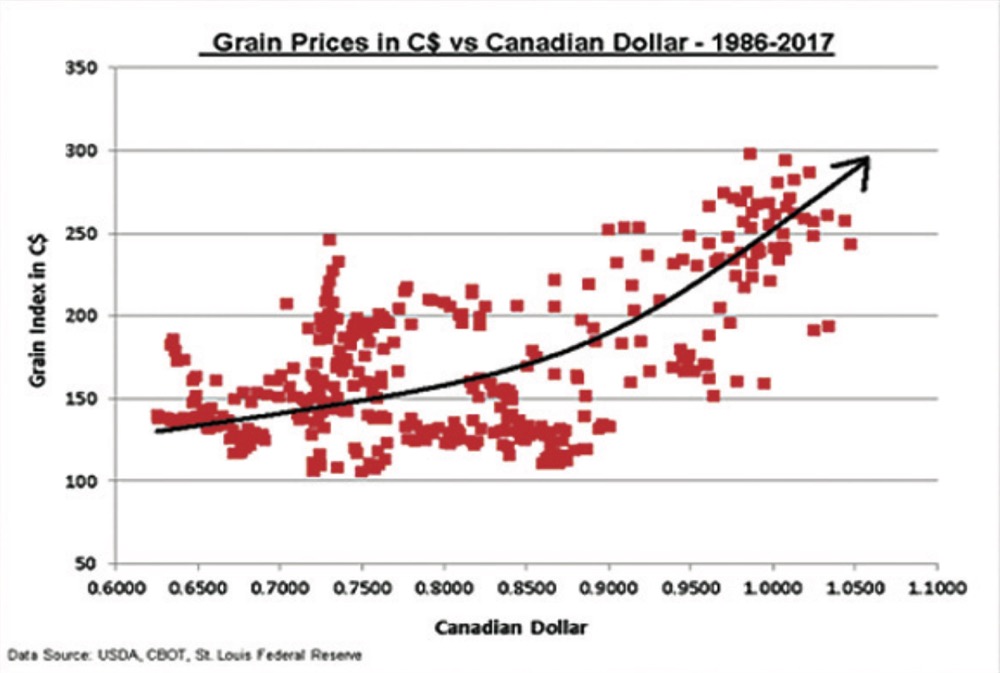

Looked at another way, a similar chart (Grain Prices in Canadian dollar versus Canadian Dollar Index 1986-2017) shows an overall trend toward better domestic prices for wheat, corn and soybeans for Canadian farmers when the Canadian dollar is higher.

This all makes sense given commodities are priced around the world in U.S. dollar. People in Europe and Asia buy more and push up prices — if the U.S. dollar weakens at a greater rate then the strong Canadian dollar hurts Canadian farm prices.

Taking a look at one more chart, in the past 20 years, the highest equivalent grain prices in Canadian dollar have been when the Canadian dollar was near par, as per the green circles. Meanwhile, cyclical low grain prices often occurred when the Canadian dollar was at quite low levels as well (shown in red boxes).

So, over time, would you rather have the Canadian dollar at par or 70 cents U.S. dollar?

Of course that’s a loaded question because with the Canadian dollar near par, soybeans were C$12 to C$15/bushel, corn was C$6 to C$8, wheat C$7 to C$9 and canola C$12 to C$15/bushel. With the Canadian dollar near 70 U.S. cents, those Canadian grain prices might be 20 per cent to 30 per cent or even 40 per cent lower.

While this analysis doesn’t factor in local basis levels and there can be other issues involved, based on the historical evidence, a strong Canadian dollar is not as scary as you think.

In fact, another potential positive of a stronger Canadian dollar is that it provides a good opportunity to buy equipment and supplies since most of it is directly or indirectly priced in U.S. dollars.

Bottom line, a strong Canadian dollar is not necessarily a bad thing for Canadian producers despite what anecdotal evidence suggests. Certainly there are times when a high loonie coincides with cyclically low grain prices. Most of the time, however, what we lose on a strong Canadian dollar, we tend to gain from higher grain prices, and then some. Whether this relationship holds into the future or not remains to be seen. This type of historical analysis is a guide to support objective decision-making and improve farm marketing strategies. So, as always, it is prudent to have a marketing plan in place that prepares you for hedging opportunities in both the currency and grain markets.