An estimated 27,000 cattle producers across the Prairies manage about nine million head in cow-calf, feeder and stocker operations worth approximately $8 billion, according to StatsCan data. That’s a lot of money.

So it’s no surprise more and more cattle producers want to learn about price protection for their cattle. Speaking with producers at the local livestock sales markets, I see they are also keen to know more about options and futures.

Whether you’re backgrounding, operating a cow-calf business or running a feedlot, flexible, open market, exchange-traded futures and options can help you manage your costs and revenues. This article will review the basics of cattle futures and options as well as Canadian cash cattle basis levels to help you use these tools for your operation.

Read Also

Feeding ergot: research on ergot-impacted grain and beef cattle continues

Saskatchewan research hopes to tease out better ways for Canadian beef farmers to manage ergot consumption in their herd’s feed

Cattle futures have a long history on the CME Group’s Chicago Mercantile Exchange. Full-weight cattle futures have been trading since the early 1960s and feeder cattle since the early 1970s.

The 40,000-pound live, or full-weight, finished cattle futures are based on 1,000-pound to 1,500-pound steers/heifers at stockyard and slaughter plant delivery points throughout South Dakota, Nebraska, Colorado, Kansas, New Mexico and, of course, Texas.

Meanwhile the 50,000-pound feeder cattle futures are based on 700- to 900-pound steers with prices determined by the CME Feeder Cattle Index of 12 major feeder cattle-producing states.

Live cattle futures are available for the months of February, April, June, August, October and December until December 2019. Options are available a year out, all the way to August 2019. For feeder cattle, futures are available for January, March, April, May, August, September, October and November until May 2019. Feeder options are available 10 months out until May 2019. Most importantly, there is full flexibility to buy or sell daily between 8:30 and 1:05 central time throughout the year, Monday to Friday.

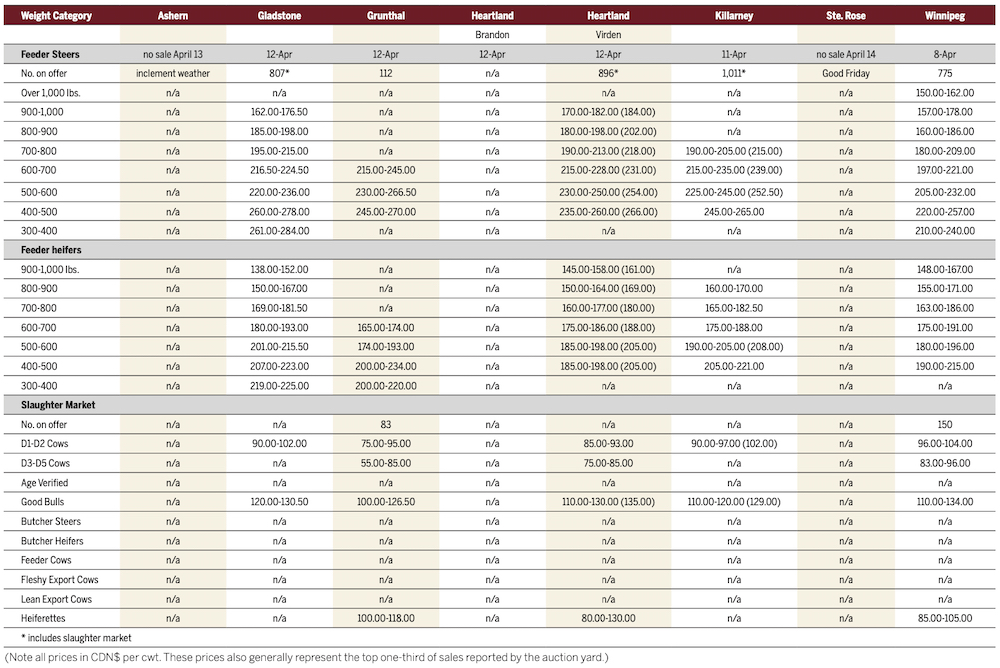

The futures market for all outstanding live cattle futures is C$18 billion while feeders is over C$5 billion. The underlying value for live cattle options is currently valued at about C$3 billion and for feeder cattle options almost C$1 billion. Both provide plenty of liquidity to implement straightforward simple hedging strategies as well as more involved option strategies. Both cattle option markets offer a wide range of price protection. For instance, with April feeders currently at US$149/cwt and April full-weight cattle futures at US$118/cwt, at the time of this writing, you would find minimum floor price put option prices as per the accompanying table.

Historically, given cattle prices can fluctuate 10 to 15 per cent in a six-month period, this makes futures and options a key tool to have in your marketing tool box.

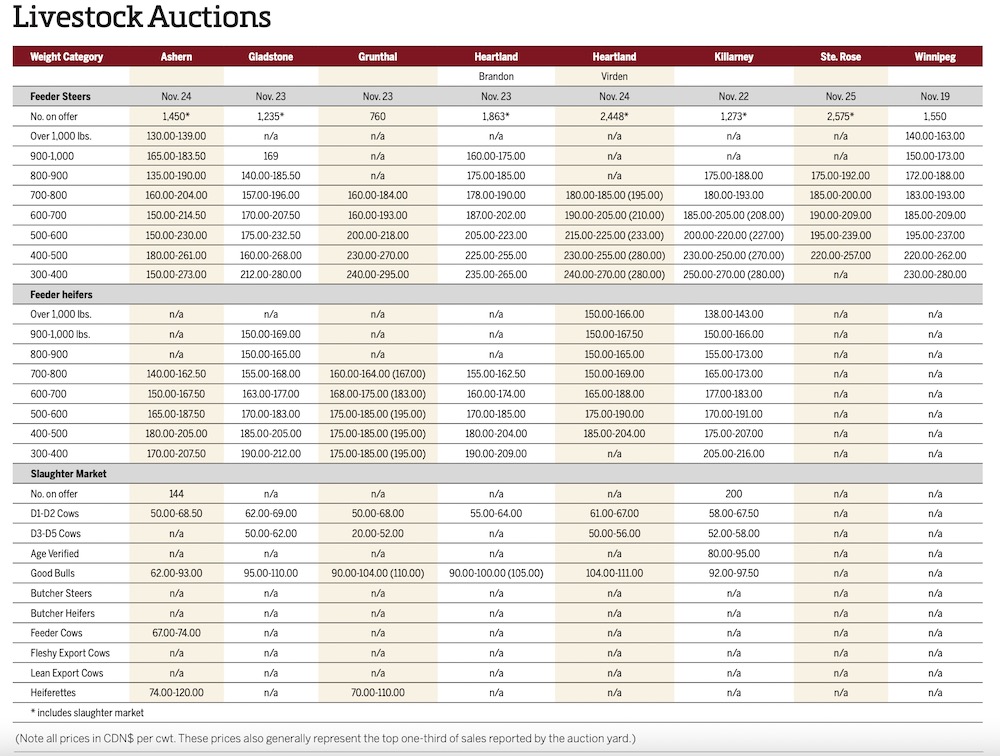

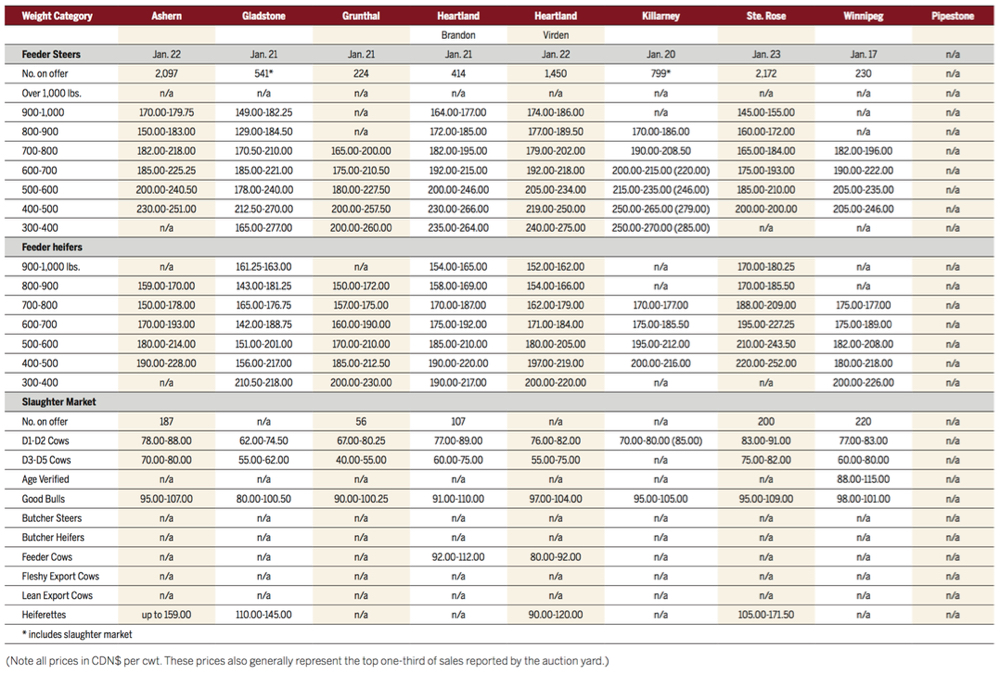

Taking the analysis one step further, it’s not just the cattle futures but also the Canadian cash price and the associated basis that’s important. Historically, over the past 17 years, Canadian Prairie cash cattle prices have tracked futures prices quite closely. Using both CME Group futures and AFSC cash price data since 2001, the basis levels for Manitoba, Saskatchewan and Alberta feeder cattle in Canadian dollars has usually been between negative C$20 under to C$0. It dropped significantly from 2003 to 2005 to as low as negative C$70, and was hovering around negative C$40 in 2014 and 2015. From 2015 to present, the basis has been between negative C$20 to near flat, or C$0 basis. Recently it was as high as positive C$10 to positive C$20.

For full-weight cattle, the basis story is almost the same, although fed cattle didn’t drop during the 2014-15 period. Instead it stayed within its historical range between negative C$20 under to flat, or C$0 basis.

Of course, since cattle futures are priced in U.S. dollars, there is the Canadian dollar component to hedge as well, just like most grain futures. The currency component is a decision that can either be made together or separate from the cattle futures price depending on market conditions. In addition, wheat, corn and soymeal futures can be used to hedge feed input costs, depending on your feed rations. But before we get too carried away, at least start by using cattle futures to protect your biggest exposure, your revenues.

Bottom line, cattle futures allow you to manage revenues by locking in prices while option strategies help you establish minimum floor price protection or even a range of favourable prices. Futures and options strategies don’t replace what you are already doing but provide alternatives to complement and help improve your operation. Depending on the existing market conditions, sometimes you need a fork, sometimes you need a spoon, sometimes a knife, or scissors, or saw or file or even a set of tweezers. Options and futures strategies are the Swiss Army knife of marketing tools for both short-term pricing opportunities and longer-term sales decisions.

Estimates and projections contained herein are our own and are based on assumptions which we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does PI Financial Corp. assume any responsibility or liability.

David Derwin is a commodity portfolio manager and futures/investment adviser with PI Financial Corp., a member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. Past performance is not necessarily indicative of future results. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an adviser or a dealer in securities and/or futures and options.