* Weaker corn supports feeder cattle

* CME hogs slip on weak cash markets

By Meredith Davis

CHICAGO, Nov 12 (Reuters) - Chicago Mercantile Exchange live

cattle futures dipped on Tuesday on profit-taking as wholesale

beef prices slipped and beef packer margins remained negative,

traders said.

Beef packer margins improved slightly on Tuesday, but were

still in the red as lower wholesale prices squeezed profits.

Choice wholesale beef values early on Tuesday were down 22

cents from Monday to $202.57 and $2.88 lower than a week ago,

according to U.S. Department of Agriculture data.

Despite negative margins, packers still need supplies, which

Read Also

Different herd, different approach needed for vaccinating calves

Intranasal vaccines are common on Canadian beef farms, but they’re not right for every herd’s calf vaccination needs.

could keep cash cattle prices at least steady this week, traders

said.

Last week, packers paid $1 less per cwt for cattle than the

week before at mostly $131, with a few sales of $132 per cwt,

feedlot sources said.

Traders noted more cattle for sale in the U.S. Plains this

week. But, the longer term trend is for tighter supplies given

the herd at a 61-year low.

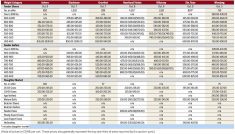

December finished 0.075 cent per lb lower at 132.675

cents, and February closed at 134.275 cents, down 0.100

cent.

Front-month CME feeder cattle ended higher as corn prices at

the Chicago Board of Trade eased. The weak CME live cattle

market pressured back-month feeder cattle contracts.

November closed up 0.450 cent per lb at 164.650

cents, and January ended at 164.200 cents, up 0.025

cent. March ended 0.125 cent lower at 164.200 cents.

HOGS PRESSURED BY LOWER CASH PRICES

Lower cash hog prices pressured CME hog futures, traders

said.

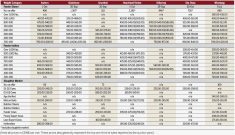

Tuesday morning, USDA pegged hog prices in closely watched

Iowa/Minnesota down $3.16 per cwt from Monday at $79.20 per cwt

in light trade. Prices in the eastern hog markets fell by $1.06

to $79.98.

Cash hog prices have been pressured by ample supplies at

higher weights, according to traders and hog brokers.

Falling cash prices and slowly rising hog numbers undercut

initial market support tied to worries about the spread of the

Porcine Epidemic Diarrhea virus (PEDv) on U.S. hog farms,

independent livestock futures trader Dan Norcini said.

Speculators recently bought deferred-month CME hogs with the

view that resurgence of PEDv, which is fatal to baby pigs, can

reduce hog production through the middle of 2014.

December hogs ended down 0.850 cent at 87.200 cents,

while February closed 0.875 cent lower at 91.350 cents.

(Additional reporting by Theopolis Waters; editing by Andrew

Hay)

LIVESTOCK-U.S. live cattle futures pressured by profit-taking

By