* Short-covering buoys cattle futures

* Feeders follow cattle higher

* Hogs gain on strong cash markets

By Sam Nelson

CHICAGO, June 6 (Reuters) - Chicago Mercantile Exchange

(CME) live cattle futures closed higher on Thursday on technical

short-covering and despite wholesale beef markets that eased

again from recent record highs, traders and analysts said.

"Boxed beef may be lower but there is still good movement.

Cash cattle haven't traded yet so it's just a seesaw affair in

the cattle market right now," said Jack Salzsieder a broker for

K&S Financials.

The U.S. Department of Agriculture's (USDA) boxed beef

Read Also

Scientists discover cause of pig ear necrosis

A University of Saskatchewan team, through years of research, has discovered new information about pig ear necrosis and what hog farmers can do to control it.

report showed choice wholesale beef carcasses at $203.08 per

hundredweight, down $1.32 per hundredweight from Wednesday.

Traders were waiting for direction from this week's U.S.

Plains cash cattle market which had not traded as of the close

of futures trading on Thursday.

"Cash cattle keep trading at a premium to futures so that's

acting as a magnet for futures but most support to cattle

futures was from short-covering," said Art Liming, a market

specialist for Citigroup.

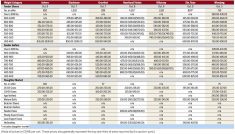

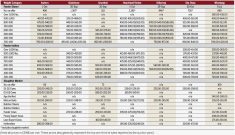

CME live cattle for June delivery were up 0.200 cent

per lb at 120.450 cents per lb. August delivery cattle

were up 0.750 at 120.025.

There were no cash bids or asking prices reported by feedlot

sources on Thursday and cash cattle last week moved at $124 to

$125 per hundred weight.

Some analysts were skeptical that weakness in the cash

market would develop this week, which helped keep a firm

undertone in the cattle futures market.

The number of cattle up for sale is roughly steady with last

week, which may support cash prices, an analyst said.

Estimated margins for U.S. beef packing companies were a

positive $39.70 per head, down from $43.55 on Wednesday and

below $75.25 per head a week ago, according to Denver-based

livestock marketing advisory service HedgersEdge.com LLC.

Feeder cattle futures turned firm on spillover support from

the gains in cattle but gains were limited by an uptrend in

Chicago Board of Trade corn futures.

Corn is the major cattle feed ingredient and an increase if

feeding costs often cut back on the demand for young feeder

cattle to place on feed in the nation's huge feedlots.

CME feeder cattle for August delivery were up 0.050

cent per lb at 144.650 cents per lb and were up 0.050 at 146.900

for September.

Lean hog futures closed higher on persistent good demand for

pork at the retail level and another upturn in cash hog markets.

"Cash hogs are firm and there is more aggressive buying by

packers," Liming said.

Cash live hogs traded in the Iowa and southern Minnesota

region on Thursday were steady to 50 cents per hundredweight

higher and markets extending from Illinois into Ohio also were

likewise steady to 50 cents higher.

Cash hog dealers said the market was uneventful in Iowa and

southern Minnesota but there was still some need for hogs or

demand amid a tight supply.

Packers were attempting to process more hogs than available

and paying up to get them in Illinois, cash dealers said.

Estimated margins for U.S. pork packing companies were a

negative $5.35 per head, compared with negative $3.25 on

Wednesday and negative $1.25 per head a week ago, according to

HedgersEdge.com.

CME lean hogs for June delivery were up 0.650 cent

per lb at 97.300 cents per lb and July hogs were up

1.250 cents per lb at 95.825 cents per lb.

(Additional reporting by Alyce Hinton in Chicago; Editing by

Marguerita Choy)

LIVESTOCK-Cattle futures gain on short-covering

By