Seasonal harvest operations will soon be winding down across Western Canada, with the soybean and corn crops in the U.S. Midwest not too far behind. How easily that grain flows out of the countryside can have a major influence on prices, especially if export demand is curtailed.

Mississippi River

An estimated 60 per cent of all U.S. grain exports move by barge along the Mississippi River before eventually leaving the country through the Gulf of Mexico, but dryness across much of the river basin has left the water too shallow for safe navigation in many areas.

Read Also

MANITOBA AG DAYS: Don’t wait to buy fertilizer, farmers warned

Higher fertilizer prices likely ahead, says Ag Days speaker. Farmers waiting until spring to buy fertilizer might end up eating the cost.

Barges are carrying less weight or not moving at all, causing freight rates to rise just when U.S. farmers have the most grain to move. Basis levels will adjust accordingly, with some U.S. export business likely shifting from the Gulf to the Pacific Northwest.

However, any reductions in U.S. exports will back into futures prices, spilling into Canadian markets as well.

Panama Canal

Any U.S. grain moving out of the U.S. Gulf Coast toward Asian destinations will inevitably travel through the Panama Canal, but that key link between the Atlantic and Pacific Oceans is facing its own drought-related issues.

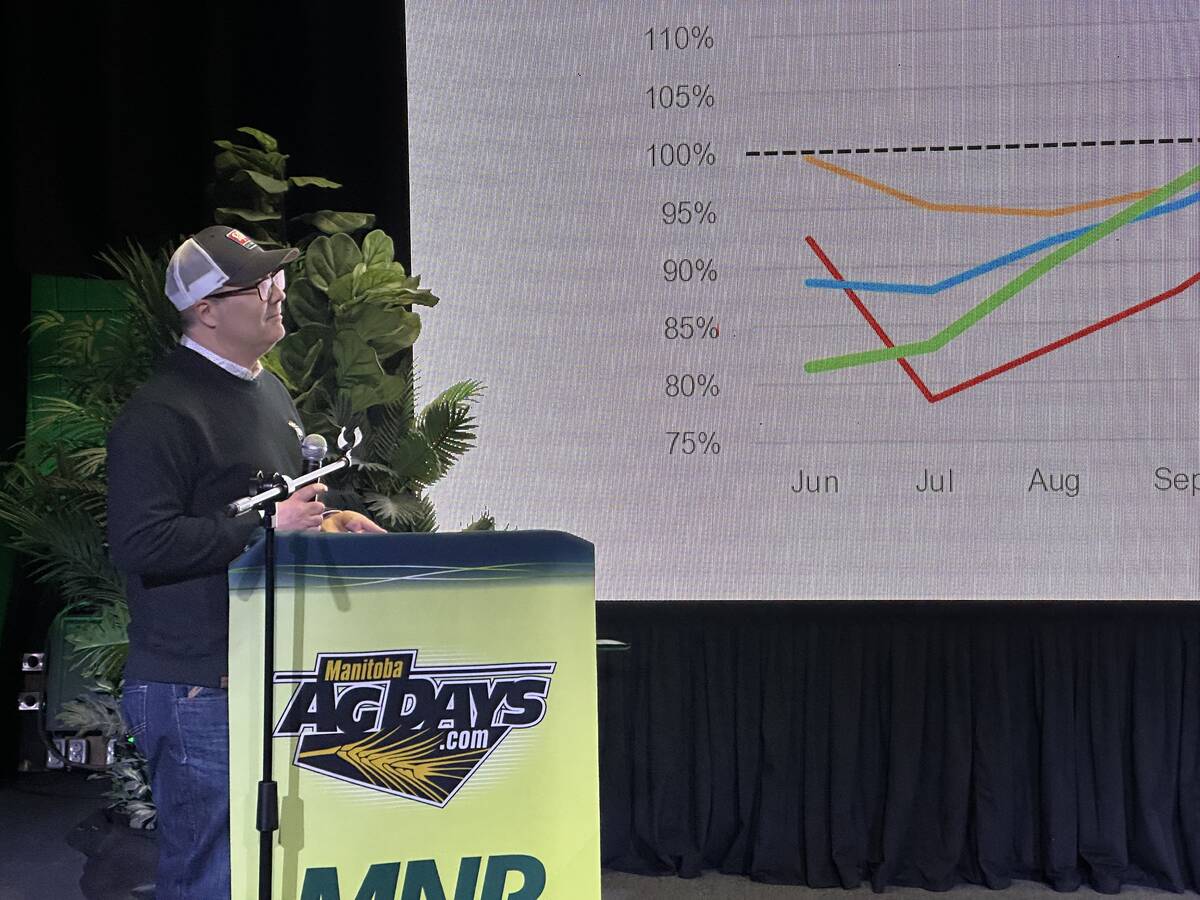

The canal relies on fresh water from a nearby lake to operate, but low water levels after two decades of drought have forced authorities to cut draft restrictions and lower the number of vessels allowed to move through the canal each day.

The backlog of vessels puts further limits on U.S. grain exports. Increased logistics costs and the bottleneck’s influence on international trade are being closely watched.

Alberta drought

Canadian crops typically move by rail to export positions, and there have yet to be any serious issues on that front this year. However, hot and dry conditions have also hurt the country’s waterways. Water shortage advisories were placed at several Alberta locations in mid-September, raising concerns over next year’s growing season if moisture levels don’t improve over the winter.

As far as Canadian grain movement goes, producer deliveries into the commercial pipeline through the first two months of the 2023-24 crop year were running slightly ahead of the year-ago level, with both wheat and canola exports solid so far, according to Canadian Grain Commission data.

Canola exports through eight weeks came in at 565,200 tonnes, roughly double last year’s pace. Wheat exports of 2.02 million tonnes were up by about 650,000 from the previous year.

Wheat exports are forecast to remain solid, but it’s questionable if the canola pace will be maintained because even larger demand from domestic processors should keep more of the oilseed at home. Year-to-date domestic canola disappearance, at 1.54 million tonnes, was up from 1.33 million in 2022-23.