Some market participants may have been surprised by the sudden downturn in the canola market, but others were prepared for it. Were you?

Technical analysis is akin to reading a road map. The patterns which form on the charts represent the road signs. Over the years, a number of rather classic formations have been identified which will either point the way, signal caution, or even tell you to turn around and go back the other way. Experience and a study of historical charts are important for understanding the signs.

Read Also

Manitoba sclerotinia picture mixed for 2025

Variations in weather and crop development in this year’s Manitoba canola fields make blanket sclerotinia outlooks hard to pin down

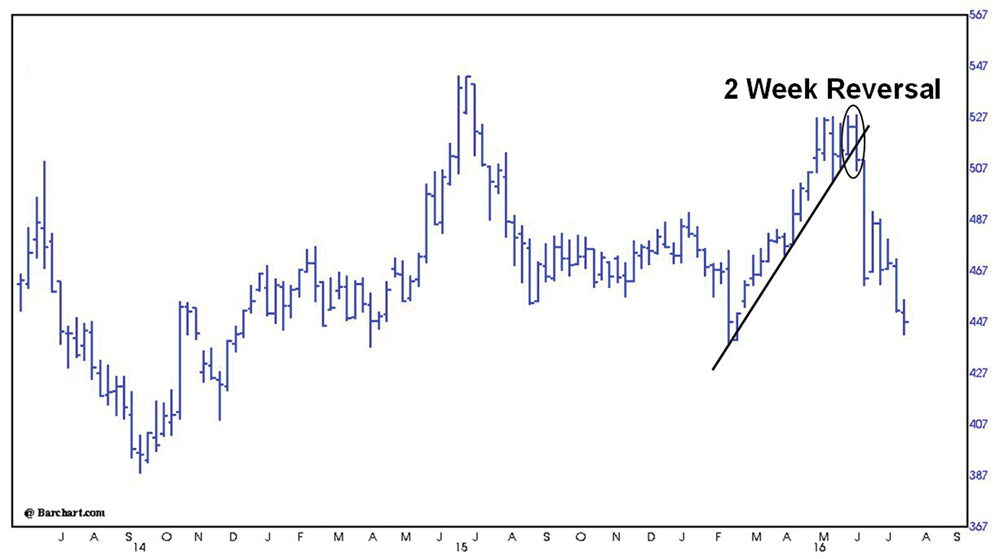

From my experience, I have found that tracking the canola market is often similar to a journey up and down a mountain. This particular journey up the mountain began on March 2, 2016 when canola turned a corner at the seasonal low of $448 and began to hike out of the valley. Canola looked forward to this climb every spring and by early June 2016 canola had made it up to an area of resistance at the $528 level. At this height, canola wondered if his three-month journey and $80-per-tonne climb up the mountain had come to an end.

Canola figured he could still go further and all that was needed was a little more momentum. Therefore, canola backed up to an area of support at $500 to take another run at it. However, canola had grown tired and did not have the energy to go higher, so he once again pulled back to the $500 area to look around and decide what to do next.

Although near exhaustion, canola doggedly decided to give it one more try. On this attempt canola mustered just enough energy to get to the $530 level, which was slightly higher than his previous attempts. However, this was not good enough, so canola began pulling back to reassess the situation.

At first, canola seemed to be reversing down the mountain in an orderly fashion, just as he had done before. Unfortunately, the numerous failed attempts to go higher caused him to be weak in the knees. Without warning, canola missed a step and went tumbling down the mountain. Now out of control and rolling down at an alarming rate, canola fell off the cliff at the $500 level and plummeted to the valley floor below.

Fortunately canola was a very tough and resilient bull, so although he suffered minor injuries, canola slowly got up, brushed off the debris and began the slow journey back up the mountain, still determined to get to the top.

Market psychology

The rally in canola ran into resistance at $528 (Stop Sign). Support and resistance areas are extremely important, as they illustrate where future rallies and declines are likely to fail. This is a classic example of prices rallying into a resistance area, only to turn around and proceed lower.

Then a two-week reversal materialized at the height of a major move up in both price and time. This was a very important formation to pick up on, as it is a reversal pattern which indicated the canola market was about to turn down (U-Turn).

Prices breached support at $500, which was an uptrend line drawn across the reaction lows. Trendlines are a valuable tool for determining the trend (road).

Sell stops were triggered when the market fell below $500, which drove futures lower. The selling came from shorts wishing to add to positions acquired near the top of the trading range as well as from longs who bought in the upper portion of the range, now seeking to cut their losses. Long liquidation was at the fore, as losses mounted for the bulls. In this environment nothing else matters and the market will not stop going down until the selling has been satisfied.

Canola producers who recognized these important signs were able to sell canola before the market turned down.

Send your questions or comments about this article and chart to [email protected].