The soy complex at the Chicago Board of Trade is usually a bellwether as to where canola prices will go, with support from gains in soyoil and soymeal countered by losses in soybeans during the week ended Nov. 9.

There are at least a couple of bearish indicators for soybeans. First is the projected Brazilian crop, which many analysts expect to break last year’s record and produce in excess of 160 million tonnes.

Then, the U.S. Department of Agriculture, in its monthly supply/demand estimates released Nov. 9, increased its projected yield and production while soybean carryout was estimated at 245 million bushels. The total was within the range of trade expectations, but was still 24 million more than the average guess.

Read Also

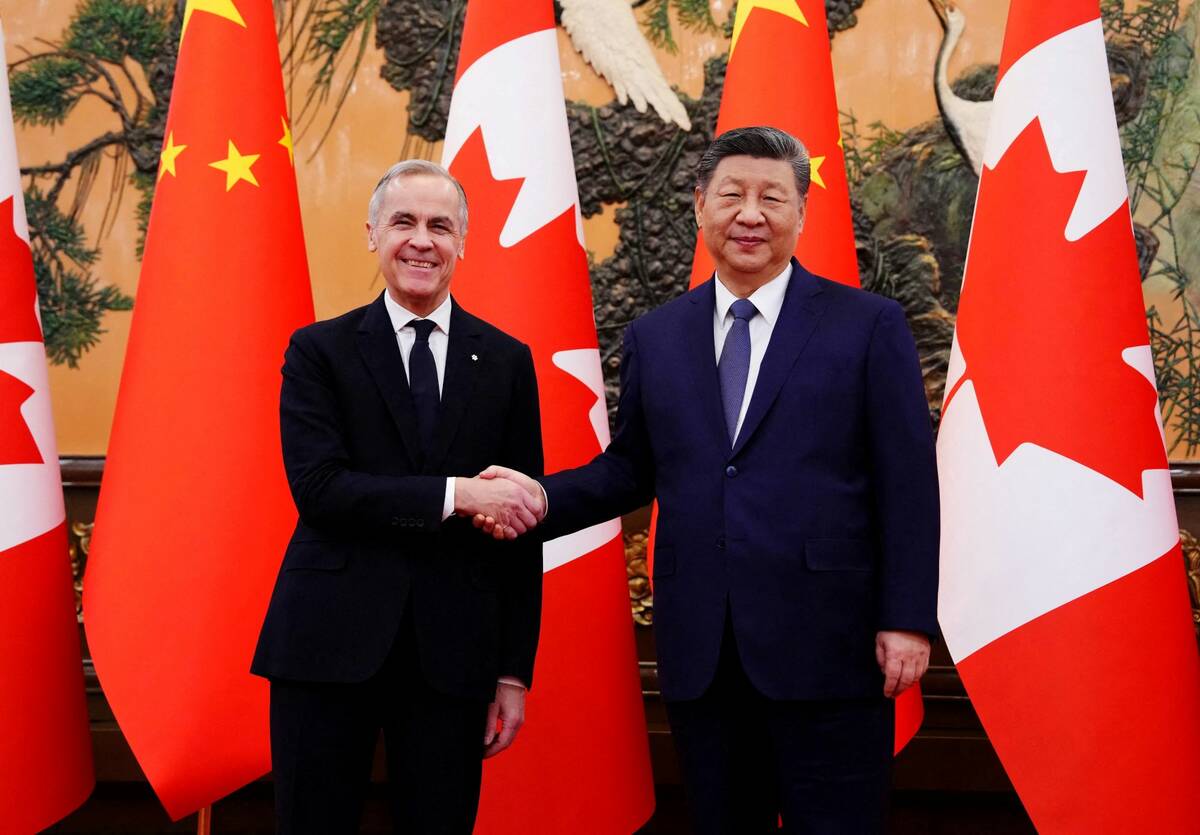

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

A stronger U.S. dollar, a net long position by the funds and declining crude oil prices could also play their parts.

However, recent events would suggest hopes for bountiful soybean supplies are slowly fading and an increase in prices could be imminent.

It’s been tough going for soybean planting in Brazil in recent weeks. Northern and central parts of the country are experiencing hot and dry weather, while southern parts are dealing with excess moisture. El Nino could still wreak more havoc on the country’s soybean crop.

USDA projected 2023-24 global soybean carryout at 114.51 million tonnes, 1.11 million less than its October estimate. However, it left its Brazilian soybean production estimate unchanged at 163 million tonnes and ending stocks increased by nearly two million tonnes to 39.69 million.

While Brazil may be facing challenges, demand for U.S. soybeans is strong. On Nov. 9, USDA confirmed that China purchased 1.044 million tonnes of U.S. soybeans for 2023-24 delivery, one of the largest one-time export sales in recent memory. USDA also reported 1.08 million tonnes of worldwide export sales for the week ended Nov. 2.

Soymeal prices are at their highest levels since July, far exceeding the 20-, 50- and 100-day moving averages and providing greater incentive to add to already-high soybean crush totals. The prices have also raised canola crush margins to $252.35/tonne for November/December 2023 and $215.92/tonne for January.

As long as crush margins remain strong, it will be a boost for oilseed prices, including those for soybeans and canola.