The beef sector can expect the market to keep its momentum in 2023.

That was the message as CanFax made the rounds in Manitoba in mid-January to present the latest economic forecasts to producers.

Why it matters: A string of hard production years was followed by a surge in calf and feeder prices, but that also has implications for producers looking to rebuild.

Read Also

Manitoba greenlights satellite-based forage insurance

Pilot insurance program will cut paperwork for farmers, province says; feeder cattle loans also boosted

Brenna Grant, executive director for the organization, expects the strong price trend that began in the latter half of last year will continue.

“We’ve had a challenging three years here with lots of supply and demand shocks impacting agricultural commodities in general, but really, we started to turn a corner in June of ’22,” she said.

While Manitoba was wet last season, rains last summer eased feed concerns for parts of Western Canada still struggling with drought, she noted. That allowed producers to grow critical winter feed and stem the flow of cattle to the auction ring.

CanFax reported tightening North American beef supplies.

“We’ve probably shrunk the North American supply by so much over the past two years that it really is going to be a driving factor in improving prices for the foreseeable future,” said Manitoba Beef Producers president Tyler Fulton.

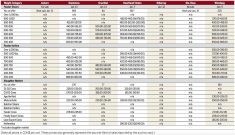

From January to December 2022, Canadian feeder prices saw their highest jump since 2015. Cattle were worth about 15 per cent more by the end of the year.

That translated to gains in the fall calf market. In Manitoba, local calf prices were 30 to 50 cents a pound higher than in 2021.

“We’re expecting that trend to continue in terms of supplies tightening over the course of the year, with greater impact happening by the time we get to summer and into the third quarter,” Grant said.

Prices have likely peaked, according to CanFax, but are expected to remain strong this year.

Feeder prices in 2023 are also expected to see support from a strong futures market and a downward shift in feedlot placements. CanFax forecasts that placements will be down 20 per cent in the third quarter compared to drought-swelled numbers in 2021, and down 11.5 per cent in the fourth.

CanFax expects to see the impact of “stickier” factors this year that have yet to trickle down into the cattle market, including a stronger market basis. Canadian fed cattle are at the weakest basis since 2014 as U.S. supplies tighten faster than those here.

Similarly, there has yet to be a true reflection of the shifting Canadian dollar, said Grant.

“One of the things that we always have to remember in a price rally like this is high prices cure high prices,” she cautioned, noting a high feed grain market, higher interest rates, exchange rate volatility and higher costs for fuel.

She urged producers to consider these factors in their risk management plans.

“I recognize that it’s really hard in an inflationary market in terms of controlling costs,” she said, so producers should focus on things they can control.

For Manitoba, eastern marketing options add another shot of optimism.

The Ontario market has been strong, with a stronger basis compared to the West, Fulton noted. Overall, he said he likes the trajectory that the eastern influence has had in Manitoba over the last five years.

“It is a strategic advantage that we should have and do benefit from in Manitoba,” he said. “We do have choices. Those animals can go to the top bidder, whether that be east, west or even south.”

Inflation and the consumer

High grocery prices add risk to the sunny forecast. Canada’s consumer price index increase doubled last year compared to the previous year (up 6.8 per cent in 2022 compared to 3.4 per cent in 2021), hitting a 40-year high. Food costs rose above those numbers.

Canadians paid an average 8.9 per cent more for food in 2022, according to a Jan. 17 report by Statistics Canada, and several fall months saw double-digit inflation.

In early December, Canada’s Food Price Report suggested that groceries would cost five to seven per cent more in 2023.

Beef consumers so far have been “resilient” against those pressures, Grant said, but cautioned that demand might erode.

“[Consumers] are going to have to make choices and that’s why we’re monitoring our price relationship with substitutes such as pork and poultry, because as long as we maintain our historical price relationship with them, we tend to see trading down within the category — between steak to hamburger versus trading away from beef,” Grant said.

In cow-calf centric Manitoba, Fulton said Canadian feedlot demand will be the deciding market factor and he would not be surprised to see calf prices gain another 10 per cent, “which is needed, because we’ve simply fallen behind other commodity groups and the gains that they’ve seen in profitability.”

In rebuild mode

Strong calf prices are great for the people selling animals, but they’re a conundrum for producers looking to rebuild. Those buyers are wary of buying expensive animals only to see the market drop before realizing a return.

In 2022, some in Manitoba’s industry noted herd liquidations despite high prices, which they linked to several consecutive years of drought and unfortunately timed snowstorms. In summer 2022, Statistics Canada put Manitoba cow-calf numbers at 682,200, down from 787,800 four years before.

Some level of liquidation is not unexpected, according to Grant. Price rallies are often taken as an exit cue for those close to retirement or who are otherwise on the fence about remaining in the industry. The sector saw similar exits during the mid-2010s, she noted.

But producers can learn lessons from those who bought bred stock during price rallies in 2014 and 2015, Grant said.

“There was a period of three to four months where, for $600 per head, you could trade up from a heifer calf to a bred heifer and then have a calf the next spring,” she said. “But if you waited, you then saw a huge jump in the breeding stock market and those cows that were bought at that high probably never paid themselves off.”

Grant cautioned producers to know their cost of production when buying stock or retaining replacement heifers.

J.P Gervais, vice-president and chief economist with Farm Credit Canada, also pointed to the cattle market’s last major surge, when there was speculation about a grand rebuilding of Canada’s herd.

That never happened, Gervais said, noting difficult production conditions. Producers instead maintained their numbers during that time, he said, and a few good years allowed them to make up for recent hardships rather than expand.

“I’m afraid that this is, perhaps, a little bit of what we’re going to see,” said Gervais.

Assuming no major blows to feed production this year, Fulton hopes the market will recover margins for both the feed yard and cow-calf producer and whet appetites to build back herd numbers.

He used the example of recent 2024 April fed cattle futures, which creeped within a few cents of an all-time high.

“There’s a lot of optimism that we could get back to levels that we saw six years ago…which would just be an injection of a huge amount of optimism and hopefully give the industry a boost to start rebuilding,” he said.