Chicago | Reuters — U.S. spot soybean futures fell 2.6 per cent on Tuesday to multi-month lows and corn futures slipped nearly two per cent, pressured by decent U.S. Midwest crop weather and strong competition for global export business, traders said.

Wheat followed the lower trend.

Chicago Board of Trade July soybeans settled down 36-3/4 cents at $13.64 per bushel after dipping to $13.58-3/4, the lowest on a continuous chart of the most-active soybean contract since Oct. 19 (all figures US$).

CBOT July corn ended down 11-1/4 cents at $5.81-1/4 a bushel and July wheat finished down 13-1/4 cents at $6.47-1/2.

Read Also

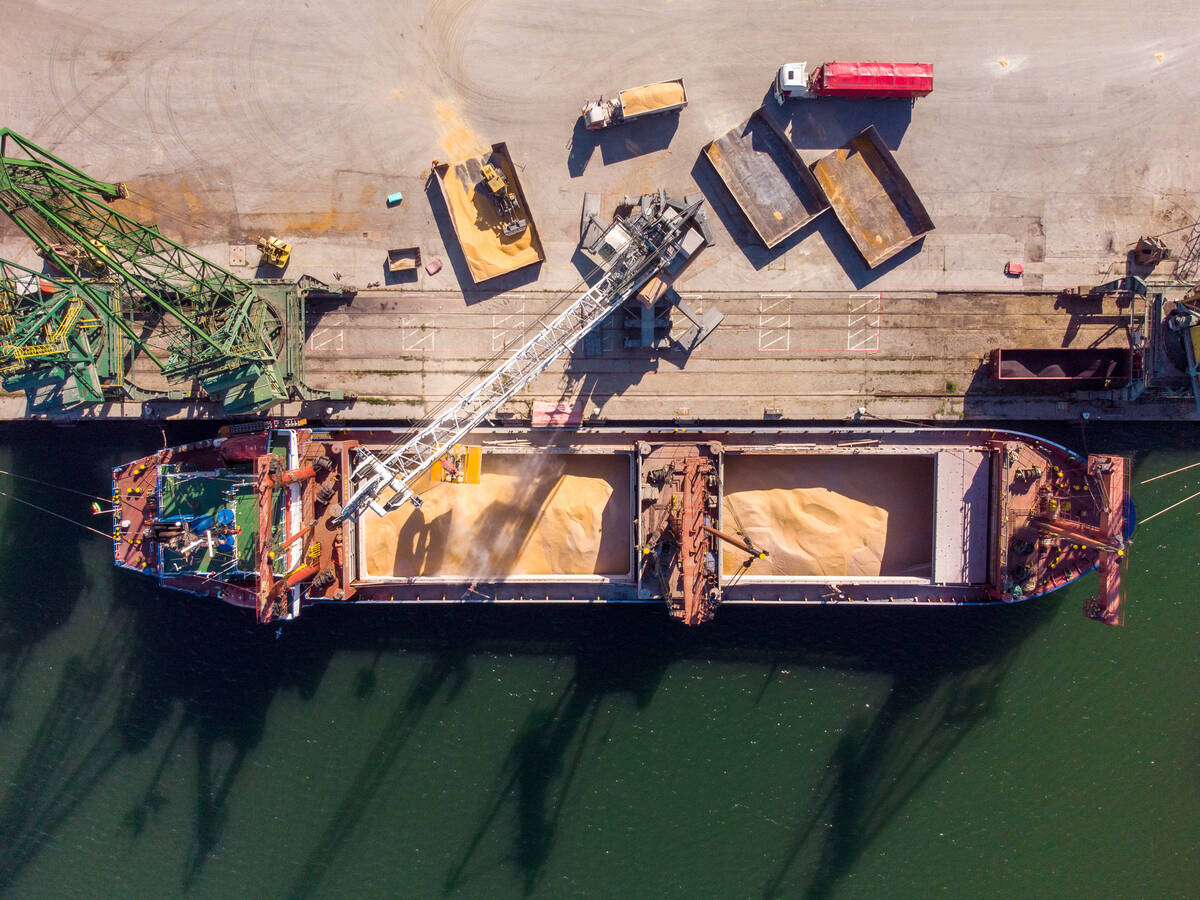

Ukraine wheat exports remain low amid Russian attacks on ports, weak demand

Ukraine’s wheat exports remained relatively low in the first half of January amid Russian attacks on Ukrainian seaports and low external demand, data from the country’s grain traders union UGA showed on Wednesday.

Technical selling in soybeans accelerated as the July contract fell below its March low of $13.83-3/4, triggering sell stops, traders said. New-crop November soybeans hovered just above $12 a bushel, and soyoil futures fell to life-of-contract lows.

Strong U.S. crop prospects pressured soybeans and corn. The U.S. Department of Agriculture last week projected record U.S. harvests of both crops in 2023, and then on Monday said the U.S. corn crop was 65 per cent planted and soybean planting was 49 per cent complete, ahead of their respective five-year averages.

“The weather is really good…. Overall we’re ahead of the normal (planting) pace and things are off to a good start, so that’s triggering a slide in prices,” said Terry Linn, analyst with Linn + Associates in Chicago.

Weak export demand added to the bearish outlook, given massive soy and corn crops in Brazil.

“We are uncompetitive, basically,” Linn said. “We need to stimulate demand, and that is what is happening. We are going to restructure our prices to get to that point.”

Soybeans faced additional pressure from the fact that commodity funds held a net long position in soybean futures as of May 9, leaving the market vulnerable to bouts of long liquidation.

Meanwhile, traders were monitoring negotiations to extend the deal allowing the safe export of Ukrainian grains through the Black Sea.

The Kremlin, which has repeatedly warned it could quit the agreement on May 18 over obstacles to its grain and fertilizer exports, said on Tuesday that questions remained about Russia’s part of the Black Sea grain deal and contacts were continuing.

— Reporting for Reuters by Julie Ingwersen in Chicago; additional reporting by Gus Trompiz in Paris and Naveen Thukral in Singapore.