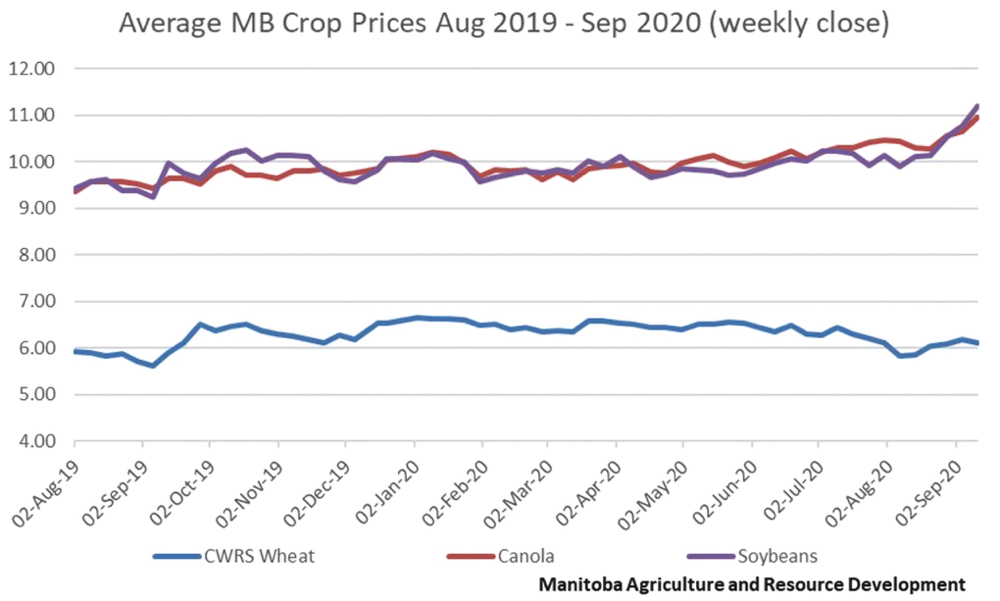

With canola prices the highest they’ve been in two years, and the added stress of harvest, it’s a good idea to have a marketing plan, says Darren Bond, farm enterprise management specialist with Manitoba Agriculture and Resource Development (MARD) in Teulon.

“We have to take that step back when we are marketing our grain and realize what are the basics and what are we trying to accomplish when we are marketing our grain,” Bond told MARD’s CropTalk webinar Sept. 16.

Manitoba spot canola prices Sept. 17 were around $11.50 a bushel, with deferred prices at almost $12, Bond said in an interview.

Read Also

Can we trust the USDA crop data anymore?

Indications that farmers, analysts and traders have started to lose trust in data from the United States Department of Agriculture are hardly a surprise.

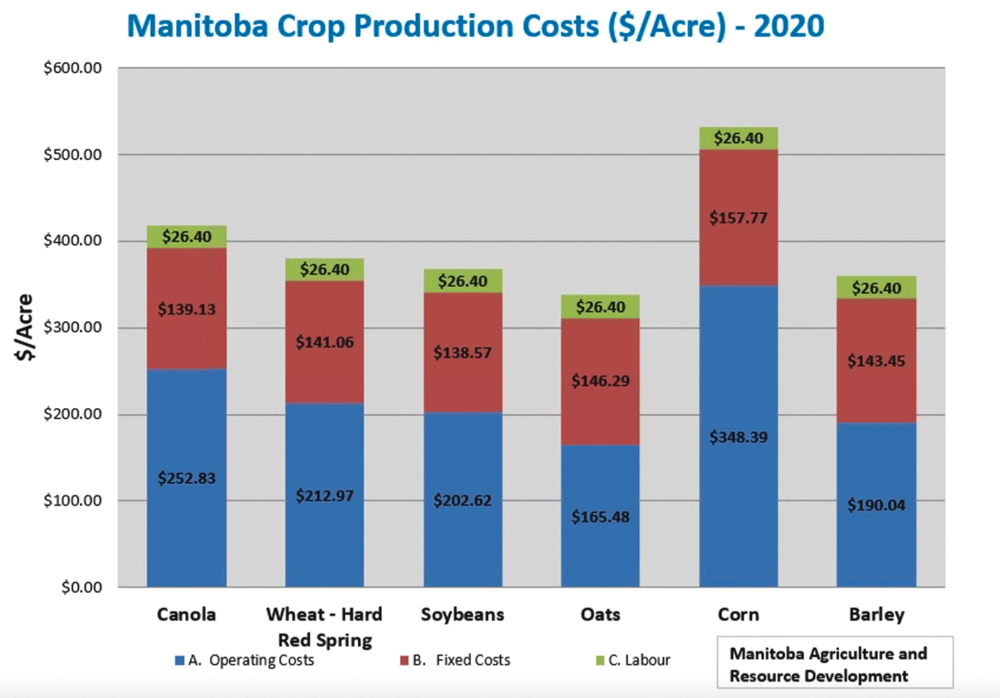

The first step in making a marketing plan is calculating each crop’s cost of production, Bond told the webinar.

“It allows you to identify where some profitable pricing is at,” he said.

Costs will vary annually, and between farms. MARD prepares a spreadsheet of projected production costs that farmers can use as a starting point.

Farmers can plug in their own figures too.

Cost estimates for 2021 will be released in December.

Why it matters: Grain farmers’ profit margins are so thin they need sharp pencils to stay in the black. Knowing production costs by crop is a prerequisite in determining break-even yields and prices.

Anticipating cash flow needs is another part of a marketing plan affecting when a farmer might need to sell certain crops, Bond said.

Farmers also need to know their tolerance for risk.

“Understanding and being true to yourself where you are with your risk tolerance I think is pretty important,” he said.

A farm’s financial condition is another factor to consider when assessing risk.

“If you are in a situation where your finances are a bit tighter it’s probably better to be a little bit more conservative than risky, versus someone who has had a good run and the finances are in good shape… then you could be riskier and try and shoot for the higher prices,” Bond said.

“It comes down to whether you are able to sleep at night with how you are marketing your grain.”

How the farmer feels about marketing also comes into play.

“If you love it you’re more likely to do it yourself… versus someone who dreads grain marketing, and if you dread anything in life you’re less likely to do a good job at it.”

Farmers uncomfortable with marketing should consider hiring an advisory service, Bond said.

Marketing should be about selling to make a profit.

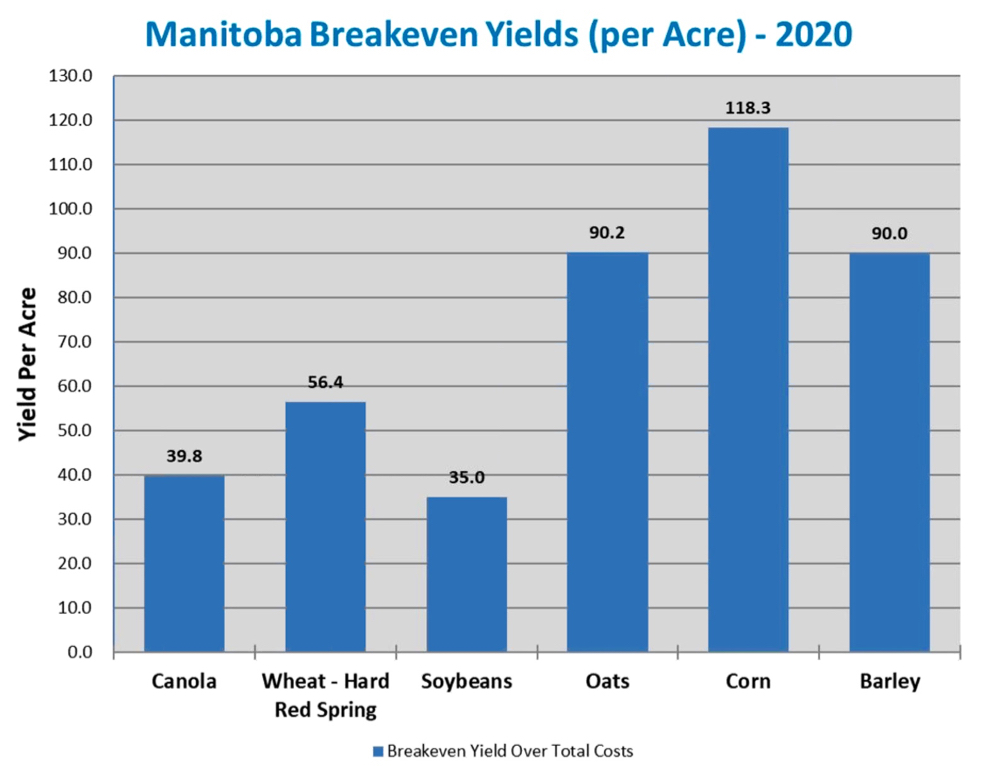

“It’s impossible to hit the top of the market all the time,” he said. “Whether you market the grain yourself or you use the best advisory service out there… you’re not going to get the top of the market all of the time. However, if you know where your break-even prices are you can identify that point of profitability.”

Don’t dwell on missed opportunities and learn from marketing mistakes, he added.

“No one has ever lost the farm selling at a profit… and if you’re comfortable with what you’re doing you are exactly where you want to be.”

Grain farmers’ operating costs, which have been rising, are relatively easy to calculate. Just add up the cost of seed, chemical and fertilizer and divide by the acres farmed to get a cost per acre, Bond said.

It’s a bit more complicated to do with fixed costs such as land and machinery. One approach is to add up annual land and machinery payments. While it may not capture depreciation on equipment, or the opportunity cost on mostly paid-for land, it’s a starting point, he said.

It’s insightful to break down those costs per acre.

“We really want to turn this into what our break-even price is and how much of that price that we are getting is going to the different (cost) areas,” Bond said.

MARD’s 2021 cost-of-production information is going to dig deeper into that, he said.

In a preliminary example for 2021, based on averages, Bond put total canola production costs at $10.03 a bushel. While operating costs amounted to $6.37 a bushel, land and machinery costs were $1.60 a bushel each. Forty-six cents was allowed for the farmer’s labour.

Based on projected yields and prices in this example the farmer makes some money, but if the projected yield remains the same, but the price falls below to $9.50 a bushel the farmer can pay his or her bills but not themselves.

“You clearly see where the strengths and weaknesses are,” he said.

“It’s about playing to your strengths and managing your weaknesses.”

Marketing plans should also be updated as the numbers become known for costs, yields and prices.

“It’s a number you can’t hide from,” Bond said. “It’s a number that might have you feeling pretty good or… feeling a little down depending on the situation. But whatever the case may be you know what it is and just like any plan you need to know where you are right now before you can develop the plan to determine how you’re going to get where you want to be.”

While COVID-19 hasn’t disrupted Canadian grain markets the novel coronavirus remains a wild card, he said. Another is the American election. Both could cause more price volatility.

“The biggest thing in my mind is the potential for grain delivery disruptions,” Bond said.

“I wouldn’t want to leave this to the last minute. I would want to make sure that I am able to market this grain, get cash in the account so I can meet my requirements well ahead of time because the thing is we just don’t know what could happen.”