Canada needs to do better at serving traditional markets with high-quality wheat while expanding its ability to serve developing markets, a study commissioned by grain industry groups says.

Consistent quality and high-protein wheats have allowed Canada to overcome its freight disadvantage in premium wheat markets around the world, but Canadian exports are less competitive in key regions of the world where demand is growing.

The solution isn’t to abandon high quality, but promote and differentiate Canada’s other wheat classes, including Canada Prairie Spring (CPS), says Cereals Canada president Cam Dahl.

Read Also

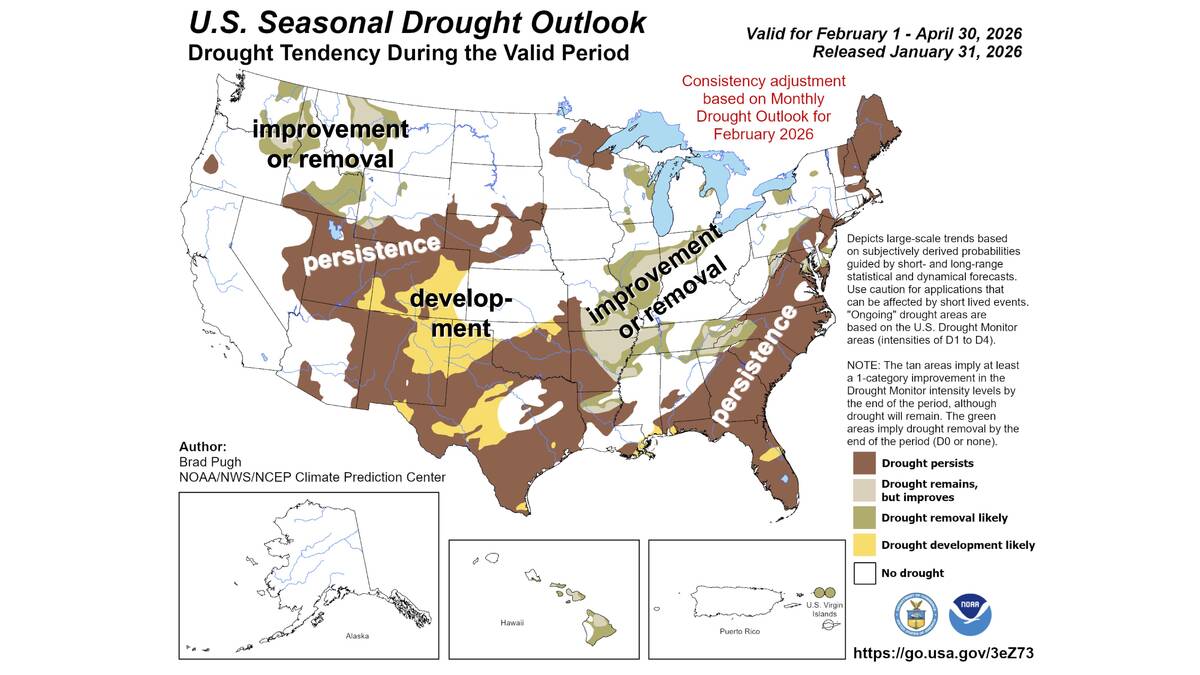

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

“I think we need to do both,” Dahl said in an interview Sept. 23. “We need to preserve those traditional markets where we do have a differentiated and branded product. But that’s not sufficient because those are not growth markets so we have to do more.”

The growing wheat markets are West Africa, the Middle East and Southeast Asia, while almost all the new demand for durum wheat is in North Africa, says a summary of the report released last week. The entire report has not been released because it contains commercially sensitive information, Dahl said.

In an op-ed based on the report Dahl wrote, Canada’s “differentiated or branded” Canada Western Red Spring (CWRS) wheat is an important source of farm revenue. The markets are in Canada, the U.S. and Japan and in North Africa for Canada Western Amber (CWAD) wheat.

CWRS wheat, which makes up more than three-quarters of Canadian wheat exports, is known for its “superior protein content and quality, consistency and cleanliness,” compared to competing wheats, the summary says. CWAD, the next largest class, is the world’s main source of high-quality durum. But good quality is a double-edged sword.

“Because CWRS and CWAD are very well suited to use in specific products in which they cannot be easily substituted, they can enter markets in which Canada faces a freight disadvantage,” the summary says. “In order to preserve these markets, the first priority for Canadian wheat must be to maintain its quality and reputation.

“However, because of the dominance of CWRS, Canadian wheat typically services a more limited range of products than its competitors. Most common wheat is used for a wide variety of different products which makes it impossible to target wheat for narrowly defined segments. This makes stimulating demand in new markets more difficult for CWRS.”

In contrast, the U.S. exports a full range of protein-strength wheats and is therefore able to take advantage of that growth, the report said.

Canada is building new classes of wheat. After last year’s wheat promotion trade missions, officials from the Canadian Grain Commission (CGC) and the Canadian International Grains Institute (Cigi) said a number of customers expressed renewed interest in CPS wheats.

Some Canadian wheat growers have also questioned whether too much emphasis is placed on growing and exporting high-quality wheat, which doesn’t yield as well as wheats with lower protein and gluten content. But Dahl doesn’t believe Canada should cut quality.

“We can grow the whole thing,” he said.

The CGC has noted CPS wheat isn’t lower quality — it’s different quality, with slightly lower protein and gluten. Its other selling features are cleanliness and consistency, which are both part of Canada’s wheat brand.

“At this point, I think CPS is one of those other classes that is looking most promising for that differentiation — Canada is different and here is why,” he said.

Differentiating CWRS and CWAD wheat is a good marketing tool and one that can be extended to other Canadian wheat classes, Dahl said. More can be done to promote CWRS wheats in markets where it’s less competitive by demonstrating its flexibility and value in blending, he said.

The study is being put to good use. Wheat trade missions later this year include visits to Côte d’Ivoire (Ivory Coast) and Ghana, as well as Southeast Asia, South America and the Middle East, Dahl said.

Dahl said Canada’s reputation as a reliable wheat supplier “has taken a hit” because of shipping delays in 2013-14.

“We can’t afford to have them happen again,” he said.