At the very least, lower usage targets for both ethanol and other biofuels are expected to reduce interest in expanding production in the sector

Many corn traders tried to shrug off the U.S. Environmental Protection Agency’s proposal to trim the U.S. renewable fuels usage targets for 2014 and 2015, noting that U.S. ethanol production is driven more by operating margins than government-mandated blending requirements and is likely to remain high as long as ethanol makers can make profits.

Many corn traders tried to shrug off the U.S. Environmental Protection Agency’s proposal to trim the U.S. renewable fuels usage targets for 2014 and 2015, noting that U.S. ethanol production is driven more by operating margins than government-mandated blending requirements and is likely to remain high as long as ethanol makers can make profits.

Read Also

New rules for organic farming on the table

Canada’s organic farmers have until July 29 to comment on new standards that would allow permit more products, but also crack down on organic management lapses.

But since the announcement it is clear from the drop in the entire forward curve of corn prices — and not just near-dated values — that other traders view this as bad news for corn’s longer-term price prospects, as the proposed changes effectively lower corn’s demand floor from the fuel sector and place greater pressure on ethanol producers to restrain output during times of low ethanol prices and demand.

No big surprise

While the EPA’s cut to renewable fuel mandate targets does have some far-reaching repercussions across the grain and fuel industries, the actual details of the proposal were not too surprising given that they had been leaked to the market beforehand in what was likely a gauge of public sentiment by officials who were unsure about the potential backlash of such a move.

To be sure, the leaked reports initially caused some uproar and complaints from members of the renewable fuels industry, many of whom viewed the proposed demand changes as a threat to their businesses.

But over time a consensus emerged — even among biofuel advocates — that actual usage levels were constrained more by the U.S. fuel ‘Blend Wall’ than by any government usage targets, and that any potential adjustments to official demand goals would only have a limited impact on actual consumption patterns. (The Blend Wall refers to the 10 per cent limit of ethanol that can be legally added to the U.S. fuel stream.)

Indeed, most analysts still expect the ethanol demand to remain fairly steady over the near to medium term as ethanol’s steep price discount to gasoline encourages blenders to use as much ethanol as possible for the time being.

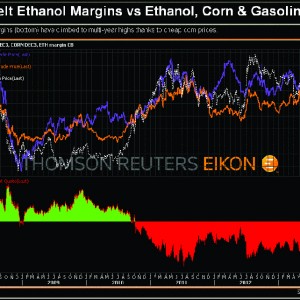

The production side to the ethanol equation is also not expected to change much over the near term, as manufacturers continue to face robust profit margins amid the current low corn-price environment and so remain incentivized to maintain output levels.

Long-term implications

Even if the near-term supply-and-demand story remains unchanged for the U.S. ethanol industry, the longer-term situation is clearly in flux given the new proposals.

At the very least, lower usage targets for both ethanol and other biofuels are expected to reduce interest in expanding production in the sector, and indeed may trigger the permanent shutdown of any plants that are currently mothballed due to poor cost structure or outdated technology.

The lower demand floor is also likely to mean that output restraint among producers will become the chief mechanism to avert any oversupply issues.

Such a problem may seem a distant possibility currently given that present U.S. inventories are at multi-year lows.

But with producers facing positive margins across the country a collective ramp-up in output is expected over the coming months.

In that environment, inventories will quickly be replenished, especially if usage levels fall off over the same period that supply outpaces demand.

And while ethanol exports can be expected to climb next year if ethanol prices remain attractive to overseas buyers, demand growth in top markets such as Brazil may be constrained over the near term as domestic ethanol production in that country picks up following the sugar cane harvest.

This may leave U.S. ethanol producers facing a deteriorating landscape in 2014 and beyond as domestic usage slows just as inventories climb on the back of robust output.

Indeed, this challenging environment has already been telegraphed by the share prices of major U.S. ethanol manufacturers such as Archer Daniels Midland. In the immediate wake of the EPA announcement, ADM’s share price took a $1-per-share (2.1 per cent) hit, and has since struggled to regain upside momentum even though robust processing margins remain generally supportive for the business’s outlook.

In contrast, the share price of Valero Energy, which is a major oil refiner, has accelerated to the upside since the EPA news, signalling that the market views the lower renewable fuel demand target as good news for traditional energy market players.

Shares of large-scale corn consumers also received a boost in the immediate wake of the EPA news.

Any lowering in the intensity of competition for grain will only materialize next year as the lower-usage mandates kick in and energy firms potentially dial down their corn purchases.

For the time being, ethanol producers remain fully incentivized to secure large quantities of corn as a feedstock, and in many areas happily outbid their counterparts from the feeding industry.

But it is clear from the pretty consistent decline in corn values all along the forward curve that the EPA’s proposals have dealt this market a significant blow, and have clouded its outlook over the longer term.

Certainly lower overall corn prices will trigger upticks in usage from the export and feed sectors over time. But given that the ethanol sector has accounted for more than 40 per cent of total U.S. corn demand for the past few years, the cut to required consumption from this sector going forward will clearly have a lasting effect.