Reuters – Insurance broker Marsh, Lloyd’s of London insurers and Ukrainian state banks have launched a program to cut the cost of claims for damage to ships and crew transporting grain through the Black Sea corridor, Marsh said Nov. 15.

Kyiv launched a “humanitarian corridor” in August for ships bound for Africa and Asia to circumvent a de facto blockade in the Black Sea after Russia quit a United Nations-brokered deal earlier this year that had guaranteed Kyiv’s seaborne exports.

Lloyd’s of London insurers will underwrite the program, which provides US$50 million of hull war-risk cover and $50 million of protection and indemnity (P&I) insurance for every voyage.

Read Also

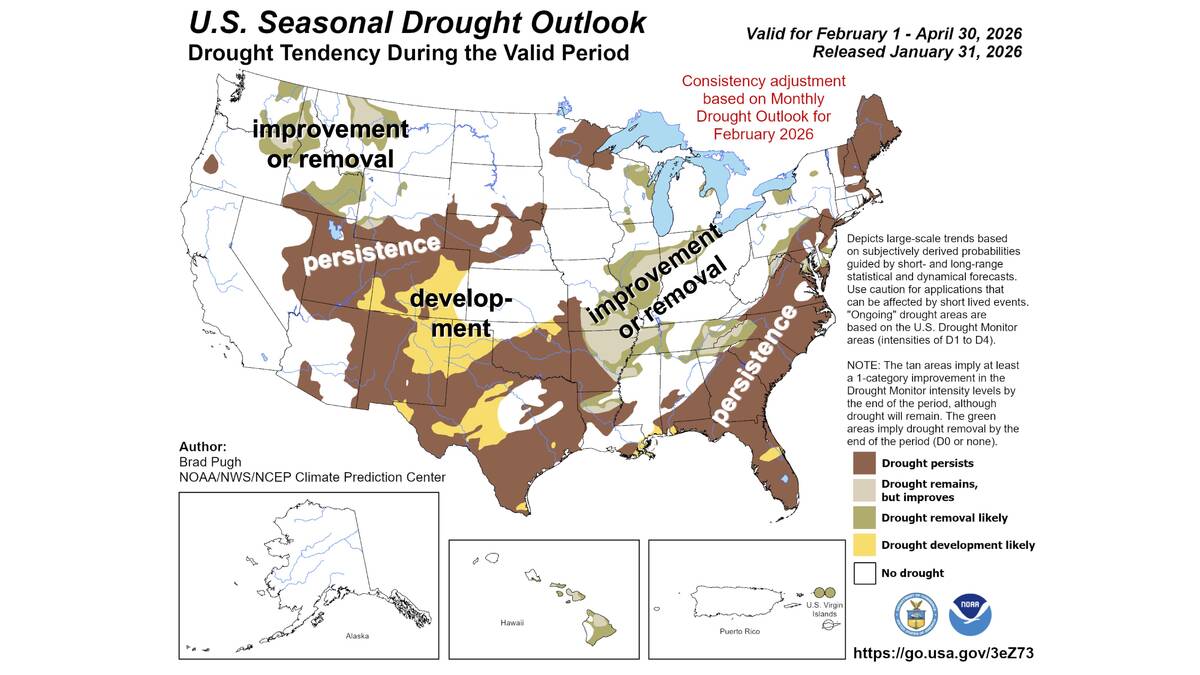

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

Ships typically have P&I insurance, which covers third-party liability claims including environmental damage and injury. Separate hull and machinery policies cover vessels against physical damage.

The State Export-Import Bank of Ukraine (Ukreximbank) and state-owned lender Ukrgasbank will provide standby letters of credit, each confirmed by Germany’s DZ Bank, Marsh said in a statement.

Ukrainian Prime Minister Denys Shmyhal said late Nov. 14 that the arrangement involved 14 insurance companies.

The program has the support of the British government, said Marcus Baker, Marsh’s global head of marine and cargo.

“For [commercial companies] to know that the U.K. government is standing behind this … has really helped to give it the credibility that it needs,” he said.

War-risk insurance premiums have risen to as much as three per cent of the value of a vessel after a missile damaged a merchant ship in the Ukrainian port of Pivdennyi in early November, industry sources said.

Baker said the program could reduce that cost to as little as “a third of the existing pricing.”

Ukraine’s financial backing for the scheme meant insurers would be able to charge less than current high rates for travelling through the corridor, he added.

“They [the market] will be able to have reimbursement of funds into their coffers if they pay a claim,” he said, declining to provide further details.

Ukraine’s First Deputy Prime Minister Yulia Svyrydenko said the discount would reduce the overall cost of grain insurance by about 2.5 percentage points, allowing grain traders to save around 100-140 hryvnias (C$5.33) per tonne of cargo and saving agricultural producers some four billion hryvnias.

The program will provide cover for shipments through Ukraine’s Danube ports as well as Odesa, Chornomorsk and Pivdennyi. It is led by Lloyd’s syndicate Ascot, Baker said.

Marsh also runs a separate facility to insure the actual grain cargo in the region. Ascot is also the lead insurer on that program.