Tax season is back and experts say there are a few things farmers should consider as they prepare their 2023 returns.

Understanding the implications of certain business activities can reduce tax amounts.

For farms that run as corporations, Dec. 31, 2023, was the last day for the temporary immediate expensing option. This program allows corporations to write off capital expenses of up to $1.5 million immediately, rather than claiming the depreciation over time.

Read Also

AAFC organic research program cut

Canada’s organic sector says the loss of a federal organic research program at Swift Current, Sask., will set the industry back.

It came into effect for the 2022 calendar year. In 2023, the program was expanded to include sole proprietorships and partnerships owned by sole proprietors. It will remain an option for those business types until the end of 2024.

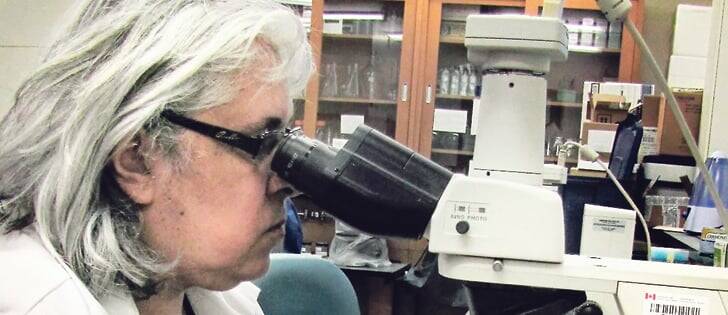

“If you bought a tractor, you could write off the whole tractor,” said Edith Frison, a business advisor with MNP’s tax service in Brandon. “Typically, that would go into a CCA (capital cost allowance) pool, and you’d have to depreciate it over the life of the tractor.”

The program is not right for every circumstance, she warned, but can sometimes prove useful.

“If somebody did come in now and said, ‘hey, I have a million dollars worth of income,’ then one of the things we might say back to them is, ‘OK, what did you buy last year?’ And if they bought a tractor, typically we could write off the whole value of that tractor all in one year.”

Frison also pointed to the return of fuel charge proceeds to farmers’ tax credit, which is another potential opportunity to maximize savings. Self-employed farmers or individuals who are members of a partnership operating a farming business may be eligible to have a portion of the carbon levy refunded. For 2023, the tax credit is $1.86 for every $1,000 of eligible farming expenses in Manitoba.

Looking to another program, Frison said most farmers are aware of the income smoothing provision in the Income Tax Act, but a reminder never hurts.

“Farmers that report on a cash basis can use optional inventory for income smoothing,” she said.

That means they can add existing inventory to the income they report for tax purposes.

“So, if you have grain in the bin or you have animals in the field, it’s likeyou take extra income this year and then you get it as an expense the next year.”

When they’ve had a tax loss, most farmers will apply enough optional inventory to bring them to break-even, she said, since they still won’t pay any tax on it in those circumstances.

“Then they have an expense to use for next year.”

Break the cycle

Frison said farmers often make the same mistakes every year. One mistake is to ignore the advice of a tax professional when making important financial decisions, like selling a major piece of equipment, selling dairy quota, or making other business moves that significantly impact the balance sheet for the year. They may be unaware of related tax implications.

Also, farmers often misunderstand the capital gains exemption, Frison said.

“Everybody in Canada gets a $1 million capital gains exemption, but it can only be used on certain assets. In farming, there are lots of assets where you can use the capital gains exemption, but farmers tend to think they can use it for absolutely anything.

“That’s not true. There are very specific rules around when and how it can be used and what assets are eligible.”

Farms are a complex entity, Frison noted, and planning is key when doing taxes. For example, “farmers report on a cash basis. So, at the end of December, they have the opportunity to go out and buy inputs to use against that income.”

That ship has sailed for the 2023 tax year but there’s always future tax years to think about.