Canola futures climbed higher during the last week of October, hitting contract highs in many months. The strength was largely thought to be tied to speculative money, with the market looking overpriced from a fundamental standpoint.

The nearby November contract moved above $1,000 per tonne in its final week before becoming the delivery month, pulling the other more actively traded months up as well. January was trading at around $950 per tonne to end the week.

Speculators were holding a large net long position in canola of about 51,000 contracts as of the most recently available data for the week ended Oct. 19. That net long has grown along with the futures since July, with the latest strength likely adding to the total.

Read Also

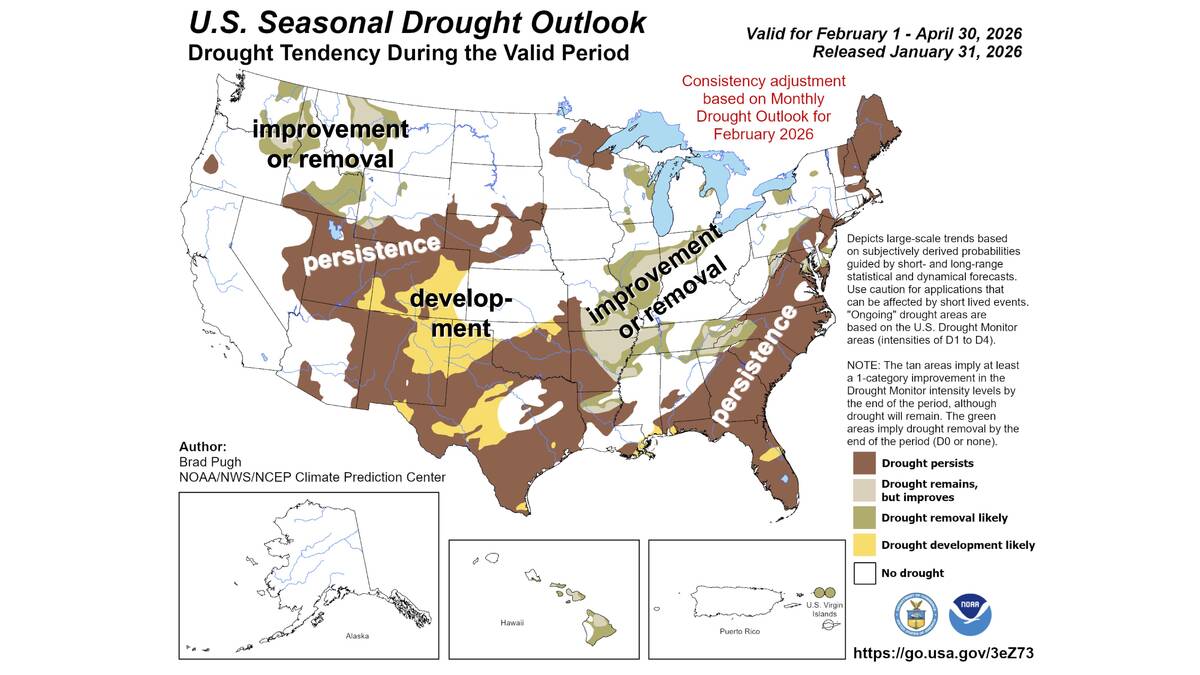

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

That speculative long position accounts for over a quarter of the current open interest in canola, which means the large fund traders controlling that position can exert a lot of influence on the relatively small market. As long as there is no selling pressure on the other side, anyone with a long position will be happy to see prices keep rising and will be doing what they can to encourage the upward trend.

With prices at unprecedented levels, the top is unknown. However, it’s only a matter of time before a profit-taking correction is triggered. When it comes, the drop could be severe, but the ongoing tight supply situation will keep canola relatively well supported compared to other vegetable oil markets.

In the United States activity was mixed during the week, with both soybeans and corn still in the middle of their harvest season. Soybeans held reasonably rangebound, while corn moved higher. Rain delays in parts of the Corn Belt were somewhat supportive, while a rally in wheat also underpinned the row crops.

Minneapolis spring wheat led the three U.S. wheat contracts to the upside, as the reality of the tight North American high-quality wheat situation set in. The nearby Minneapolis contract soared above US$10 per bushel for the first time since 2012, widening its spread over the winter wheats.

Declining production estimates out of Russia during the week were also supportive, with the country expected to be a smaller player on the world market over the next year.

Oats were another interesting market during the week, climbing above US$7 per bushel in the front month for the first time ever (after rising above US$6 for the first time ever only a few weeks earlier). Much like canola, this year’s drought and poor North American crops cut seriously into production — which provided the fundamental catalyst for the rise. In addition and also much like canola, oats are also a relatively lightly traded market which meant small volumes likely exaggerated the move.

The oats futures are often disconnected from the cash market due to their volatile nature, but cash bids have seen similar strength with demand for oats on the rise in recent years. Oat milk is fast becoming one of the most widely available non-dairy beverages, making the oat market one to keep an eye on going forward.