A severe weather system rolling across the Prairies triggered an alert on my phone the other day. Television and radio programs also interrupted with warnings to take precautions.

The sun was still shining at the time, but the rumble of thunder from the approaching storm could easily be heard.

My location caught only the edge of that eventual thunderstorm, but there were reports of heavy rain and hail only a few miles away. A day later, lightning and the rumble of thunder were nearly instantaneous as another storm rolled through. This one must have been milder because there were no alerts.

Read Also

The lowdown on winter storms on the Prairies

It takes more than just a trough of low pressure to develop an Alberta Clipper or Colorado Low, which are the biggest winter storms in Manitoba. It also takes humidity, temperature changes and a host of other variables coming into play.

From the time this is written to the time it goes to print, North American weather conditions will likely have seen numerous shifting forecasts.

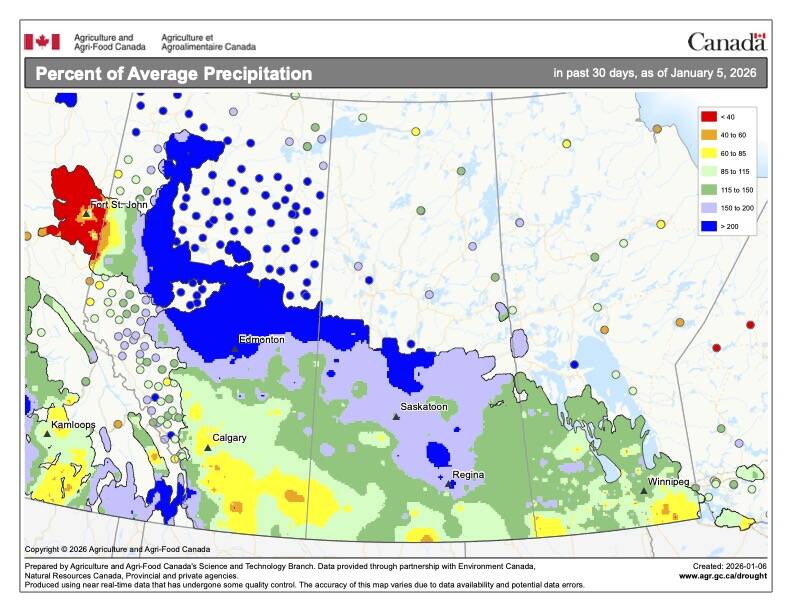

The hot and dry forecasts that underpin prices on one day may be quickly followed by a milder long-range reading that triggers a sell-off. While any rains would have weighed on prices over the past month, precipitation will soon be unwelcome as attention turns to harvest operations. Winter cereals and pulse crops are already coming off many Canadian fields, with oilseeds and spring cereals not far behind.

Soybeans and corn in the United States still have some time to go before harvest. Cooler and wetter August forecasts are countered by headlines pointing to excessive heat in many areas.

Black Sea

Attacks on Ukrainian grain handling facilities and Russia’s withdrawal from the Black Sea Grain Initiative would usually have sent world wheat prices sharply higher, but wheat futures moved lower in early August.

New from the region changes so rapidly that it almost seems like the trade ignores it at times.

Grain is reportedly still moving out of Ukraine, and Russian wheat also continues to find a home. There was even talk that India may be looking to import nine million tonnes of Russian wheat, but that remains to be seen.

Charts

The tea leaves of the charts are another unknown.

For Canada’s canola, fund traders shifted from a net short to a net long position over the past month, meaning they are betting on higher prices. They could add to those positions if the right technical signal is there, but could also easily book profits, liquidate longs and go back to the short side with a different reading of the technical signals.

Much like a summer storm hitting one field and leaving another dry only a few miles down the road, markets could go either way right now.