The ICE Futures canola market fell 10 per cent off its highs in the span of two weeks, with the January contract trading below $600 per tonne by Nov. 21 for the first time since September.

While the underlying canola-specific fundamentals remain relatively supportive, losses in outside markets and ideas that end users may be covered for the time being weighed heavily on values.

The selloff took January canola below all its major moving averages, and $600 turned into nearby psychological resistance. The harvest lows around $560 per tonne could be the next downside target as the market searches to uncover demand.

Read Also

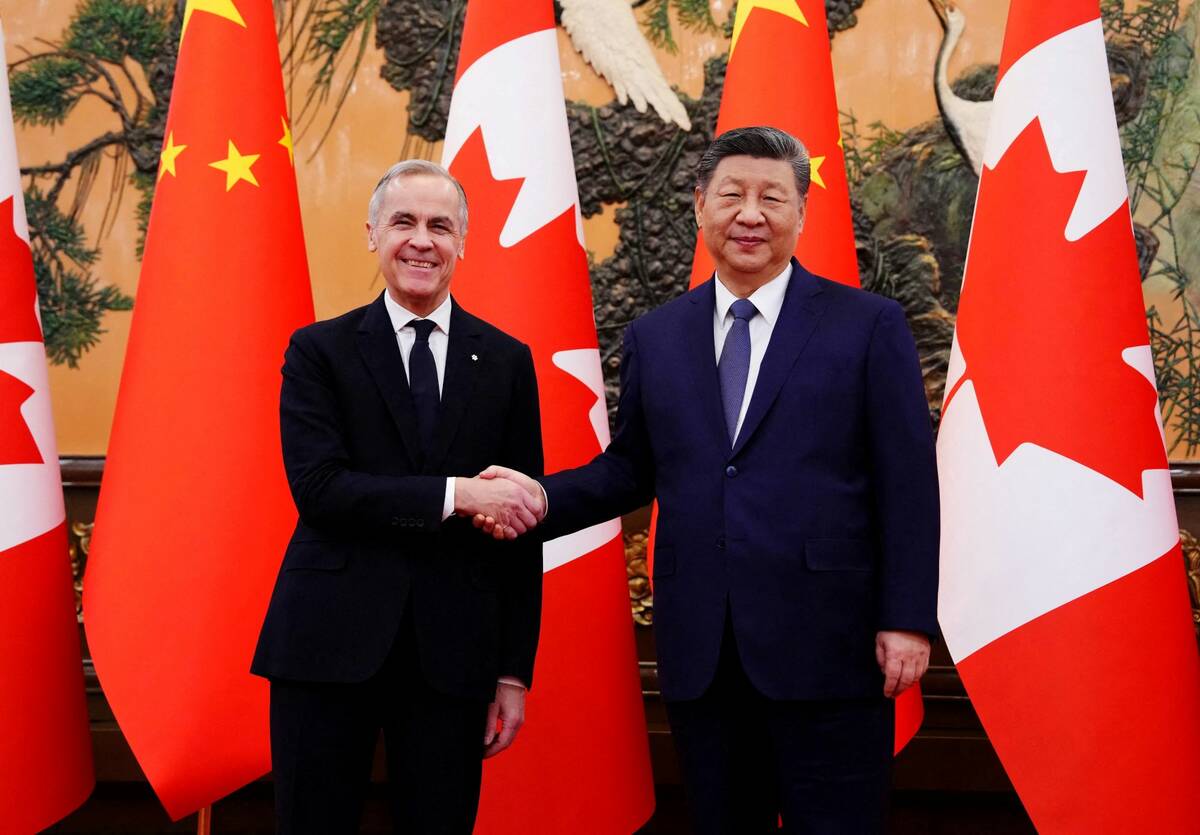

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

While canola exports are running at roughly double the year-ago pace, much of the buying was thought to be front-loaded and line company purchases have backed away from the market. Basis levels have softened, while domestic crush margins showed little movement as the futures fell.

Rising production prospects for soybeans out of South America were behind some of the latest bearishness in canola, as the resulting weakness in the Chicago soy complex spills into the Canadian market. Soybeans are also caught up in uncertainty over what the proposed trade policies of President-elect Donald Trump will do for export movement.

Canola may look good on its own, but the Chicago soy complex is dragging on values. Soyoil futures lost about five cents per pound in just one week, while soybeans hovered near contract lows.

Canadian canola remains relatively cheap on the global market, which should encourage buying interest. With only so much of the oilseed to go around, the tightening balance sheet would suggest a need to ration demand, but that does not seem to the case.

Agriculture and Agri-Food Canada released updated supply/demand tables on Nov. 19, leaving its call on 2024/25 canola ending stocks unchanged at 2.2 million tonnes. However, that’s using Statistics Canada’s September production estimate of around 19 million tonnes. Survey-based data will be out on Dec. 5, and the general trade consensus is that actual production was at least one million tonnes below that.