For three-times-daily market reports from Don Bousquet and RNI, visit “ICE Futures Canada updates” at www.manitobacooperator.ca

Grain and oilseed prices at ICE Futures Canada in Winnipeg closed the week ended June 5 higher, with the market supported by gains in the U. S. markets. Canola rallied as cold conditions in Western Canada, slow farmer selling and gains in crude oil gave support. Offsetting that, to some degree, was the strength in the Canadian dol lar and slowing demand with both export interest and crusher pricing slowing. Western barley posted modest gains in lacklustre trade as market participants took to the sidelines ahead of ICE Futures Canada unveiling its new barley contract. The market was supported by gains in U. S. corn and the slow farmer selling.

Read Also

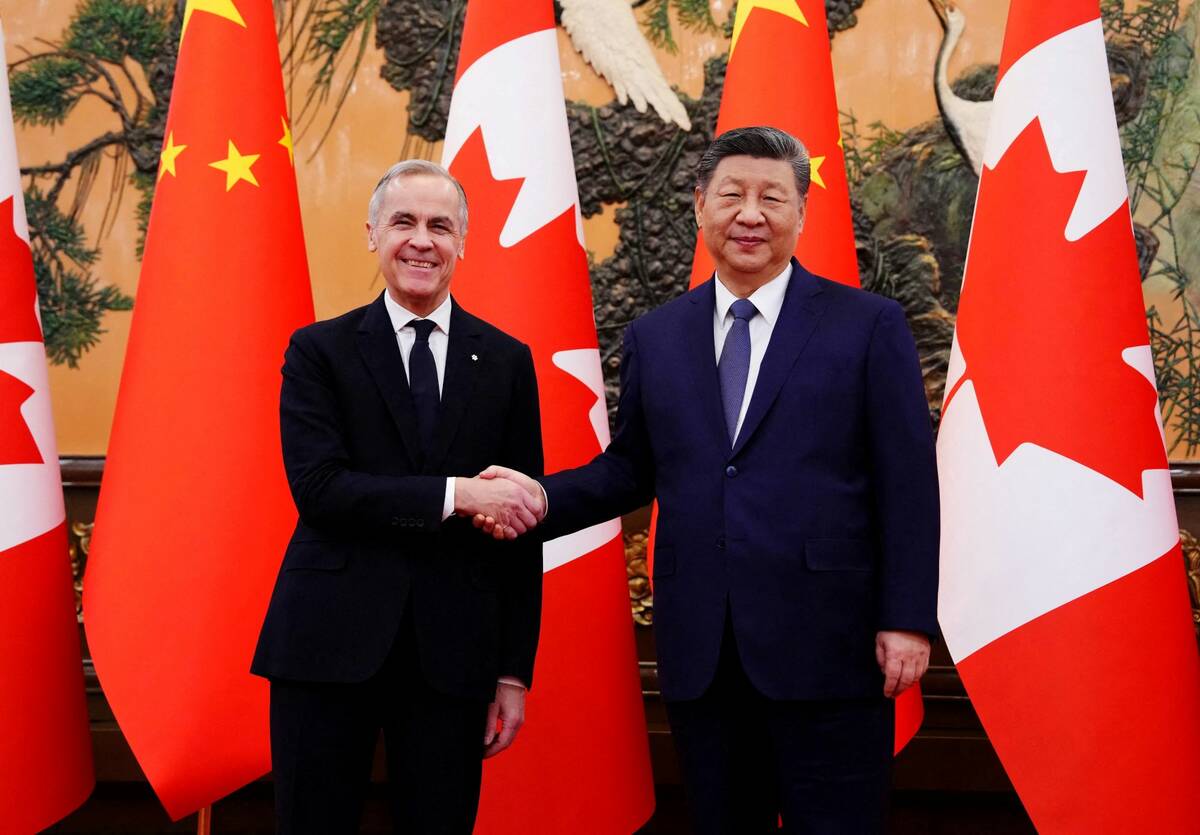

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

On June 4, ICE Futures Canada unveiled its revised barley contract , mainly

shifting delivery from Saskatchewan to southern Alberta, where the majority of Canada’s cattle-feeding operations are. This should attract more interest to this contract, particularly as we are facing some volatility in the barley market.

FUNDS RUSH IN

Chicago soybean and corn markets rallied during the week, as the soft tone in the U. S. dollar supported prices, as did positive technical signals that resulted in a large flow of speculative commodity fund money into grain and soybean futures.

Soybeans got an added boost from the tightness of old-crop supplies and some soybean planting delays. News that China cancelled a four-million-bushel purchase of U. S. soybeans and ideas that U. S. soybean acres would be higher weighed on the market, but were unable to overcome the huge speculative inflow of money.

Corn rallied in the wake of the big gains in crude oil and on ideas that corn production will be lower than recent forecasts. The virtual completion of planting did pressure prices down, although continued significant planting delays in the two key states of Illinois and Indiana did offset some of the negative impact of the near completion of planting. Export demand has started to slow and that also restrained the gains.

U. S. wheat futures were lower in all three markets. Slow export demand and profit-taking after hitting eight-month highs at the beginning of the week sent the market down. Minneapolis futures saw only small support from delays in spring wheat seeding. Winter wheat futures contracts were also undermined by current improved growing conditions for the crop. Chicago wheat drew some support from disease problems in the Soft Red Winter wheat crop. As was the case in corn and soybeans, the three wheat markets saw a big participation by speculative commodity funds.

GOT CANOLA?

Farmers with contracts for canola delivery in July have been approached by several grain companies to move those deliveries up to June as demand at the West Coast is outstripping supply. Over 500,000 tonnes of canola are needed to meet sales in June

and companies are willing to pay premiums to get supplies now, so it is probably worth your while to call around and see if you can get a bit more money to deliver now.

Be aware that canola demand is slowing, so we are probably facing the seasonal price decline. This is normal for this time of year, as the market sits back to assess the size of the crop. Exporters have indicated that China has completely withdrawn from the export market as its own harvest is on. The domestic crush rate has dropped off sharply to just 45.4 per cent of capacity in the week ended June 3. Up until now the crush rate has been running at over 90 per cent of capacity. This slowdown in demand will eventually impact your farm gate bids, with basis widening and cash falling.

However, weather can still change this. The dryness we have seen in eastern Saskatchewan and parts of Alberta has been partially alleviated by light rains this past week, but the drought in the area has not ended.

Cold conditions are also plaguing the Prairie crop with record-cold temperatures from Manitoba to Alberta in the past week. Crop specialists say crops have been saved by their late seeding, as the crop emergence is well behind normal. This still has negative implications on yields, depending on weather from now on.

Weather forecasters feel that the Prairies will not see a significant warmup until early July and this will have to be watched.

In the U. S., cool, wet conditions have changed the planting situation, as delays in planting the corn crop have likely reduced corn acres by about one million. The lateness of overall planting is expected to reduce corn yields. Traders feel that the U. S. corn crop will be well below usage levels and that the average prices for corn through the winter will be over US$5 per bushel.

Of course, those lost corn acres are expected to show up in the soybean plantings and boost total acreage. The late planting of the U. S. soybean crop is likely to result in a drop in average soybean yields and the average higher planted area will not be as negative for the market. It will, though, still result in higher 2009-10 U. S. soybean ending stocks than in 2008-09.

The wet, cool conditions have also caused spr ing wheat acres to fall and traders expect them to be down a whopping one million. This is particularly good news for Canadian farmers who will benefit from the reduced competition from the U. S. and the strong market for high-quality wheat.

DROUGHT DOWN UNDER

The consensus now is that an El Nińo will develop this year in the southern Pacific. This warming of the Pacific Ocean current is not expected to have any significant effect on North American weather patterns. However, it does have a strong effect on the main Australian wheat-producing area, which has a much higher chance of seeing more drought. It also tends to affect weather for the palm oil crops in southeast Asia as dryness cuts into production. This could turn the wheat and oilseed markets quite bullish.

On Wednesday, June 11, the U. S. Department of Agriculture brings out its latest supply-demand reports and the trade is looking for some notable revisions. In corn, the expectation is that yields will be lowered due to the late crop planting, with U. S. corn ending stocks also lowered. For soybeans, most analysts are looking for lowered 2008-09 soybean ending stocks and unchanged to higher soybean ending stocks for 2009-10. U. S. wheat production is expected to be lowered and global wheat ending stocks are expected to fall from the May level.

Overall the USDA report is expected to be friendly but not hugely bullish for the grain and oilseed markets.

– Don Bousquet is a well-known market analyst

and president of Resource News International (RNI), a Winnipeg company specializing in grain and commodity market reporting.