ICE Futures Canada canola contracts moved higher during the first trading week of 2018, as speculators covered short positions and the market saw a modest recovery off late-December lows.

Bitterly cold temperatures across much of Western Canada and the resulting slowdown in country movement were also supportive, although the latest grain-handling numbers still show ample supplies in the commercial pipeline.

The general outlook remains relatively bearish for canola, despite the early-2018 pop higher, with the narrowing old/new-crop spread worth keeping an eye on.

As recently as November 2017, the July 2018 canola contract routinely traded at a premium of $30 to the November 2018 contract. That was before Statistics Canada raised its production estimates and concerns over tight supplies by next summer started to fade. The old/new-crop spread hit a session low of $2.50 over at one point during the week, but eventually settled with the July contract trading at a premium of $7.90 per tonne to new-crop November.

Read Also

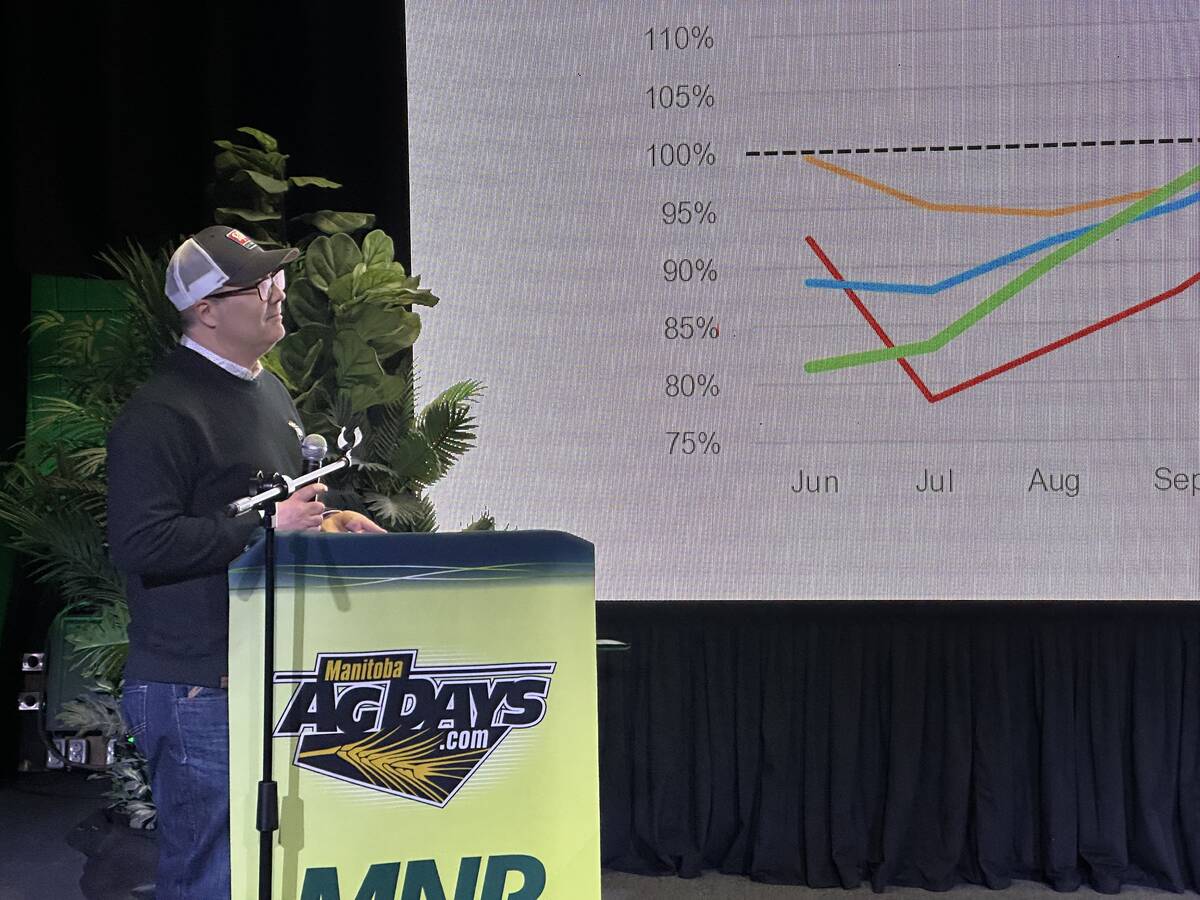

MANITOBA AG DAYS: Don’t wait to buy fertilizer, farmers warned

Higher fertilizer prices likely ahead, says Ag Days speaker. Farmers waiting until spring to buy fertilizer might end up eating the cost.

In addition to expectations that canola supplies won’t be that tight by the end of the crop year, the narrowing old/new-crop spread also ties into ideas that farmers will likely seed a big canola crop again this spring. While prices may not be that great, the alternatives are worse in many cases and early forecasts suggest another large canola crop in 2018. All that should keep canola under pressure in the near term, barring activity in outside markets.

Movement in the Canadian dollar could be another bearish influence, if the first trading week of 2018 is any indication. The currency climbed well above the 80 U.S. cents mark on some favourable jobs data, and could be due for some more strength if improving economic indicators also result in an increase in interest rates from the Bank of Canada.

In Chicago, excitement these days is all weather related. Argentina is either too dry or seeing just enough water, depending on the day and the forecast. South American soybeans are still being planted in some areas, and day-to-day shifting weather outlooks which sway the futures could lead to longer-term trends once the outlook from the continent gets a bit clearer. The U.S. Department of Agriculture releases a slew of reports on Jan. 12, including quarterly stocks, winter wheat acres and updated production estimates, which could provide some nearby direction for grains and oilseeds.

Wheat futures were also keeping an eye on weather forecasts, with cold temperatures across the U.S. Plains raising concerns over winterkill. However, world wheat supplies remain large and all three U.S. wheat contracts ran into resistance and drifted lower in the latter half of the week.