LANGHAM — Canada’s oat crop is looking average to above average, and that’s a good thing, says a processor.

“We’re going to need that (production) to keep feeding the demand that’s out there,” Scott Shiels, grain procurement manager for Grain Millers, said during an interview at the Ag in Motion (AIM) 2025 show.

Statistics Canada estimates farmers planted 2.98 million acres of oats this year, a 2.6 per cent increase over last year.

Shiels said industry sources believe the increase is closer to seven to 10 per cent.

Read Also

Expert’s Radar: Ups and downs in wheat futures

Recent strength in wheat futures is partly tied to ideas that the U.S. crop won’t be as big as officially projected, but world supplies remain burdensome and Southern Hemisphere harvests are coming to market.

Oat fields look better than most other crops this year because it is one of the last crops to go in the ground and took full advantage of the late rain.

Western Producer markets desk analyst Bruce Burnett is forecasting an average yield of 94.8 bushels per acre, a 2.8 bu. increase over last year.

Production is forecast at 3.32 million tonnes, a 6.8 per cent increase.

Shiels said that is a good because demand is strong, due in part to the oat milk “craze.”

The United States has accounted for 78 per cent of Canada’s exports through the first 10 months of 2024-25, with Mexico chipping in another 11 per cent.

Oats and other agricultural products are insulated from U.S. president Donald Trump’s ever-changing tariffs by the Canada-United States-Mexico Agreement.

Shiels hopes CUSMA remains intact because it would be impossible to replace the U.S. market.

“It would be very detrimental to our industry,” he said.

“We don’t have a lot of other outlets.”

Some business occurs with the European Union, but it grows its own oats.

Buying interest seems to be picking up in the EU market of late. The Saskatchewan Trade & Export Partnership recently introduced Shiels to processors from Europe and the Middle East that are looking to buy Canadian oats.

He wonders if that could be a direct consequence of the war in Ukraine.

Ukraine is a big oat producer, but its reputation as a reliable supplier has been tarnished by the conflict.

Shiels said robust global demand is keeping oat prices strong.

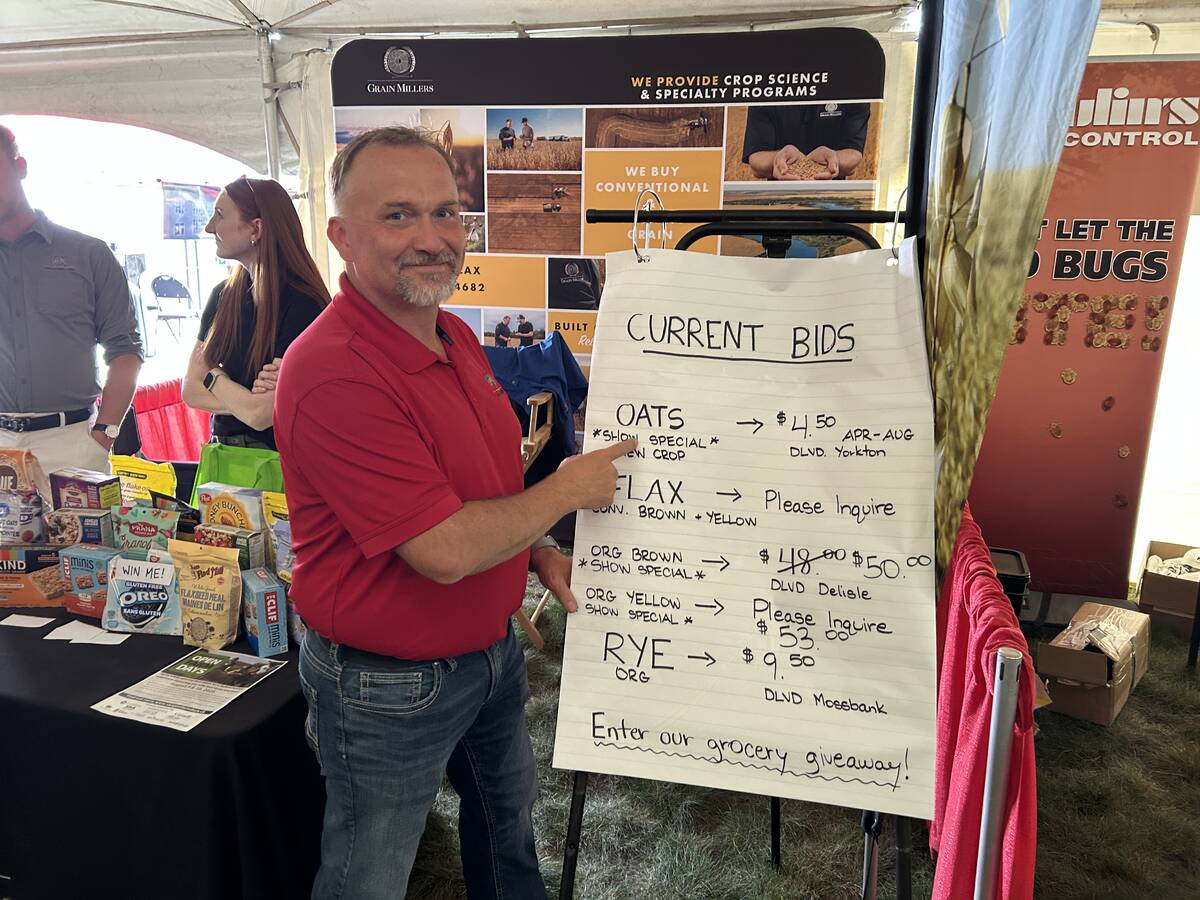

Grain Millers was bidding $4.50 per bu. for new crop oats at the AIM show. He said that is a “fantastic” price when looking back at the long-term history of the crop.

However, during the past three years, prices have fluctuated in that $4 to $5 range, so today’s price is the midpoint of that spread.

He said $4.50 oats compares favourably to $8 wheat and $14 to $15 canola when factoring in the cost of production because oats are an easier crop to grow.

Even in a bad harvest year, the bulk of the oats grown in the Prairie region still make milling grade.

Shiels hopes Canada’s oat acres grow by five to 10 percent per year, especially if the industry continues to see some overseas demand.