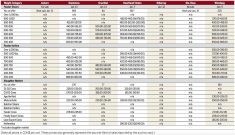

Calf prices rose and yearling prices dropped at one Manitoba cattle auction site during the week ended Nov. 23.

Scott Anderson, field representative for Winnipeg Livestock Sales, suggested that those buying yearlings were more likely to follow declining cattle futures than those who were buying calves. He also said the yearling market has tailed off due to a lack of quality, increasing demand for calves.

“I know calves kind of dropped off a little bit during the period when we had poor weather with snow, slush and mud and everything. But now, the ground is starting to freeze up. The local guys are actually coming back on the market, trying to gather up a few calves before things run out.”

Read Also

Expert’s Radar: Ups and downs in wheat futures

Recent strength in wheat futures is partly tied to ideas that the U.S. crop won’t be as big as officially projected, but world supplies remain burdensome and Southern Hemisphere harvests are coming to market.

Over the past week, live and feeder cattle prices on the Chicago Mercantile Exchange were in a sideways pattern. The February live cattle contract closed Nov. 22 at US$175.275/cwt., just five U.S. cents lower than on Nov. 16. There was no trading on Nov. 23 due to Thanksgiving Day south of the border.

Meanwhile, the January feeder cattle contract ended Nov. 22 at US$227.125/cwt., 37.5 U.S. cents less than six days earlier.

Across Manitoba, heifer prices were higher at most auction sites, shrinking steer/heifer price spreads.

“The lighter heifer calves are trading very strong. There’s always the large gap between steers and heifers and it seems like some of the prices were a little bit narrower. Local guys are buying heifers, so that certainly helped,” Anderson added.

As temperatures drop, he advised cattle producers to not let calves get “stale.”

“Don’t sell short-weaned cattle, because typically they’re going to need some TLC.

“Guys that are taking in any kind of volume certainly don’t want to have to treat calves the minute they get off the truck. They want calves that are arriving with bounce in their step. They don’t want anything with droopy ears or runny noses. Those cattle are getting discounted substantially.”

Most lightweight calves are staying local, while mid to heavyweight calves are being sent to Ontario, according to Anderson. He said if the futures find balance, there will be more confidence in the markets.

“If (the futures) continue to drop US$3 to US$4 a week, that will certainly pull some of the rug out from underneath feeder cattle prices,” he said.

“As we get closer to Christmas, the numbers at the sale will be smaller and smaller … guys that have to spend money in order to avoid paying taxes on cattle they’ve sold, that could also put some higher demand into the market.”

On Nov. 21, Rabobank released its Global Beef Quarterly Report, which showed Canadian cattle prices rising three per cent from June to October, while U.S. prices were steady. Australia and Brazil are expected to increase beef production, while the U.S. and Europe will see declines.

As a result, worldwide beef production is expected to be down one per cent in 2023 compared to the previous year.