Farm business specialists warn that producers should start building their own steady ground, since tariffs, trade wars and general uncertainty seem set to send markets heaving.

For hog and cow-calf producers, particularly with cattle prices so strong coming into the tariff chaos of early 2025, that might involve taking out a livestock price insurance policy (LPI) this year.

WHY IT MATTERS: Canada’s beef producers have enjoyed a long stretch of strong calf prices, but U.S. tariffs threaten to derail a key market for the sector.

Read Also

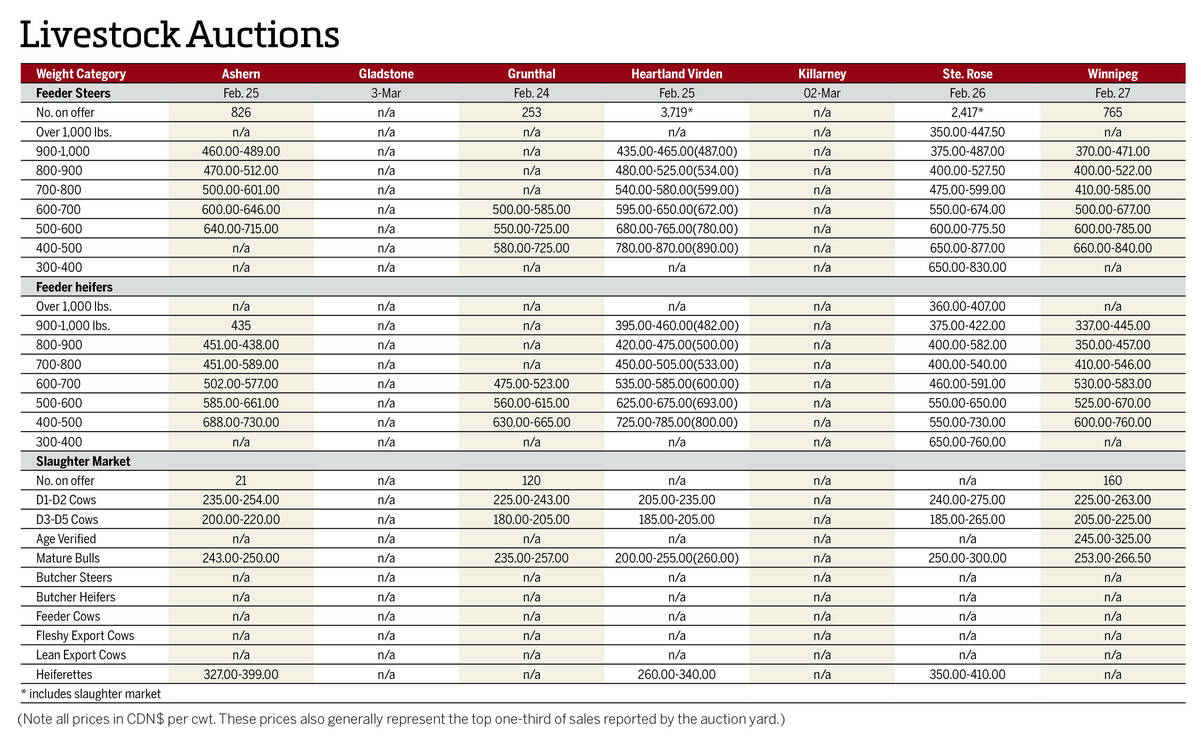

Manitoba cattle prices, March 4

Chart of weekly Manitoba cattle prices.

The business risk management tool is designed to hedge against market volatility. Producers can insure for a certain value (by hundredweight for cattle or by hundred kilograms for hogs), essentially creating a price floor in case the bottom drops out of the market by the time they go to sell.

At the start of their cattle policy, producers opt for a coverage option, policy length and premium derived from the futures markets for the month they plan to market their cattle. Then, if the average market prices have fallen below that coverage level during the four weeks around when they plan to market (their claim window), they can get a payout for the difference.

The settlement index for calf, feeder and fed cattle programs is published weekly, and producers can choose different weeks within their claim window to trigger a portion of their policy, or let the whole thing settle out upon the policy’s expiry, depending on where they think the market is likely to go.

Hog programs do not have a claim window, due to the sector’s continuous production and generally more volatile market, the LPI website states.

Why LPI?

Fans of the program point to its use for farm business planning. An insured price floor means a minimum revenue value that producers can then better plan around. Detractors often point to cost. LPI premiums are not cost-shared by government.

“There’s always a time and a place for risk management,” said Brenda Hagen, livestock insurance manager with Alberta’s Agriculture Financial Services Corporation (AFSC).

With tariffs looming, she noted, LPI this year might provide needed peace of mind.

Interest in LPI has grown over the past five months, she said.

Both beef and pork sectors are justifiably worried about the trade tone coming out of the U.S., while the second week of March threw yet another wrench in pork trade. China, one of the sector’s biggest markets, announced their own 25 per cent tariffs against Canadian pork, among other Canadian ag products.

“LPI was designed for events like this and any policies that are in place will always be honoured,” said Hagen.

It’s not just about tariffs, she added, unseasonably strong cattle prices have attracted new and returning participants.

She said that, unlike traditional insurance products, LPI premiums do not increase individually based on claim or payment history.

“Premiums for this program are influenced solely by market volatility, as well as a few other factors — being interest rates or time value.”

That does mean, however, that the program is most economical when the market is stable — not a word most would associate with the current trade landscape.

Even with the lingering threat of tariffs, Hagen said recent premiums as a percentage of coverage were around three per cent, “which, in itself, is quite reasonable.”

Is LPI worth it?

Trade uncertainty and a weakened Canadian dollar means policy holders won’t get the kind of high price floors they have seen in recent years, said Tyler Fulton, a Manitoba beef producer, Canadian Cattle Association vice-chair (and co-chair of the organization’s foreign trade committee) and director of risk management with H@ms Marketing.

But with high beef and cattle prices and the hog sector experiencing larger margins, taking out a policy is still worthwhile, he argued.

While premiums are totally producer funded, administration is paid for by the federal and provincial governments, Hagan said.

The cattle sector has long argued that premium cost is a barrier for business risk management programs available to them.

Fulton noted that producers have been dealing with tight margins for about 20 years. LPI made little sense in the face of those slim profits. Premiums often exceeded the margin that could be realized by selling.

Like Hagan, however, Fulton noted that is no longer the case.

“To go and spend what seems like an exorbitant amount of money on a policy that protects those margins is a lot easier to take when you know you’re assured of profitability at current levels,” he said.

Strategy for LPI

Fulton discussed ways producers can use LPIs strategically to manage risk.

“I think what’s valuable, and it’s going to differ from one producer to the next, is having the ability to match when you plan to sell your animals to a particular policy. That’s a critical component of a strategy,” he said.

Using LPIs to distribute risk is another tactic. Fulton shared an example of a 200 head cow-crop operation, which is planning to sell 150 calves in the fall. He recommended insuring the calves in separate groups at different times for a more “averaged protection level.”

“It would be reasonable, I think, in most years, to say ‘Well, how about I take a policy now on 50 calves and possibly another 50 calves in a month from now and then another 50 calves a month from then.’”

Producers also need to determine their risk tolerance, he said.

Heavily leveraged producers who can’t afford to take a price hit may want to buy a more expensive policy for maximum protection. More established growers with little debt may opt to spend less on a policy.

Producers should also be aware of the fine details. The calf LPI program is seasonal and is aimed at offering accurate prices for people selling weaned calves in the fall, said Hagen. The deadline to take out a calf LPI this year is June 12.

“Feeder and fed (cattle) programs, as well as hog, run year-round with a few minor blackout periods, meaning that we have certain times that we don’t sell or settle because we don’t have the volume or quality of data that the program needs to be actually sound and sustainable,” she said.

LPI policies are sold on specific days and specific times: Tuesdays, Wednesdays and Thursdays in the afternoon and evenings.