Cattle prices are high across all categories and uncertain trade has created pressure for beef producers to build a guardrail against volatile markets. Locking in a price floor with livestock price insurance (LPI) has been one suggestion.

Producers have heard a lot of misinformation about the tool though, said Jeff Legaarden, LPI co-ordinator for the Manitoba Agriculture Services Corporation (MASC).

WHY IT MATTERS: Cattle producers are enjoying cushy prices at the auction mart, but with tariffs and trade wars still looming in the background, there’s still concern about how long the good times can roll.

Read Also

Canadian cattle industry has wins to shout about

Canada’s cattle management has become more efficient, more humane and more knowledgeable, but industry terms may not resonate with the general public.

Legaarden was tapped as a speaker May 8 during a Manitoba Agriculture webinar outlining LPI.

LPI is a federal insurance program delivered by provincial agencies and is meant to hedge against market volatility. It allows beef and hog producers to insure a basic price for their cattle. If markets fall below that level, coverage kicks in to make up the difference.

Legaarden has been involved in Manitoba’s program, administered through MASC, since its inception in 2014.

The western program, offered in B.C., Alberta, Saskatchewan and Manitoba, offers beef-related policies for fed cattle, feeder cattle and calves. Last year, an LPI pilot launched in Eastern Canada. It covers producers in New Brunswick, Nova Scotia and Prince Edward Island.

Prairie LPI myths

Webinar topics May 8 were based on results of survey responses from the Manitoba Beef Producers fall district meetings last year. Brett Hassard, LPI product co-ordinator for Agriculture Financial Services Corporation (AFSC) — which delivers the program in Alberta — added a few of his own “myths” in a separate interview.

Myth 1: A producer has to own the cattle and have calves born and on the ground to be eligible.

Not so, said Legaarden. If a producer is interested in taking out an LPI calf policy, they can do so whether they have calves on the ground or not.

“The terms and conditions say that as long as you own the cattle for 60 days within that policy and you have your hundredweight at the end of (the policy), you’re in full control to do that,” he said.

“It’s the same as if you have a grasser operation where you put cattle feeders on grass, and … you see a policy that would (have) really nice protection for you, but you haven’t bought those feeders yet. “

Myth 2: You’re locked into the market price you insured.

Not true at all, said Legaarden. “Buying an LPI policy only protects you from a downward trending market. It’s like setting a floor price. So whatever that is, as long as the market is above that, you get all that opportunity … if it goes below that, you would get the difference. So it’s giving all the upswing in the markets you can get now.”

Myth 3: You have to sell your livestock when the policy’s finished.

The truth is that producers do not need to sell at all, said Legaarden. The policy’s term can complete, and the producer can just decide to retain the animal.

“You can own these cattle (and) never sell them until they go right to slaughter,” he said.

The same goes for multiple policies on the same animal. Producers can place a policy on a calf, take out a feeder policy when it’s old enough and then buy a fed cattle policy as well.

“So you could have three policies on the same animal and never sell them until they actually go to slaughter,” he said.

The LPI program allows for flexibility, said Hassard.

“(Producers) can retain ownership of the cattle at the end of their policy term or sell them. They just have to meet the ownership criteria during the life of the policy.”

That dovetails with the next myth.

Myth 4: It’s a contract.

LPI is just an insurance tool — not a contract, said Hassard.

“A producer isn’t locked into any sort of contract. They’re not restrictive with what they do with their livestock.

“So if the market goes up, they can see those gains and, if the market goes down, they’re protected. They’re not limited to the price that they’re insured for.”

Myth 5: You need an existing identification number or a subscription to buy an LPI policy.

This is true in most provinces, but not in Manitoba. Producers in the Keystone province can buy a policy before submitting an application.

“If you fill out your subscription form and your policy request to purchase form and get it to MASC within, not business hours, but from 3:30 p.m. until midnight of the day you want to purchase, we will get this done for you,” Legaarden said.

Myth 6: LPI insures on an individual basis.

LPI is a market-driven program, designed to protect producers against market declines, said Hassard, but its coverage looks at state of the broader market. It does not kick in based on the price a specific producer is offered for their cattle.

Settlement values for feeder and calf policies reflect the week’s market conditions, based on sales data from a large number of online and live auction markets across the provinces.

“It’s more the overall market average price in Alberta, or whatever provincial index you’re insuring against,” Hassard said.

LPI calf policy season ending soon

This year’s deadline for buying a LPI calf policy for the fall 2025 marketing season is June 12.

“So if you don’t have one in by then, you will have to wait until next February to get a calf policy,” said Legaarden.

Calf policies are the only ones under beef LPI with a deadline attached. Fed and feeder policies can be bought year-round.

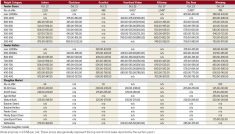

According to MASC, LPI calf policies expire 16 to 36 weeks after coverage purchase, depending on the customer’s preference. The settlement price is based on the average price of a 600-pound calf, derived from current auction mart and electronic sales data.

Feeder policies expire 12 to 36 weeks after purchase of coverage. Settlement is based on the average price of an 850-pound steer, based on auction market and electronic sales data.

Fed policies are available for fed cattle intended for sale. Policies expire 12 to 36 weeks from the date of purchase. Settlement price is based on the weekly Alberta Fed Cattle Price Settlement Index using CanFax data.

LPI’s hog programs, meanwhile, run on a different mechanism. Settlement prices are based on the U.S. Department of Agriculture spot cash price, converted to Canadian dollars and — in Manitoba — adjusted for a “Manitoba factor.”

Further information is available on the MASC website under “other programs.”