Prices generally for commercial and purebred lambs were up a little bit from last year, say organizers of this year’s Manitoba Sheep Association Show and Sale held at Carberry on August 28 and 29.

For commercial lambs, pens of five averaged $197.50 per head, and for pens of two the average price was $214 per head. Jackpot ewe lambs fetched an average of $180 per head and all but two purebred rams sold at $500 per head on average.

Fifteen consignors brought 55 lots for sale, slightly down from last year’s 70 lots, but Sarah Lewis, show organizer, said she suspects that’s because Manitoba also hosted the All Canada Sheep Classic show this June in Winnipeg. Some producers may have chosen not to attend both.

New for this year’s show was a stock dog demonstration on Saturday and back after about a decade’s absence was the Sasktoba Sheep 4-H achievement.

“The overall quality of the stock this year was really good,” says Lewis. “The show and sale went very well.”

Canadian Lamb Producers Co-operative meeting

The Canadian Lamb Producers Co-operative (CLPC) held an informational meeting at the show to discuss how the co-operative works and the market opportunity for Canadian lamb products across North America.

The producer-owned co-op has hundreds of members across Canada, and aims to recruit a total of 1,000 lamb producers by the close of 2018. Anyone producing lamb in Canada is eligible to join.

Currently Canada imports about 58 per cent of its lambs — the equivalent in weight of around 1.3 million animals. Domestic markets continue to grow, thanks to increasing demand from ethnic markets, as well as from consumers looking for healthy, locally raised meats.

At the same time, however, processing capacity is declining and domestic lamb production is not increasing. This creates the perfect storm for the CLPC to supply convenient, value-added lamb products such as lamb burgers, sausages, kebabs and meatballs, said Terry Ackerman, chief executive officer of CLPC in his presentation to Manitoba lamb producers.

Read Also

Feeding ergot: research on ergot-impacted grain and beef cattle continues

Saskatchewan research hopes to tease out better ways for Canadian beef farmers to manage ergot consumption in their herd’s feed

LÄM is the brand name chosen for the CLPC products, which contain only 100 per cent Canadian lamb. The Canadian Lamb Company, a marketing company owned by the CLPC, will sell the products in North America. Ackerman says there is great demand for Canadian lamb, which is generally of a higher quality and has a better flavour profile than lamb produced in other countries.

The CLPC model has been designed to make use of all the meat on the lamb and maximize cash receipts for members, who pay a $500 fee per farm to join as a voting member, and a $30 one-time investment share fee per lamb, with a minimum of 25 shares required up to a maximum of 75 per cent of the member’s flock.

“We encourage people to keep some lambs out to play the market,” says Ackerman.

Producers sign a renewable, 36-month contract with CLPC and receive a guaranteed market and a guaranteed, published, annual floor price. In return CLPC requires properly finished, slaughterable lambs with a high meat yield of between 48 to 51 per cent per carcass.

A unique grading system

The co-op has developed a unique electronic instrument grading system which will provide members of the CLPC with a customized report about how much meat yield and fat was on the carcass of their delivered lambs.

The industry traditionally purchases lambs on a live weight basis, and the average meat yield on a carcass — even from the same breed — varies wildly from 35 per cent to 60 per cent. The excess fat is cut off at the processing plant when the animal is slaughtered, so whether they realize it or not, producers’ prices are discounted to allow for that wastage.

“We want to increase the amount of meat yield by giving the producers grading information that tells them whether their carcass had too much fat or not enough fat, or what kind of feed efficiency they are getting,” said Ackerman. “Currently there’s no information available to them that is sufficient or accurate enough to help increase the efficiency of their flocks.”

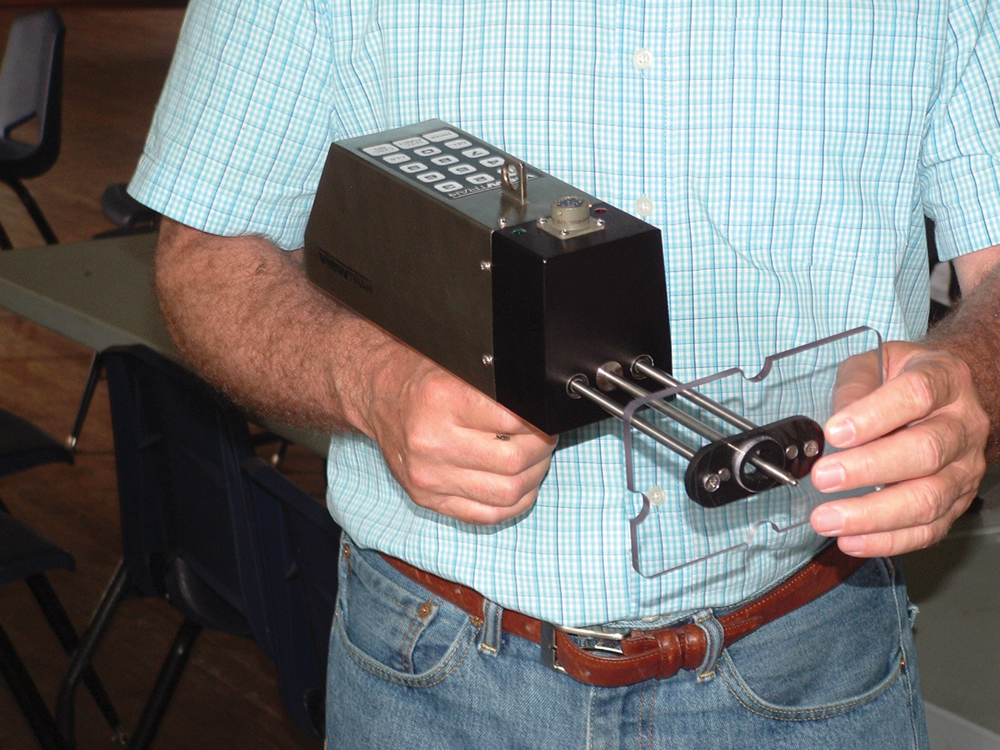

The co-operative plans to pay better prices based on the lean meat yield from each carcass, so it has developed, in partnership with ViewTrak Technologies of Edmonton, a $1.4-million grading device with funding support from Western Economic Diversification that can accurately grade 1,200 lambs an hour.

To generate baseline data for the device’s algorithm, the University of Guelph is comparing measurements taken by the device to physical measurements of 500 cut-up lambs in the laboratory.

“The grading device is inserted into the carcass between the 11th and 12th rib and it measures 60 points of the lamb carcass in a split second,” said Ackerman. “The information is sent via a link to a computer and is populated by the algorithm. With every lamb we grade we will have more information to build a database for the co-op members who have invested in this system.”

Traceability is key

CLPC has also developed an electronic traceability system based on RFID tags that follow the lamb from the farm right through processing and fabrication to the final product.

Producers deliver lambs to the closest of 40 collection points in nine provinces, which in Manitoba are located at Ashern, Blumenort, Brandon and Steinbach.

Ackerman said the value-added lamb products will launch in November and he believes that there is at least a $3.6-billion marketing opportunity for these products in North America.

Interested producers can get more information at cdnlamb.com.