At the time of writing this article, there are no U.S. tariffs on Canadian beef or cattle. Over the past month, I’ve been overwhelmed with calls some days from producers asking about the influence of a U.S. tariff on prices for finished cattle and feeders. We all dreaded courses on Agriculture Trade and Policy in university; however, having worked in international agriculture trade for 30 years, it’s the most referenced textbook. U.S. wholesale beef prices were trading at or near historical highs in January. Usually, wholesale beef prices make seasonal lows in January and February. What’s going on?

To start, I want to discuss the theory. It’s important to note that a tariff on beef is totally different than a tariff on car parts. Demand for beef is inelastic. A small change in supply has a large influence on the price. The demand curve is steeper than the supply curve.

Read Also

Ship’s turning for gene-edited crops

More and more countries have decided that gene-edited crops will be treated the same as conventional plant breeding.

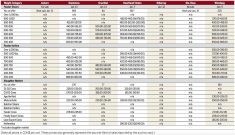

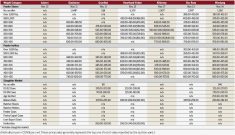

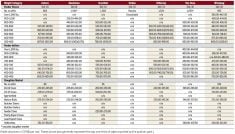

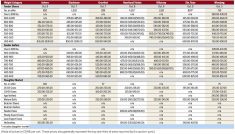

Consider the above diagram, which represents the supply and demand for beef. The current price is “C,” which is where the current North American supply and North American demand intersect for beef. If a tariff of 15 per cent is applied to beef, the demand curve for the Canadian producer shifts to Demand 2. The new price for the Canadian producer is “B,” which is where the supply curve and Demand 2 intersect. For the U.S. consumer, the new price is “A.” The supply and demand curves are the same; however, less product is supplied to the market, resulting in stronger demand. You can see from the diagram that the bulk of the tariff is absorbed by the U.S. consumer for a product with inelastic demand.

If the slope of the supply and demand curve is the same, the cost of the tariff is absorbed equally between the seller and the buyer (for example, steel). If the demand curve is elastic or more horizontal, the bulk of the tariff would be absorbed by the seller (e.g., wheat).

The second factor to consider is that beef is sold on longer-term contracts. Companies like McDonald’s buy beef on six- or eight-month contracts. How can a packer sell beef for September delivery when they don’t know if there will be a tariff on beef or cattle? The U.S. packer factors in a worst-case scenario when selling beef. The wholesale beef market has incorporated a risk premium due to the uncertainty in production and tariffs. At the time of writing this article, wholesale choice beef was trading at US$333/cwt which is higher than the monthly average COVID highs of 2020 and 2021.

In the short term, cattle producers are selling into a market that has factored in tariffs but there is no tariff in place. President Trump is also talking about tariffs when supplies are at modern-day historical lows. The stars have aligned because the U.S. had also closed the border to Mexican feeder cattle. The U.S. usually imports about 120,000 head of Mexican feeder cattle per month. Most politicians don’t understand international trade; hence they need advisors. In the previous Trump term, the president listened and acted on advice of advisors.

A tariff on feeder cattle will take the steam off the market, but remember, Canada is a net importer of feeder cattle so the effect for the cow-calf producer will be minimal. Don’t worry, you can sleep comfortably at night knowing a U.S. tariff on Canadian beef or cattle will punish the U.S. consumer. It takes about two or three months for the higher wholesale prices to work through the supply chain at retailers and restaurants.