Chicago | Reuters — U.S. soybean futures fell to a 1-1/2-week low on Monday on technical selling and on concerns about demand from China as the world’s top soy importer remains locked in a tariff war with the United States.

Wheat also fell after Russia, the world’s top supplier, left its export forecast unchanged despite recent speculation that supplies are dwindling.

Corn ended firm as spread traders bought corn and sold soybeans or wheat.

Grain markets languished as Chinese trade figures dampened demand sentiment and fueled concerns across financial markets about an economic slowdown in China and beyond.

Read Also

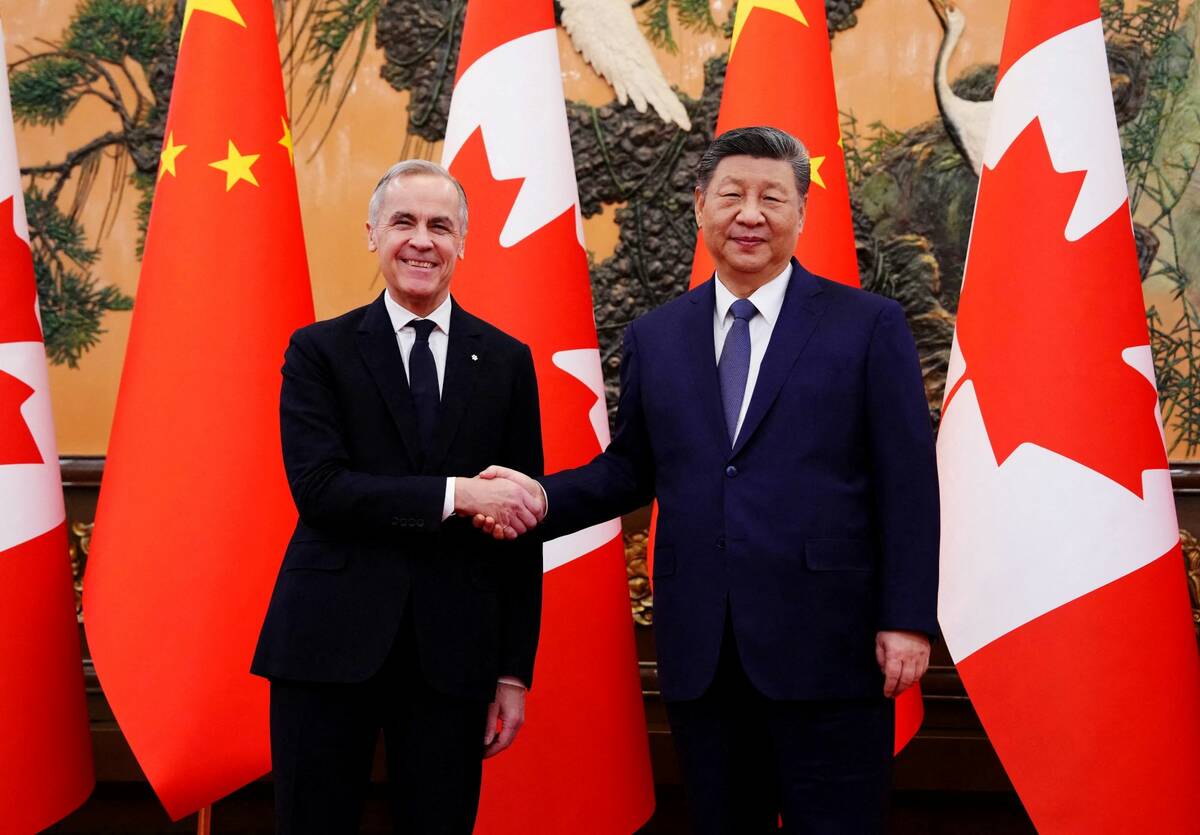

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

China’s General Administration of Customs said December soy imports in December fell 40 per cent from the same month a year earlier, the lowest for the month since December 2011.

Future Chinese demand for animal feed imports also remained a concern due to the spread of African swine fever, which has prompted culling of the hog herd and pressured Chinese soymeal prices.

“The market doesn’t like the African swine fever and it likes even less the Chinese trade numbers,” said Mike Zuzolo, president of Global Commodity Analytics.

Losses in grain futures were limited, however, by concerns about adverse growing weather for corn and soybeans in South America, as well as continuing hopes of fresh Chinese purchases during a 90-day truce for negotiations.

U.S. officials expect China’s top trade negotiator to visit Washington this month, signaling higher-level discussions are likely to follow last week’s talks in Beijing.

Chicago Board of Trade March soybeans fell 6-3/4 cents to $9.03-1/2 a bushel after breaching chart support at several key moving averages (all figures US$).

March corn held chart support at its 100-day moving average and ended 1/4 cent higher at $3.78-1/2 a bushel.

CBOT March wheat shed 5-1/4 cents to $5.14-1/4 a bushel, dropping below its 20- and 50-day moving averages.

Easing concerns about harsh cold in the U.S. Plains wheat belt weighed on prices as farm fields in a large portion of the region received several inches of snow over the weekend. The snow cover should protect dormant crops as severely cold weather hits the region this week.

Expectations that dwindling supplies in Russia would create export demand for U.S. wheat had helped to push Chicago prices higher on Friday. But export hopes were tempered on Monday by confirmation of the Russian agriculture ministry’s outlook for 2018-19 grain shipments.

— Karl Plume reports on agriculture and ag commodities for Reuters from Chicago; additional reporting by Gus Trompiz in Paris and Naveen Thukral in Singapore.