MarketsFarm — ICE Futures canola contracts hit their lowest levels in two months during the first week of June but uncovered support to the downside to recover on Wednesday and hold rangebound overall.

While crush margins are still well off the levels seen at this time a year ago, they have improved over the past month and should be bringing in some end-user demand, Ken Ball of PI Financial in Winnipeg said.

Strength in the U.S. soybean market was lending spillover support to canola, but Ball noted the Canadian oilseed was lagging to the upside.

Read Also

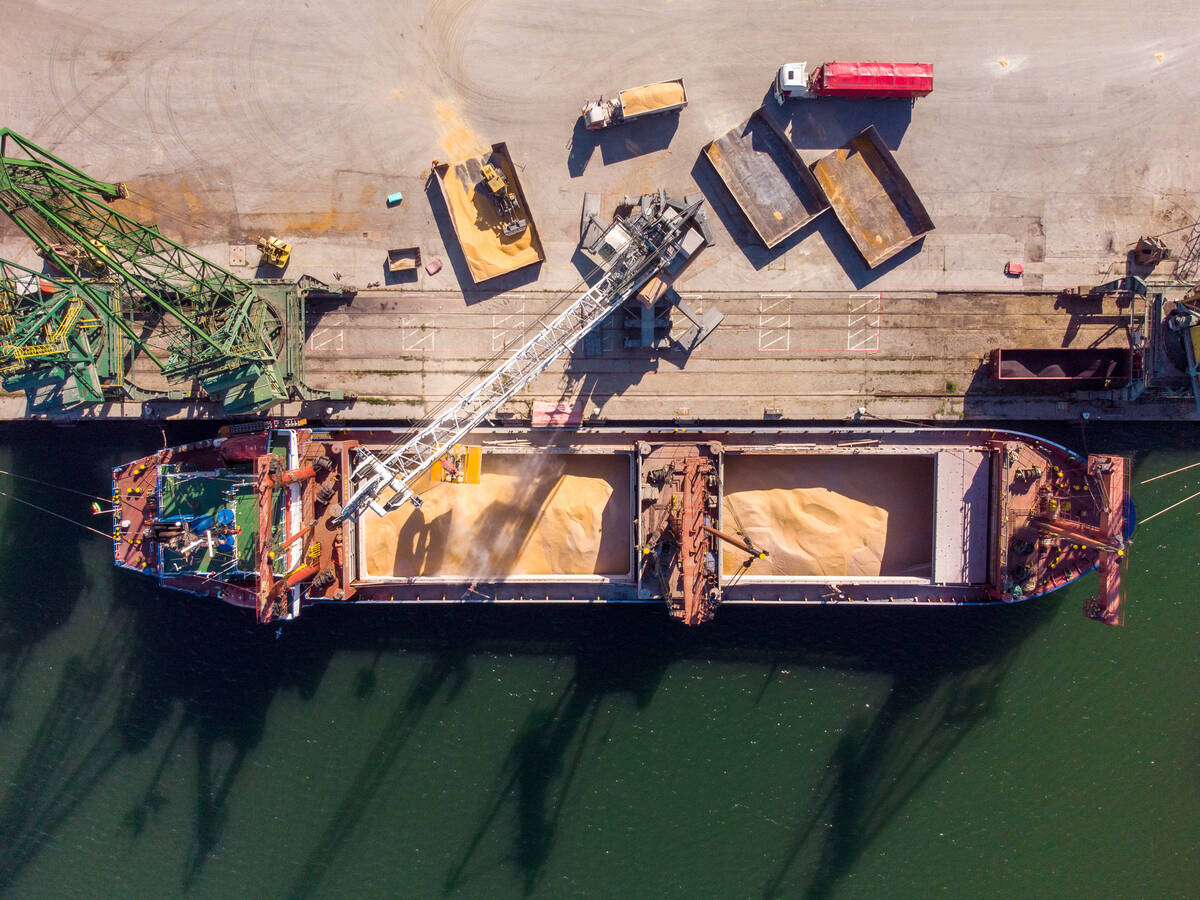

Ukraine wheat exports remain low amid Russian attacks on ports, weak demand

Ukraine’s wheat exports remained relatively low in the first half of January amid Russian attacks on Ukrainian seaports and low external demand, data from the country’s grain traders union UGA showed on Wednesday.

With seeding operations nearing completion in the Prairies, growing conditions over the next few months could lead to some price swings. However, canola prices are already historically high, which may limit the upside.

Seeding was well behind normal in Manitoba due to excessive moisture earlier in the spring. The lateness could see some area originally intended for other crops switch to canola instead, according to a provincial crop report.

Ball noted Manitoba accounts for a very small amount of the total Canadian canola area, with the province’s late crop unlikely to have much influence on the market overall.

“North America will be off to a very good start overall,” said Ball.

Wet areas of the eastern Prairies will see good germination, while western areas are looking good so far but will need rain soon.

— Phil Franz-Warkentin reports for MarketsFarm from Winnipeg.