Don’t look to Canada’s canola crushers for relief from the Chinese canola seed bans.

Canola oil and meal are still being exported to China, but because Canadian crushers are working at almost full capacity there’s not much opportunity to offset the loss of canola seed exports to China with increased shipments of oil and meal.

“We don’t have a lot of additional capacity to crush seed,” Chris Vervaet, executive director of the Canadian Oilseed Processors Association (COPA), said. “Basically we’re running full out in terms of what our existing capacity is. There’s always room for a little bit more, but not huge volumes that’s for certain.”

Read Also

VIDEO: Manitoba’s cabbage seedpod weevil explosion

Crop pest could pose a big problem for Manitoba canola growers in 2026 if last year’s population jump wasn’t a fluke.

Why it matters: The halt of seed shipments to China highlights the need for more crush capacity in Canada.

Much of this crop year Western Canada’s 11 canola-crushing plants have been operating at 80 to 85 per cent capacity and sometimes even 90 per cent, he said.

China stopped buying Canadian canola seed in March, complaining shipments were contaminated with weed seeds and plant diseases.

The Canadian Food Inspection Agency (CFIA) says China’s complaints don’t match what was found in export samples it inspected.

The Chinese government has not responded to the Canadian government’s request to meet with CFIA to discuss China’s claims and try to address its complaints.

As a result, it’s widely suspected China’s boycott reflects its displeasure with Canada’s arrest late last year of Meng Wanzhou, vice-president of Chinese technology firm Huawei, at the request of U.S. government.

China is Canada’s biggest canola seed customer, accounting for 40 per cent of our canola exports in 2018, worth $2.7 billion.

But China is also Canada’s second-biggest export customer for canola oil and meal, after the United States.

China is Canada’s biggest canola seed customer and second-biggest buyer (after the U.S.) of canola oil and meal. Last year, it bought just over one-third of canola oil exports (1.2 million of 3.2 million tonnes).

The U.S. imported 1.7 million tonnes, or 52 per cent of total Canadian canola oil exports.

Canadian canola meal exports to China in 2018 jumped 40 per cent to 1.4 million tonnes, representing 30 per cent of total meal exports.

In China canola meal is used in aquaculture production and fed to hogs and dairy cows.

The U.S. imported 3.2 million tonnes of Canadian canola meal, accounting for 68 per cent of Canadian meal exports last year.

When crushers are working at nearly full capacity, it doesn’t necessarily mean they are making lots of money, Vervaet said.

“They have commitments to deliver to customers essentially 24-7, 365 days a year,” he said, even when crush margins narrow.

“You’re better off running that asset and covering variable costs making sure you’re not losing more by not operating.”

About half of Canada’s canola seed is crushed domestically, which on average, has been the case the last 30 years, Vervaet said. The crushing industry has essentially kept pace with the increase in canola production.

“As the crop has grown, we (the crushing industry) have seen expansion as well,” he said.

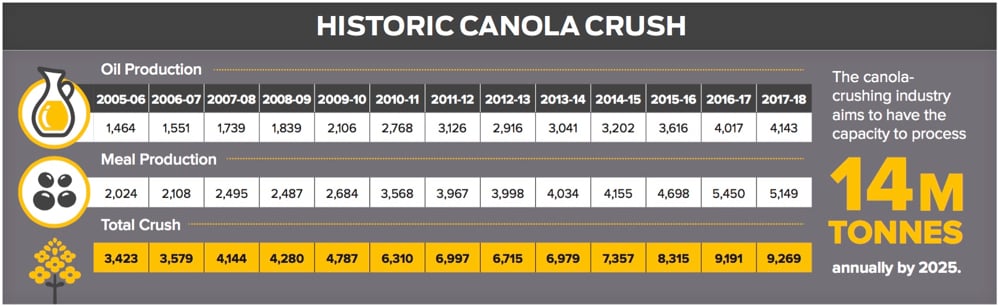

Canada has 10.7 million tonnes of canola-crushing capacity — double what it was a decade ago, thanks to around $2 billion in investments.

“We do have the goal to process 14 million tonnes (of canola seed) by 2025,” Vervaet said. “We’re at about 9.3 million tonnes for the last calendar year.

“If we want to reach our target by 2025 we’re going to have to add three to four Yorkton-sized (one-million-tonne-a-year) facilities…”

But at a construction cost of around $300 million, companies think carefully about where and when to build a new crushing plant, Vervaet said.

Canola seed supply and the railway service to get oil and meal to export terminals and end-users in the U.S. are among the biggest factors to consider, he said.

It boils down to whether a new facility can compete in the world market.

“When you look at the players that are part of COPA… these are global companies and when they look at making investments for capacity upgrades and new facilities they literally look at the globe in terms of where those investments are going to go,” he said. “Canada is only one of those places when it comes to investments in oilseed crushing.”

Like grain shippers, Vervaet hopes the Transportation Modernization Act, which became law almost a year ago, will improve rail service.

Canola oil and meal shipments were delayed at times this winter, he said.

“And then just generally through the winter months there were issues on inconsistent service,” Vervaet said. “We saw cycle times increase significantly and that did impact our ability to use our capacity and to crush what we hoped and wanted to crush.

“We had some issues of what we call ‘lost crush,’” he said, alluding to plants that had to temporarily stop crushing because product was backing up.

The problem was worse during the 2017-18 crop year.

“I think we’re still in that ‘wait and see’ mode in terms of how we can use some of the tools that came out of that new law,” Vervaet said. “I think we’re going to have a better idea once the new crop year rolls around.”