David drozd

Although technical analysts, such as myself, rely primarily on analyzing charts for determining price reversals and in forecast ing price direction, we do keep one eye on the fundamental information as well.

I’ll have to admit though, that whenever technical and fundamental analysis are at odds, and they are more times than not, I’ll definitely rely on the technical analysis to cut through the news (noise).

Technical analysis will often provide farmers with an edge in identifying a turning point at a major top or bottom in spite of all the bullish news that’s always heard at the top and the incredibly bearish news seen at the bottom.

Read Also

Potatoes join Innovation Farms testing ground

New MacGregor site adds potato farming to FCC and EMILI’s agriculture tech initiatives in Manitoba.

However, when technical analysis and fundamental information are in agreement, this greatly enhances the odds of accurately predicting price direction.

The August USDA report was bearish for corn. After resurveying eight states because of late seeding, USDA kept seeded acreage unchanged at 87 million acres, while many in the trade were looking for a .5-million to 1.5-million-acre reduction. USDA also increased yield a whopping 6.1 bushels per acre to 159.5 bushels per acre, which, if realized, would produce the second-largest U. S. corn crop of 12.7 billion bushels. (Record 13.1 in 2007.)

Technical analysis agrees with this fundamental information, which indicates corn prices will remain under pressure.

RISING WEDGE

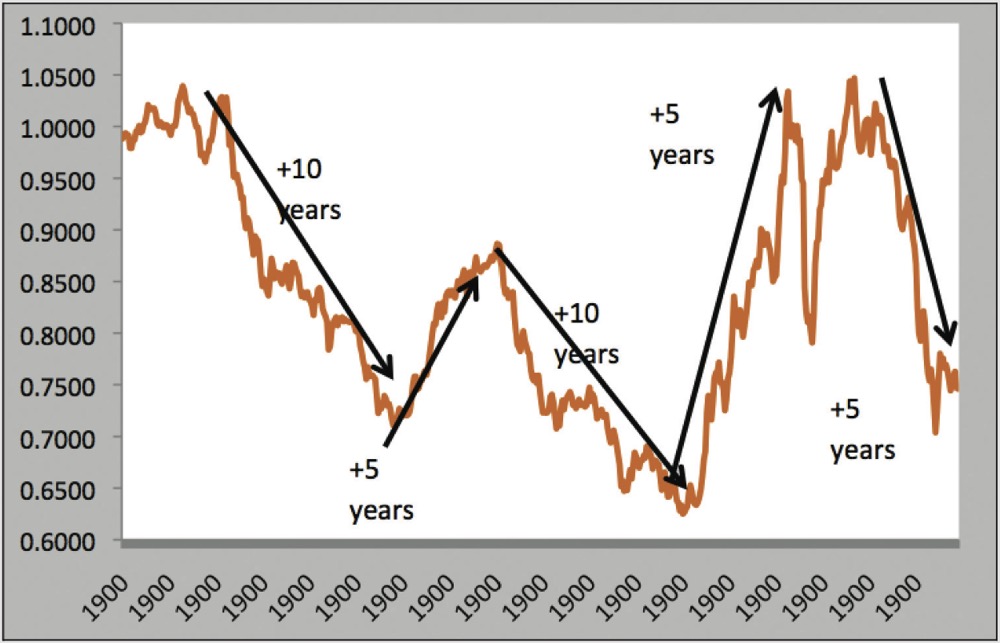

A rising wedge is an upward slanting formation which contains all price activity between its converging boundaries. The essential feature distinguishing a rising wedge from any of the various triangles is the accentuated slope of the pattern.

The rising wedge pattern implies a minor or intermediate turn. As illustrated in the accompanying chart, a rising wedge occurring in a major downtrend is bearish. The pattern is completed when prices break down below its lower boundary (B).

One should be on the alert for rising wedges in bear markets, as this is where they are most apt to occur and are most reliable. As a rule, after the pattern is completed prices should retrace all of the vertical movement comprising the wedge. This gives us a price objective of $2.90 per bushel for corn (A).

MARKET PSYCHOLOGY

Rising wedges will often begin with a high volume day marking at least a temporary end to the current price move (A). Typically, the market’s decline has had the speculative longs on the run and when their selling ends, the wedge begins to form (A).

With the weakest longs now sold out, additional selling pressure at prevailing prices is absent. All remaining longs in the market have made the financial and psychological commitment to at least hold for a rally. With selling abated, prices begin to recover. Progress is slow but the pattern is clear, a series of higher minor highs and lows.

At first, normal profit-taking by the shorts triggers the rally. But soon, bargain hunters begin buying on the small price setbacks. The market’s ability to rally to higher minor highs attracts additional buyers. Lows begin to rise faster than the highs, giving the pattern its narrowing shape. The converging boundaries of the wedge signify its limited duration. Speculative buying continues to rally the market, but volume fails to grow – a reason for caution. There is no great quantity of contracts for sale overhead, but each time buying diminishes the market backs down.

The advances will progressively gain less ground until all the potential buyers have been satisfied. At this point, the market begins to fall under its own weight (B).

Exiting longs, as well as new shorts now comprise the sellers. Volume normally increases at this time, confirming that the rising wedge pattern and the rally have been completed.

Join me online at www.Ag-Chieve.ca/cooperator/foran audiovisual presentation about this article and chart.

David Drozd is president and senior market analyst for Winnipeg-based Ag-Chieve Corporation. The opinions expressed are those of the writer and are solely intended to assist readers with a better understanding of technical analysis in the markets influencing agriculture. The information contained herein is deemed to be from sources that are reliable, but its accuracy cannot be guaranteed. Visit us online at www.Ag-Chieve.ca/cooperator/formore grain-marketing ideas and educational tools, or call us toll free at 1-888-274-3138 for a free trial of our text alert service or Online Resource Centre.