“You can save a lot of money in a short period of time without the consumer noticing that you are changing your product, in fact, without changing your product at all.”

– JEFF HARMENING

General Mills Inc. thinks that now that consumers have been eating more meals at home during the recession they will keep doing it, even after the economy recovers. It is also looking to older consumers to help fuel its longer-term growth plans.

“I think we are going to be able to hold on to them for quite some time because of demographics,” Ian Friendly, chief operating officer for U. S. retail at General Mills, said, referring to more consumers eating at home.

Read Also

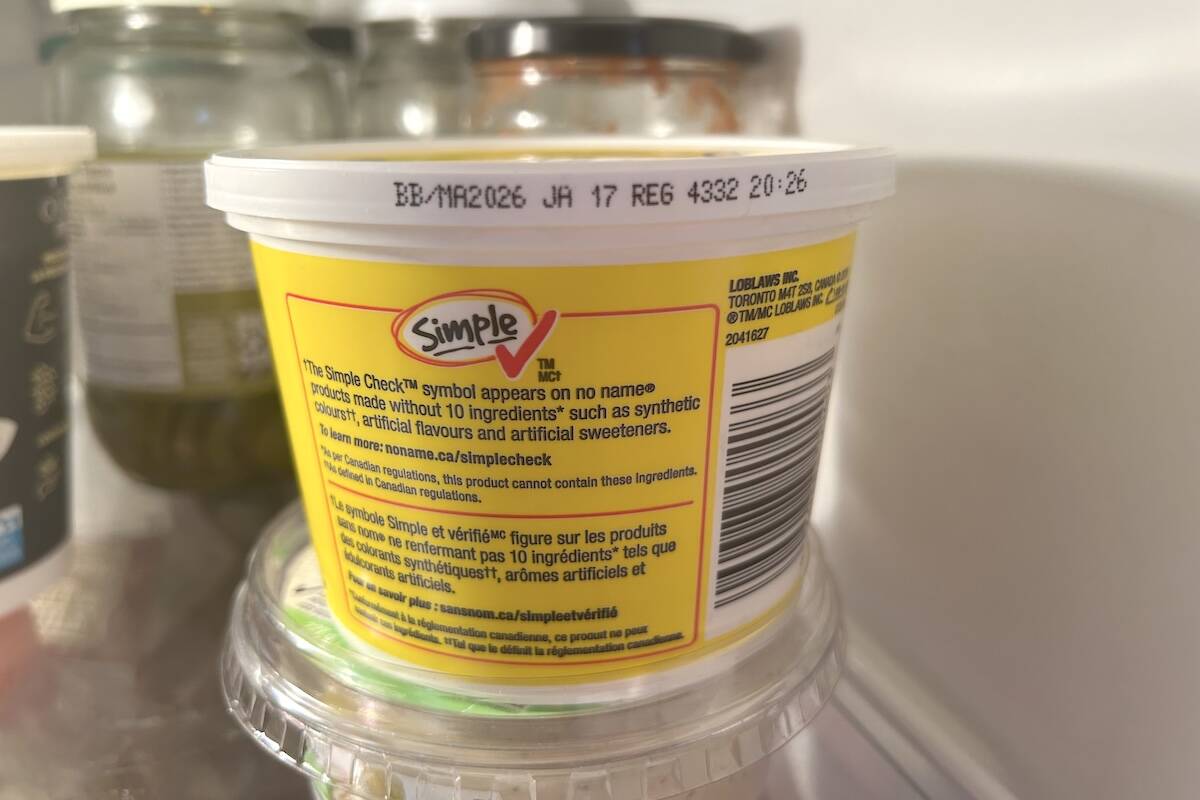

Best before doesn’t mean bad after

Best before dates are not expiry dates, and the confusion often leads to plenty of food waste.

In fact, General Mills started seeing a shift to people eating more at home about four years ago, well before the recession hammered restaurant sales.

That’s one reason CEO Kendall Powell thinks the food industry’s sales can keep growing at three to four per cent even after the economy recovers, a rate in line with the company’s long-term growth model.

Older people tend to eat more at home and as the U. S. population ages, that means more people should be eating at home, Friendly said. For General Mills, the hope is those people will be eating foods like Progresso soup, Yoplait yogurt and Fiber One cereal.

Also, during this recession consumers have purchased more General Mills items like Betty Crocker cake mixes and Hamburger Helper meal kits. Hamburger Helper has a long history of being a less expensive way for consumers to stretch their budgets, having been introduced during the recession of the 1970s.

Food companies in general are well placed in this economy, in part because food is such a cultural staple, Powell said in an interview at the company’s headquarters here this week.

“We grow up with things that we like and we tend to keep eating them our whole life,” Powell said.

STOCK OUTPERFORMS S&P 500

Since the beginning of 2008, General Mills shares are down 6.6 per cent.

While that may not seem like the boon a food company’s shares are supposed to get in a recession, the stock has still well outperformed the 18 per cent drop in the Standard and Poor’s 1500 Packaged Foods and Meat Index over that time. And its decline is about one-sixth of the 39 per cent plunge in the Standard & Poor’s 500 index.

Powell declined to comment on General Mills’ financial expectations for fiscal year 2010, which begins in June, other than to say the company should see a moderation in commodity inflation from the roughly nine per cent it has seen in the current fiscal year.

“It’s very clear right now that inflation is going to be lower for next year,” Powell said, noting that prices for oil and ingredients like wheat have moderated.

Still, once the global economy gets back on track there may be other inflationary pressures. Demand from developing nations like China will likely lift cost inflation back to the three per cent to four per cent level seen earlier this decade, he said.

HOLISTIC MARGIN MANAGEMENT

That uptick in the long-term inflation trend is one reason that every executive one talks to at General Mills is focused on what the company calls “Holistic Margin Management,” an effort to cut costs, shift its sales mix to higher-margin products and otherwise help lift margins so that General Mills can withstand normal inflation without having to raise prices.

Even with the unusual inflation seen in the past two years, “we’ve nowhere near priced to inflation,” Friendly said.

The margin improvement program takes many forms.

A slight change in how the company cut boxes, for example, reduced waste and saved it $2 million, while reducing the types of cereal clusters used in some brands to four from 17 also saved several million dollars, Jeff Harmening, president of the company’s Big G cereal unit, said.

In cereal, “you can save a lot of money in a short period of time without the consumer noticing that you are changing your product, in fact, without changing your product at all,” he said.

The company is also looking to work with suppliers and retailers to cut costs in their operations, which in turn could help General Mills improve its margins, chief financial officer Don Mulligan said.