Canadian farm organizations had reason to be nervous when the world woke up Nov. 6 to an incoming second Trump presidency in the U.S.

Now president-elect of Canada’s largest trading partner — one that buys about 60 per cent of our agri-food exports — Donald Trump promised a tsunami of tariffs while on the campaign trail. The biggest one was a blanket 10 per cent tariff on all American imports, but his speech at one event also suggested a 200 per cent tariff on John Deere imports, should the manufacturer move production to Mexico.

Also featured were a 60 per cent tariff on Chinese-made products and a 25 per cent tariff on Mexican goods if that country doesn’t tighten its border.

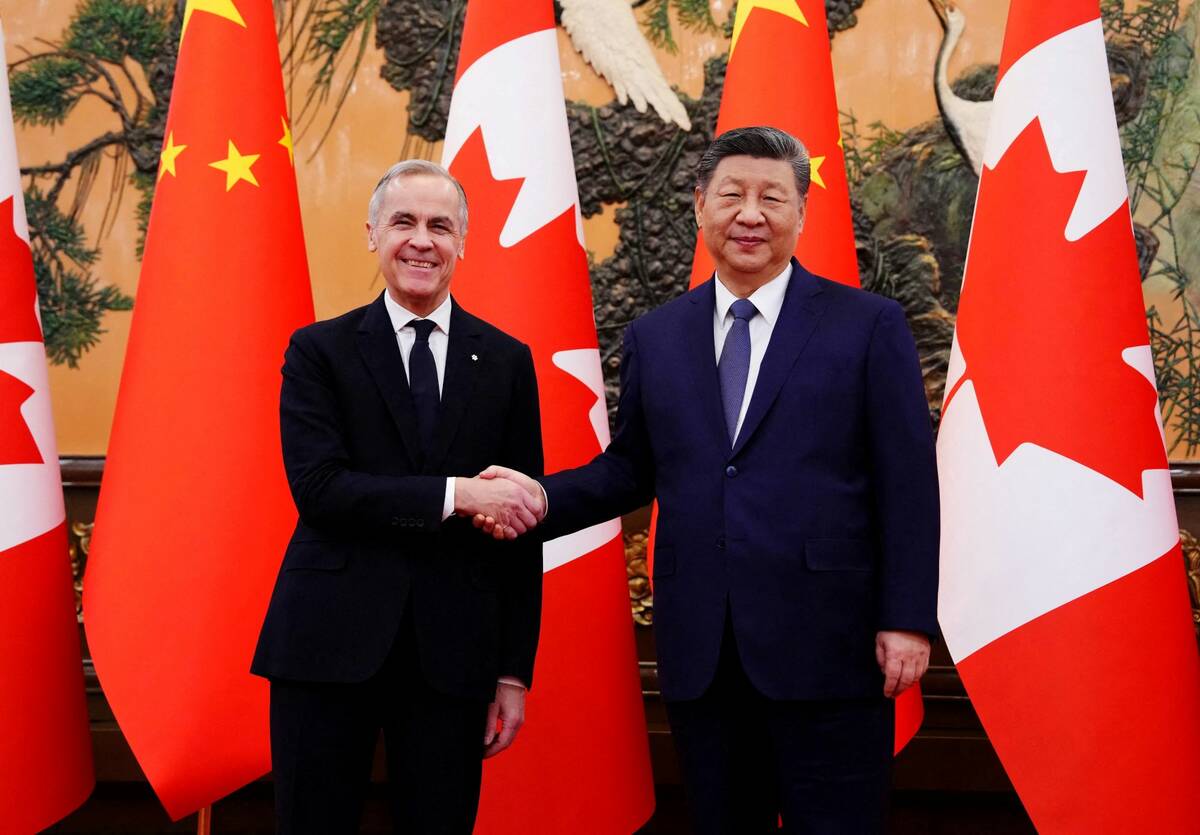

Read Also

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

His first administration’s trade policy was also more enamoured with sticks than carrots. As well as strong-arming replacement of NAFTA with CUSMA, there were 2018 tariffs against Canadian steel and aluminum, imported solar panels and washing machines (again, under the rationale of boosting U.S. manufacture) and a trade war with China. In 2019, he threatened a five per cent tariff against Mexican products if the stream of undocumented migrants to the U.S. didn’t stop.

To sum up: the new Trump trade playbook appears to be the old Trump trade playbook.

While Canadian businesses brace for the fallout, U.S. election results may also make Canada’s Senate chamber particularly interesting in the next few weeks.

As of Nov. 6, the Senate’s committee on foreign affairs and international trade was still picking through Bill C-282, which would take concessions on supply management off the table the next time Canadian negotiators hammer out a trade deal.

Canadian dairy was a favoured target for Trump during his first presidency. He decried Canada’s system on his way to tear up NAFTA, and dairy was one point of dispute during negotiations.

Canadian concessions in CUSMA, in turn, became one of the instigating cues for Bill C-282. Proponents of the bill argue that supply management has become a go-to bargaining chip in recent trade deals, and those sectors are tired of being sacrificial lambs to secure trade for everyone else.

“Canada has negotiated 15 trade deals and only the last three agreements have required negotiators to concede market access on our domestic supply-managed sectors,” read an opinion piece from from the Egg Farmers of Canada, Dairy Farmers of Canada, Chicken Farmers of Canada, Turkey Farmers of Canada and the Canadian Hatching Egg Producers.

“This track record demonstrates that safeguarding supply management does not hinder Canada’s ability to secure beneficial trade deals, nor does it imply that Bill C-282 would hold the entire Canadian economy hostage. Instead, this important bill provides a clear negotiating stance that can expedite other trade talks and yield positive results for a broad range of Canadian sectors.”

With a protectionist administration heading back into the White House, Canadian supply managed sectors will doubtless want Bill C-282 standing between them and U.S. negotiators, especially as U.S.-Canada dairy tensions are far from resolved.

But other agricultural sectors, including those in the Canadian Agri-Food Trade Alliance, are against the bill, saying it would hobble Canadian negotiators.

They are worried about what a Trump presidency and the 2026 review of CUSMA will mean for their member organizations, who represent export-reliant sectors like canola, soy, pork and beef.

A statement on the Canadian Cattle Association website says the bill “will hurt Canada’s ability to launch, negotiate, and renegotiate the best trade deals.”

In an October letter to the Senate, Pulse Canada likewise said, “Bill C-282 enshrines significant trade protectionism into legislation that has long guided Canada’s global leadership in promoting free and open trade.”

They suggested passage of the bill would lead other sectors to seek similar exemptions.

Supply managed sectors disagree. In the same editorial, dairy, egg and poultry groups said that, “arguing that countries would abandon trade talks simply because we aim to protect our domestic dairy, poultry, and egg sectors is unsupported rhetoric.”

Policy schisms between supply managed and non-supply managed agriculture are nothing new, and trade is often a lightning rod for those disparate priorities.

It’s likely the dairy sector would be back in the trade crosshairs at some point no matter who won down south. Canada’s tariff rate quota system sparked trade disputes under Joe Biden’s administration, as well as with New Zealand. The situation now feels more urgent, while the anti-Bill C-282 crowd worries about risk.

Both sides are trying to prepare for what comes next. Bill C-282 has been characterized as a zero-sum game; a win for one leaves the other vulnerable.